It appears that Ethereum (ETH) has become the belle of the ball, much to the delight of Wall Street’s corporate patrons. After a rather dreary year of playing second fiddle to Bitcoin (BTC)—imagine the poor dear’s plight!—recent on-chain analysis reveals that the long-term investors have decided to roll out the red carpet for Ether.

A Resounding Encore for Ethereum from Long-Term Lovers

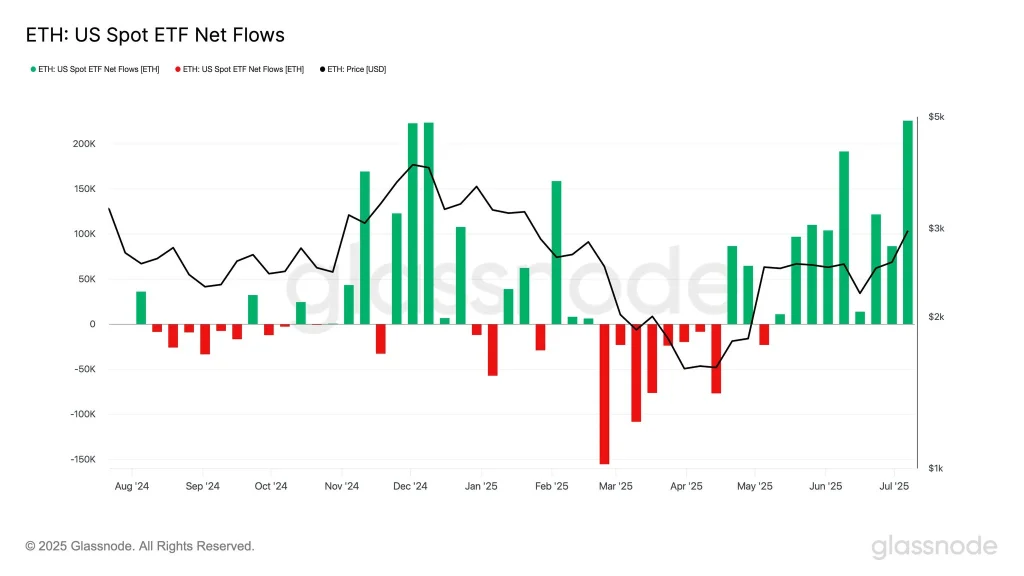

Take, for example, the rather sprightly performance of the U.S. spot Ether ETFs, particularly BlackRock’s very own ETHA, which has amassed a staggering cash inflow of approximately $908 million since its debut. Not to put too fine a point on it, but this remarkable influx of dosh has stretched their multi-week streak of cash inflows to a rather impressive $2.7 billion over the past four months. Quite a tidy sum for a digital trinket!

As if that weren’t enough to tickle your fancy, the corporate appetite for Ether has reached stratospheric levels recently. Just ask BitMine, a publicly traded entity, which announced with great glee that its Ether reserves have surged past the halfway mark of $500 million! Following a $250 million private placement—let’s hope that coincides with a fine bottle of bubbly—they have now hoarded a whopping 163,142 coins.

“We are positively chuffed to have bolstered our ETH treasury just three short days after wrapping up our private placement,” declared Jonathan Bates, BitMine’s CEO, likely with a twinkle in his eye. “It is abundantly clear that Wall Street is getting ‘ETH-pilled,’ or whatever the youngsters are saying these days.” 😂

Midterm Price Goals for Our Dear ETH

After a rather tumultuous two-month rollercoaster ride, where one could easily lose one’s lunch, Eth has finally peeked beyond the $3k threshold for the first time since January 2025. With a robust valuation hovering around $363 billion, this large-cap altcoin seems to be sending delightful signals of bullishness, as if the cosmos is in perfect harmony.

$ETH – Consolidate, form a new support, then higher. This is the most bullish way to go higher even though impatient people just want one giant candle.

— IncomeSharks (@IncomeSharks) July 14, 2025

From a technical standpoint that would make a mathematician proud, Ether’s price appears to be ambitiously aiming for $3,400 next, with the golden road to $4k unfolding like a well-rehearsed play. Furthermore, the weekly MACD indicator is flashing bullish vibes as the MACD line joyfully dances above the zero line, much to the delight of the bullish histogram fans.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- USD PLN PREDICTION

- Chainlink’s 2025 Hype? It’s a Wild Ride! 🚀

- JPMorgan & Coinbase Join Forces: Crypto Gets Its Official Big Kid Pants

- SOL PREDICTION. SOL cryptocurrency

- Crypto Market Madness 🚀

- HBAR PREDICTION. HBAR cryptocurrency

- SKY PREDICTION. SKY cryptocurrency

2025-07-15 00:27