In the ever-unfolding tale of Bitcoin, that most illustrious of digital currencies, it appears that the price has bravely ascended above the formidable psychological barrier of $109,000—a threshold that, like a long-forgotten relic, had stubbornly withstood the test of time since December of the year 2024. Lo and behold, in a dazzling display of wealth and ambition, our beloved BTC has experienced a buoyant rise, exceeding three and a half percent within a mere 24-hour cycle, reaching an unprecedented height of approximately $118,885. This audacious peak was unveiled during the solemnity of the mid-London session on a Friday, that fateful day of July 11.

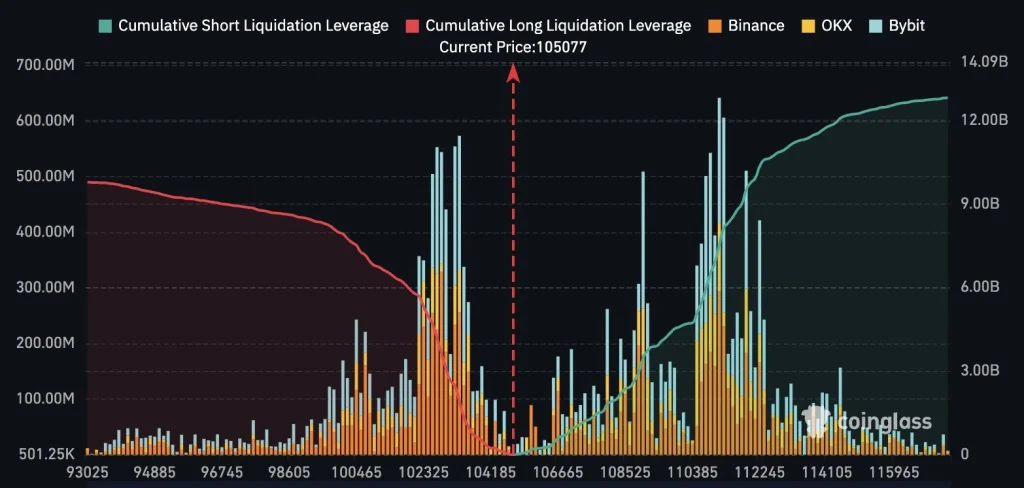

Yet, amid this celebratory atmosphere, the dark specter of heavy liquidations loomed, with an astounding $1.2 billion wiped away in the crypto market within the blink of an eye over the past day. Alas, the drama deepens, for within this financial theater, short trades alone contributed to over $1 billion of this grand spectacle, with BTC assuming a rather hefty share of approximately $567 million. Quite a twist, wouldn’t you say?

Top Reasons Why Bitcoin Price Has More Upside Momentum

The winds of fortune whisper that Bitcoin shall continue basking in the warm glow of bullish sentiment, propelled primarily by a burgeoning demand from institutional investors—those titans of the financial world. Indeed, the U.S. spot BTC ETFs have experienced the most gratifying cash inflows, totaling around $1.18 billion in recent months, as if beckoned by some invisible force.

One cannot overlook the towering figure of BlackRock’s IBIT, standing proud with more than $80 billion serenely resting under its management’s vigilant gaze. As chronicled by BitcoinTreasuries, it appears that companies such as Strategy and Metaplanet have taken a leading role among the multitude of enterprises hoarding BTC in their proverbial treasuries, the gleam of profit dancing in their eyes.

Furthermore, as if the universe conspired to fortify Bitcoin’s position, the unfolding drama of the global money supply continues to swell, causing ripples of optimism. More nations engage in a delicate dance away from the U.S. dollar, a curious trend observed through the BRICS alliance—a collective mischievously undermining the greenback amid its ongoing decline.

How to Trade Crypto Summer

Ah, the much-anticipated crypto summer! During this lively season, almost the entirety of the market revels in a euphoria akin to springtime blossoms, fueled by optimism and exuberant growth. The migration of capital from the behemoths of the crypto world to the small, yet promising projects unfolds like a grand narrative, ripe for the experienced trader.

From a sanctuary of technical contemplation, it would be wise to ponder upon the undervalued tokens—those memecoins that whisper tales of disruption in the web3 landscape, promising substantial returns amidst their whimsical nature. The atmosphere of 2025 seems to echo the fervent peak of the fabled crypto summer in 2017, a period that birthed one of history’s most exhilarating bull runs, a fact that deserves both recognition and a round of applause.

No less ironic is the realization that back in 2017, the U.S. President Donald Trump held the power, and lo and behold, he remains the current stalwart of the nation—a curious twist in this grand narrative of ambition and opportunity.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Silver Rate Forecast

- WalletConnect Dives into Stablecoin Mayhem with dtcpay in Asia! 🎉

- XRP Staking: A Tale of Tension and Tokens 🚀

- TAO PREDICTION. TAO cryptocurrency

2025-07-11 21:27