What you should pretend to know:

- Deribit’s notional open interest in XRP options has catapulted 38% in two weeks. Yes, even faster than my landlord raises the rent.

- The volatility of XRP mocks the “major” tokens like bitcoin and ether, luring bold-hearted yield hunters to the marketplace like moths to a financial flame.🔥

- Bulls grow fat on positive risk reversals, because everyone loves a good call. Preferably with less waiting on hold.

Somewhere between dreams of fortune and dread of failure, the dollar value entombed in XRP options balloons toward a record, driven by volatility that would make a Dostoevsky protagonist blush. Everywhere, yield hunters sniff the air with the hope of easy riches, while the crypto bazaar thrums with the music of anxious wallets unlocking and options contracts multiplying.

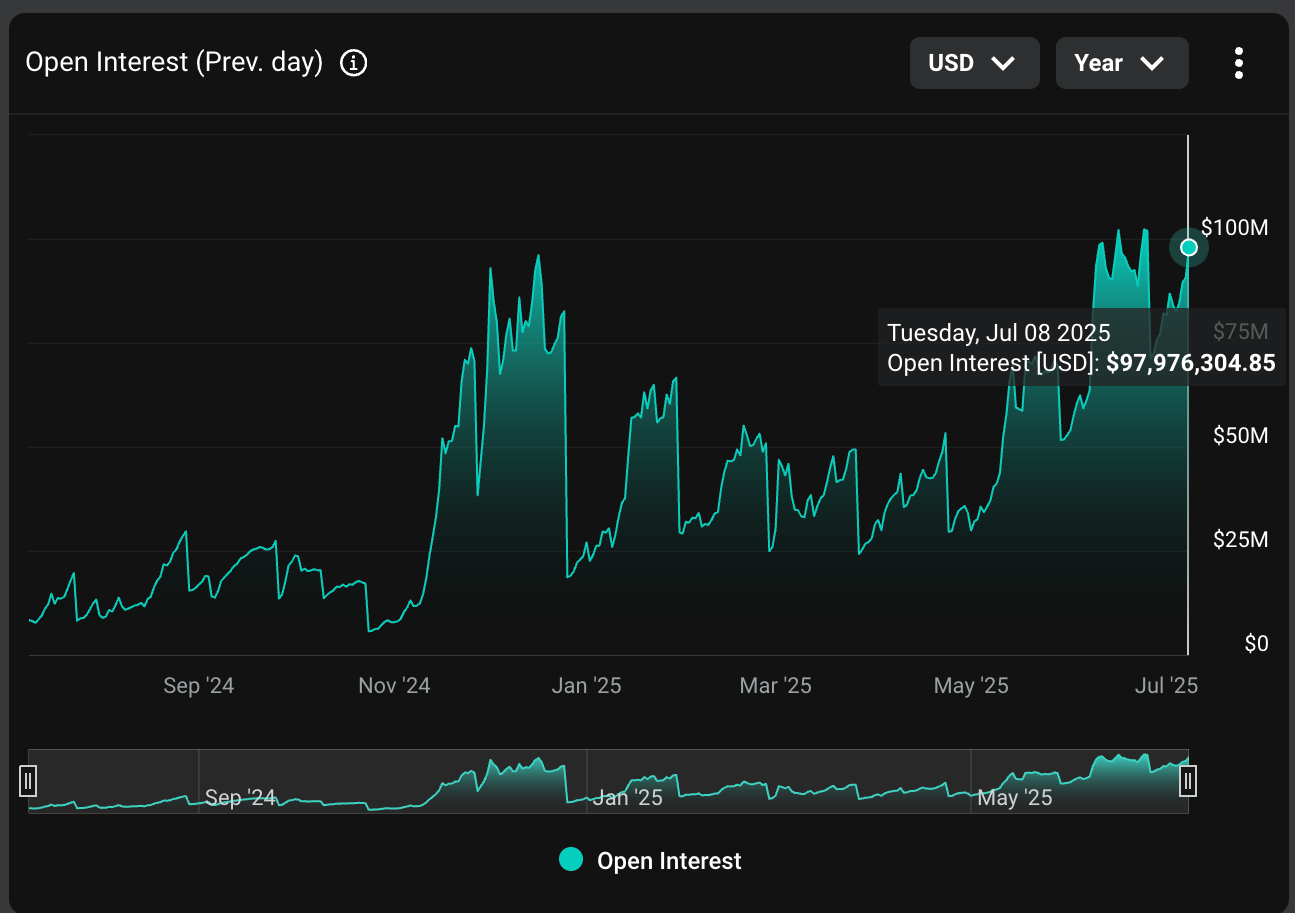

Behold: the notional open interest (OI) has clawed its bitter way up to nearly $98 million from $71 million—since the June 27 quarterly expiry. A 38% rise in two weeks! The record of $102.3 million, set June 24, trembles in anticipation (or terror). In contract terms, OI rose by 26% to 42,414. Remember: XRP on Deribit multiplies by 1,000, because ordinary math is for mortals.

Why this sudden rush? Implied volatility, comrade! The trembling anticipation of wild price swings. XRP, the wild child, outshines bitcoin, ether, even solana. Lin Chen of Deribit (knower of mysterious things) whispers, “XRP has returned over 300% in a year.” Jackpot, unless you staked your fortune on dogecoin instead.

Gains? The traders—half daredevils, half insurance agents—are selling cash-secured puts. You write a put, you promise to catch the asset if it tumbles, like a financially motivated safety net. They pocket premiums, hoping the only thing dropping is someone else’s savings account.

Options are written against spot holdings, or—if the trader is careful—backed by enough stablecoins to keep appearances up when things inevitably go sideways. Volatility is their muse: higher volatility, richer premiums! Who doesn’t love earning a little something while sweating nervously?

Risk reversals: Bulls have the wheel 🐂

At this grim and glorious moment, the 25-delta risk reversals beam with positivity—a bias towards calls, the siren song of bullish gamblers. Amberdata, keeper of numbers, tracks their fever. The 25-delta game is a bet with a twist: long put and short call (or the reverse), both far from price reality. Positive numbers? Bulls are in—until, of course, they aren’t.

Positive risk reversals across all sorts of expiries: short-term, August, September. It’s as if the market believes in a kind, benevolent future. How charming (and suspicious)!

Even more dramatic: thirty million call options strut about the bazaar, dwarfing the modest 11.92 million puts. A put-call ratio of 0.39! The herd is bullish, the bandwagon full, and the abyss beckons discreetly on the horizon. 🤡

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- XRP Staking: A Tale of Tension and Tokens 🚀

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Silver Rate Forecast

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- TAO PREDICTION. TAO cryptocurrency

2025-07-10 18:07