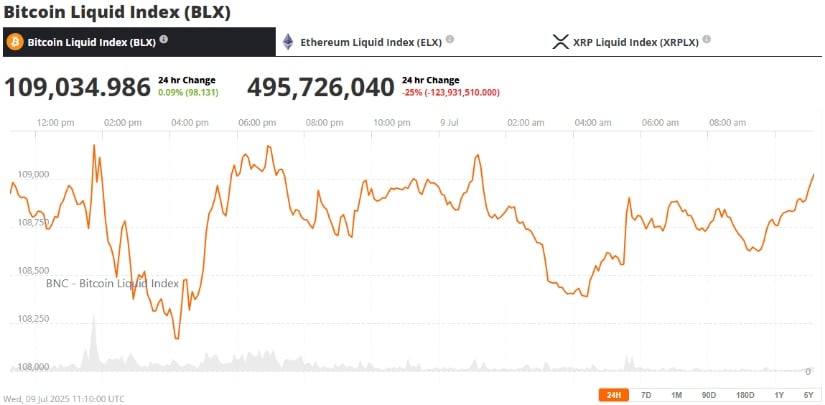

And so, dear reader, we find ourselves in the midst of a most thrilling spectacle – the Bitcoin market, poised like a debutante on the cusp of her first ball, quivering with anticipation. The price, a tantalizing $109,000, hangs in the balance, as the crypto world holds its collective breath in expectation of the forthcoming FOMC meeting minutes. Will it be a night to remember, or a crushing disappointment? Only time will tell, but one thing is certain – the drama is simply delicious 🍿.

A Technical Tango

A glance at the charts reveals a tantalizing tale of consolidation, as Bitcoin pirouettes above the $108,300 support zone, forming a tight ascending triangle that has all the makings of a breakout – or a breakdown, depending on one’s perspective. The RSI indicator, that trusty barometer of market sentiment, sits at a tantalizing 53.8, while the MACD, that sly mistress of momentum, whispers sweet nothings of mild bearish pressure, but no decisive downside shift… yet.

Ah, but what of the future, dear reader? If Bitcoin closes above the $109,600 resistance, the sky’s the limit – or at least, the May 22 high of $111,980. But, alas, a daily close below $107,200 would signal a breakdown of bullish structure, and a most unseemly scramble for the exits. The 50-day Exponential Moving Average (EMA), that stalwart sentinel of market trends, stands watch at $105,300, ready to sound the alarm at the first sign of trouble.

The Fed: A Most Unpredictable Dance Partner

And now, dear reader, we come to the pièce de résistance – the Federal Open Market Committee (FOMC) meeting minutes, due to drop like a bombshell later today. Will the Fed’s rate strategy for Q3 2025 be a dovish delight, or a hawkish horror show? The world waits with bated breath, as a more dovish stance could weaken the U.S. dollar, and send fresh capital inflows pouring into risk assets like BTC. Ah, but what of the converse? A most unpleasant prospect, indeed 😬.

Meanwhile, the Bitcoin ETF narrative continues to unfold like a tantalizing tale of mystery and intrigue. Spot Bitcoin ETFs have recorded consistent demand, with $80 million in net inflows reported on Tuesday alone – a most impressive display of institutional accumulation, if we do say so ourselves. And Trump Media, that most unlikely of players, has filed for five new crypto-focused ETFs with the SEC, including a proposed “Crypto Blue Chip ETF” that allocates 70% of its holdings to Bitcoin. Ah, but will it be approved? Only time will tell, dear reader 🤔.

Expert Insights: A Most Cautious Optimism

According to K33 Research, Bitcoin implied volatility has dropped to yearly lows since May 22, suggesting that markets are in a “wait-and-see” mode – a most sensible approach, if we do say so ourselves. The options market, that most mercurial of beasts, remains neutral across most timeframes, as skew metrics whisper sweet nothings of… well, nothing, really 😐.

And so, dear reader, we find ourselves at a most critical juncture. A break above $109,600 could open the door to retest all-time highs near $112,000 – a most thrilling prospect, indeed. Conversely, a drop below $108,355 may lead BTC toward the $105,000 region – a most unpleasant outcome, to say the least 😬.

Outlook: A Most Uncertain Future

As Bitcoin halving 2025 approaches, and with regulatory clarity gradually improving through ETFs and broader institutional interest, BTC remains well-positioned for growth – provided macroeconomic conditions align, of course. Ah, but what of the short term? Bitcoin’s next move will likely hinge on how markets interpret the Fed’s tone in the upcoming FOMC minutes. Until then, cautious optimism and range-bound price action may define the trading landscape – a most sensible approach, if we do say so ourselves 🤔.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

2025-07-09 19:07