Ripple’s XRP has managed to charm the altcoin market, rising 4% over the past seven days. 🌟

But, dear reader, let’s not be too hasty in our celebrations. Beneath the surface, the waters are murky, and the sharks are circling. Key on-chain indicators suggest that this rally might be more of a mirage than a solid foundation for future gains. 🌵

XRP Is Up 4% This Week—But Traders Are Quietly Exiting the Market

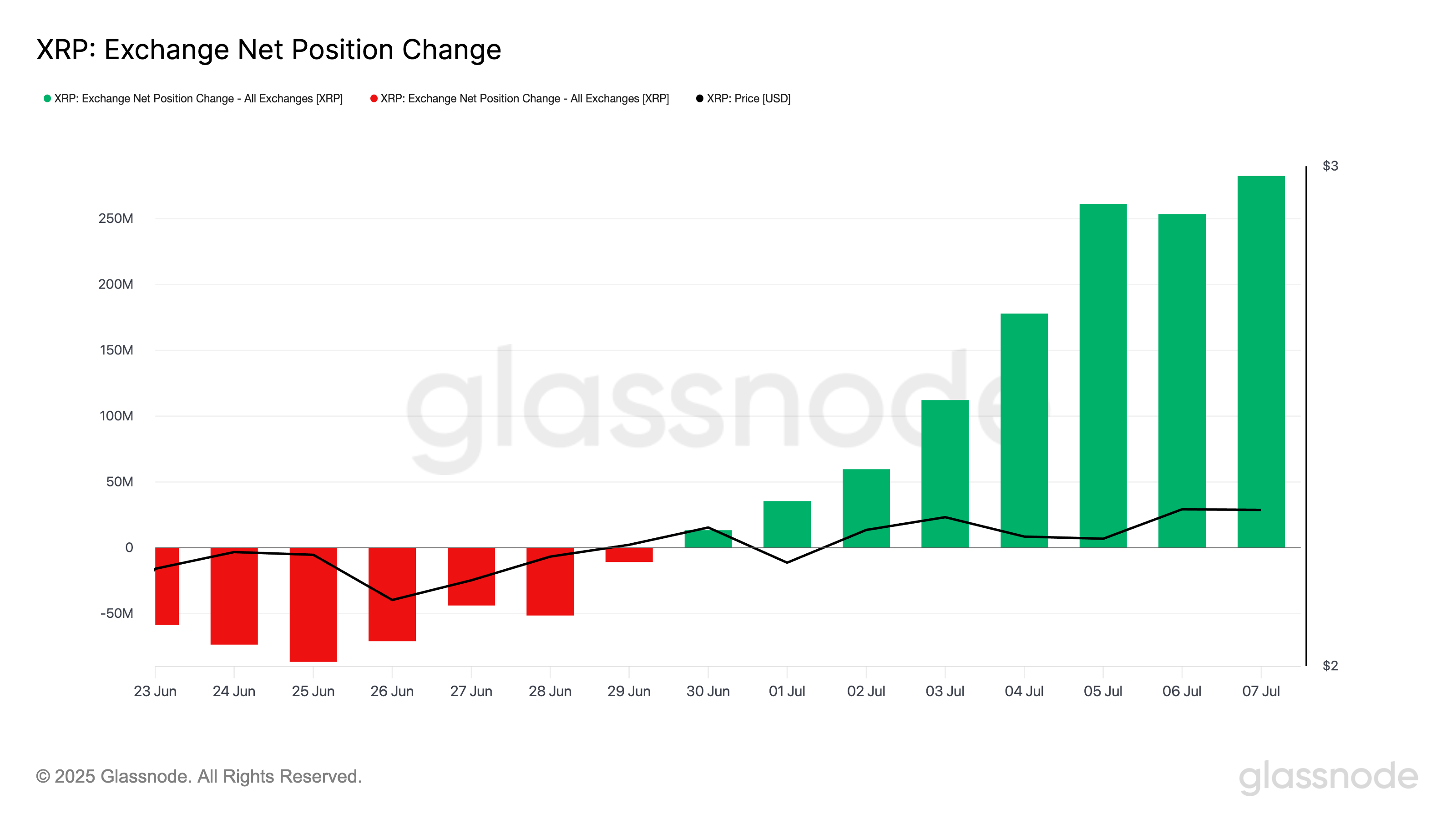

According to Glassnode, there’s been a steady uptick in XRP’s Exchange Net Position Change over the past week. On-chain data shows that this metric, which tracks the net amount of tokens moving onto centralized exchanges, hit an eight-month high of 283 million XRP on July 7. 📈

The timing is, shall we say, rather convenient. The spike in exchange inflows coincides with XRP’s recent price increase, suggesting that many traders are using the rally as an opportunity to cash out. This, in turn, is putting some downward pressure on the token. 📉

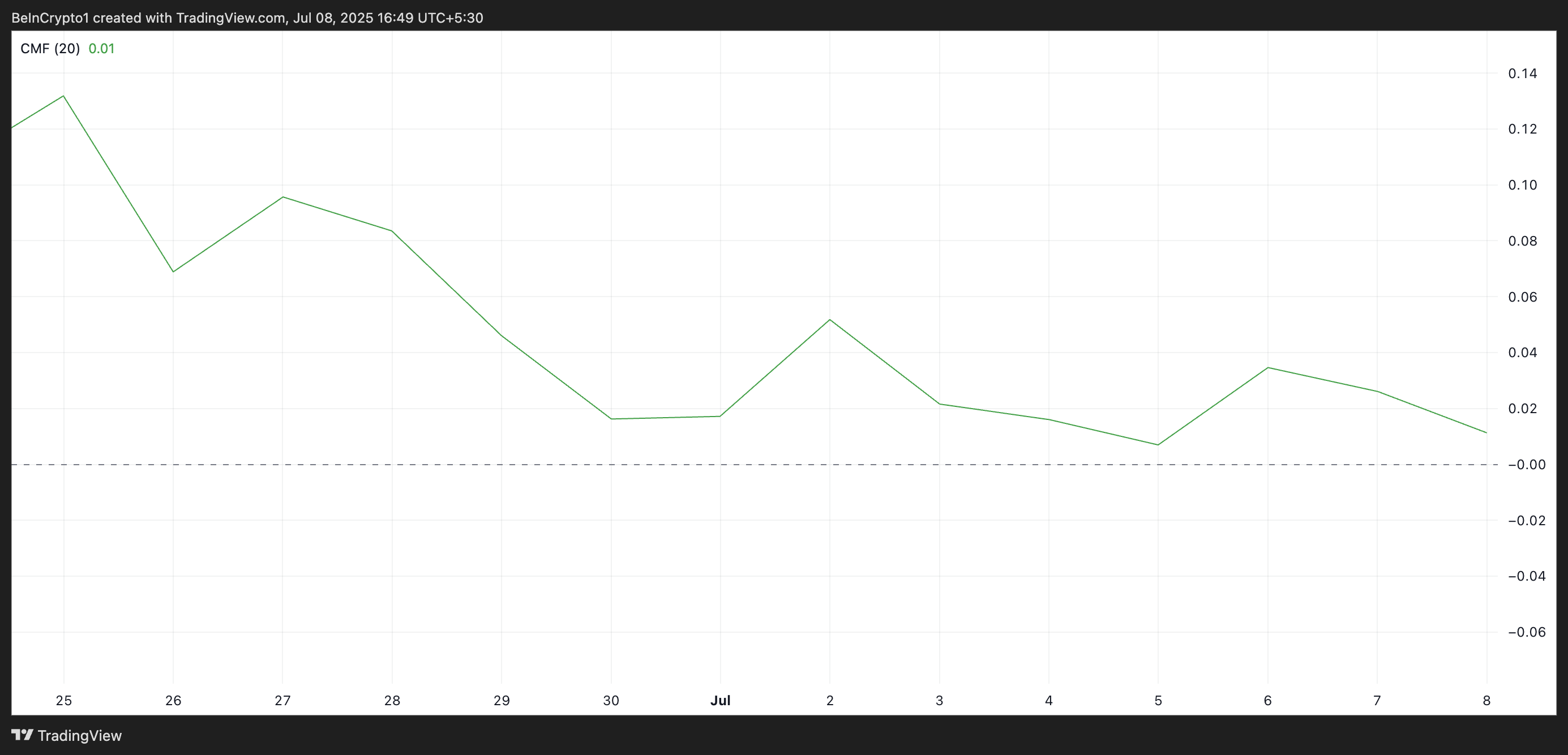

Moreover, despite XRP’s impressive spike, its Chaikin Money Flow (CMF) has been trending downward, forming a negative divergence with the token’s price. As of this writing, this indicator is at 0.01, teetering on the edge of falling below the zero line. 🌍

The CMF indicator, for those not in the know, measures how money flows into and out of an asset. When its value is positive, it suggests high demand and upward price momentum. Conversely, negative CMF readings point to strengthening selling pressure and rising bearish sentiment. 🐻

While XRP’s CMF hasn’t yet fallen below the zero line, its continued decline signals weakening accumulation. This trend often precedes a bearish reversal, and in XRP’s case, that outcome seems increasingly likely unless fresh demand enters the market to absorb the growing supply. 🚀

Losing This Support Could Spark a Drop to $2.14

On the daily chart, XRP is retesting the lower line of the ascending channel it has trended within over the past week. 📊

This channel is formed when an asset’s price consistently makes higher highs and higher lows within two upward-sloping, parallel trendlines. The upper line acts as dynamic resistance, while the lower line serves as dynamic support. 🛡️

When the price begins to test the lower boundary, especially after a strong rally, it often signals exhaustion in upward momentum. 🏃♂️

A decisive break below this lower support line is considered a bearish signal, as it suggests that buyers can no longer hold the trend. If this happens, XRP risks falling to $2.14. 🤦♂️

However, if the bulls regain control and demand climbs, they could drive XRP’s price to $2.35. 🐂

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- TAO PREDICTION. TAO cryptocurrency

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

2025-07-08 21:41