Bitcoin – or BTC to the unflappable observers who treat acronyms like weather vanes – hovers near 67,853 dollars, flirting with the idea of a ceiling before it decides to get uppity. In the background, 24-hour volatility sticks a stubborn nose into the air at 1.4%, with a market cap around 1.36 trillion and daily volume about 47.33 billion. The broader crypto market tightens its cloak and waits for the delayed January US inflation data, CPI, which is due sometime this week, as if the universe forgot to mail the forecast.

BTC is perched near 68,000, attempting to plant a solid floor after a correction that arrived wearing a fedora and a ledger, courtesy of shifting macroeconomic expectations.

FED RATE CUTS STILL LIKELY-BUT NO RUSH: UBS

Easing U.S. inflation should keep the Federal Reserve on track for rate cuts despite strong jobs data, UBS Global Wealth Management says. It expects two 25-basis-point cuts in June and September, supporting equities, bonds, and gold.…

– Walter Bloomberg (@DeItaone) February 12, 2026

EXPLORE: What is the Next Crypto to Explode in 2026?

Market Eyes US Inflation Data and Fed Path

The postponed BLS inflation print has become a bigger deal than a dragon at a tea party after January’s jobs report-130,000 nonfarm payrolls added and unemployment slipping to 4.3%, wages rising, and the Fed suddenly looking unusually committed to a “higher-for-longer” vibe. Traders wonder whether CPI will help the Fed hit its 2% target or simply confirm inflation’s stubborn mood remains in the room.

Adding a touch of farce to the proceedings, President Trump’s nomination of Kevin Warsh, a pro-Bitcoin advocate, to replace Jerome Powell as Federal Reserve Chair (effective after May) hints at long-term shifts in monetary policy that could influence risk assets and Bitcoin’s future mood swings.

NEW: Job growth SURGED in January, adding 130,000 total non-farm jobs and 172,000 private sector jobs – shattering expectations once again.

The unemployment rate fell. Wages grew. Federal employment is now at its lowest level since 1966.

This is the Trump Economy 📈📈📈

– Rapid Response 47 (@RapidResponse47) February 11, 2026

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

Potential Market Scenarios – Bitcoin Price Towards $60K?

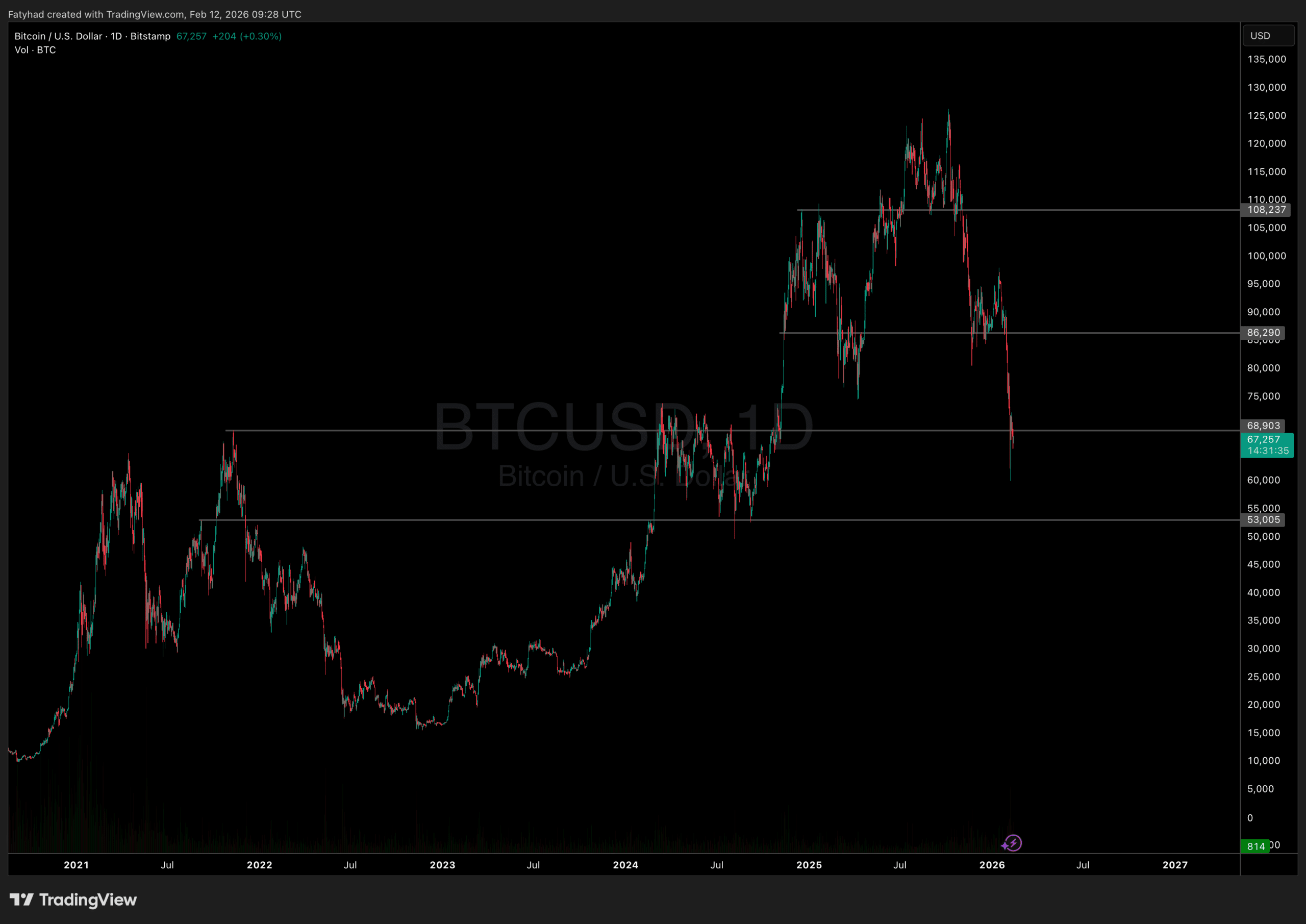

Bitcoin Price Action Source: TradingView

If tomorrow’s CPI data comes in “hotter” than 2.5%, a break below the $60,000 psychological floor is likely. This level represents a critical support zone where institutional “buy-the-dip” orders are concentrated. Conversely, a lower-than-expected inflation reading could cause a squeeze back toward the $74,400 resistance level.

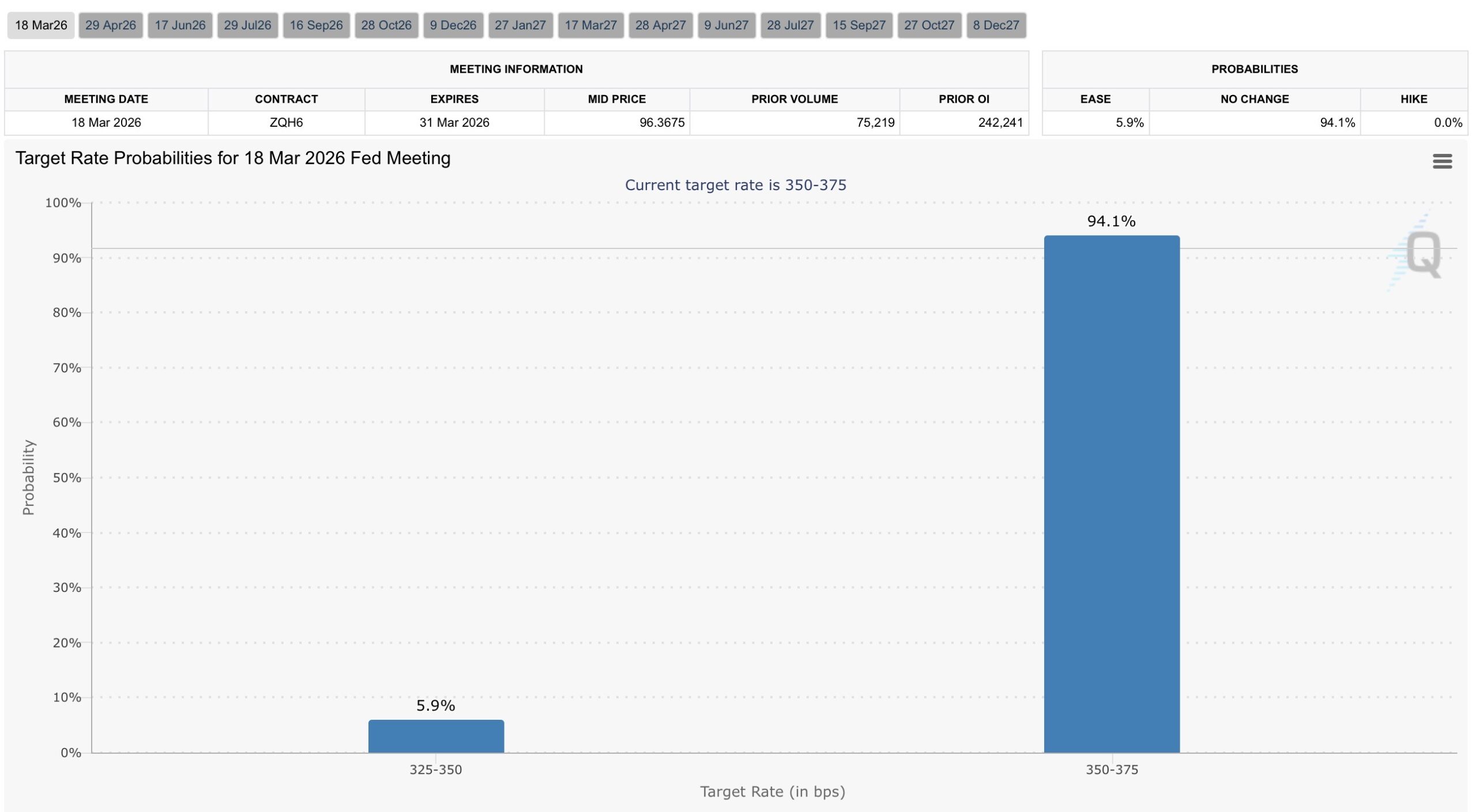

Data from the CME FedWatch tool currently shows a nearly 95% probability that the Fed will keep rates unchanged at 3.50%-3.75% in the near term.

Target Rate Probabilities for 18 Mar 2026 Fed Meeting Source: FedWatch

Tim Sun, Senior Researcher at HashKey Group, warned that “good news” for the economy, such as robust growth or sticky prices, is currently treating markets to “bad news” by delaying liquidity injections.

While some analysts argue that the crypto winter that began in January 2025 shows signs of recovery, the immediate price action remains tethered to this week’s critical data release.

EXPLORE: Best Solana Meme Coins by Market Cap 2026

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Bitcoin’s Sleepy Whale Wakes Up with $44M Splurge 💸🤑

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Bitcoin Miners Strike Gold Again, But Is It All Shiny? 🤔💰

- XRP: A Most Disappointing Turn of Events! 📉

- Market Madness: CPI Hijacks the Show While Gold Plays Dead

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

2026-02-12 18:33