Solana, that restless digital mule, couldn’t manage a tidy breakout above $90 and trimmed its gains like a vacation souvenir. The price now eyes the stubborn $88 gate and could drift below $82 if the stars align against it.

- Solana did manage to lift its spirits a bit, nudging above $78 and $82 against the US dollar, as if it found a tiny glimmer of hope in the snack tin.

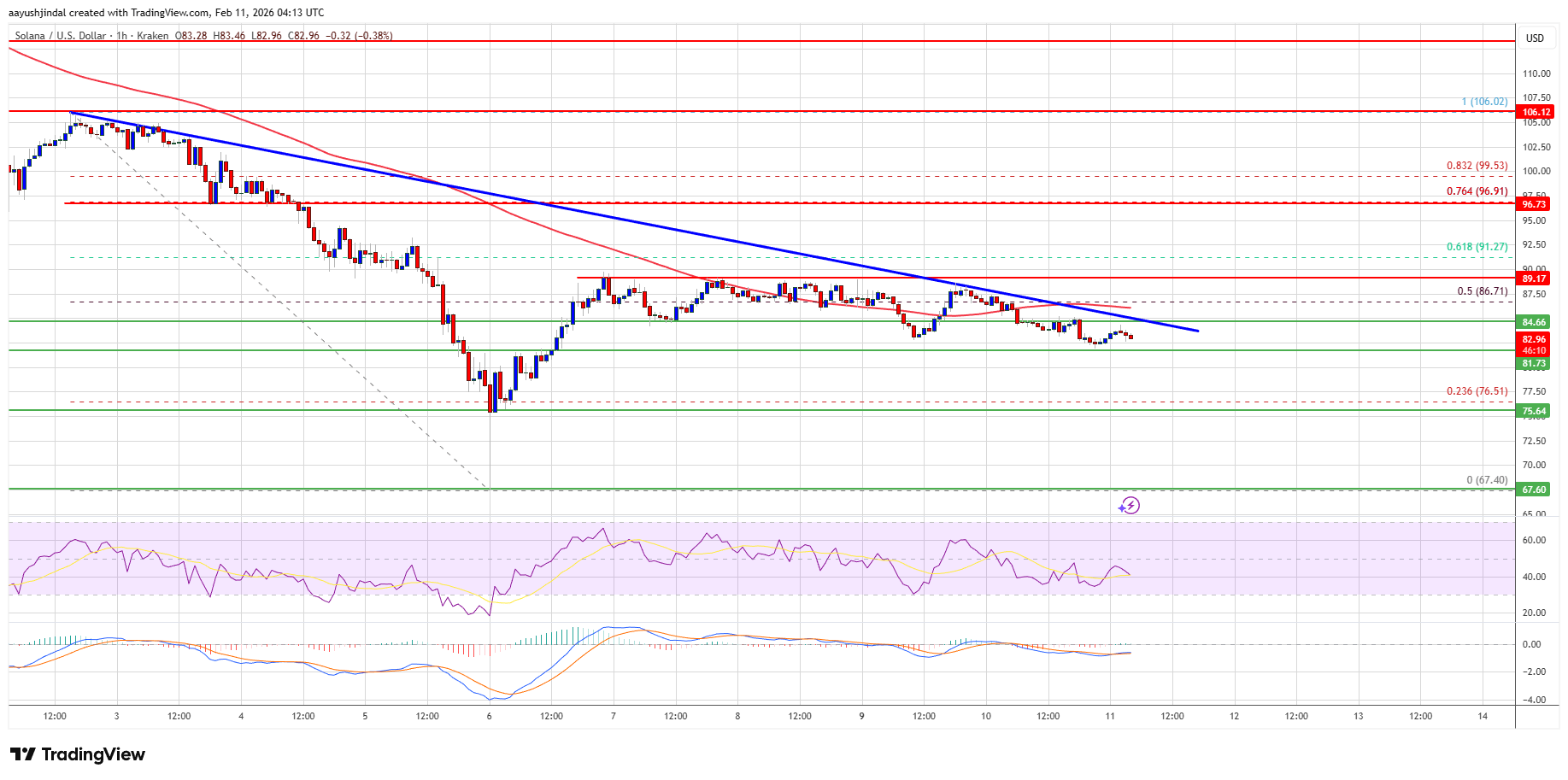

- These days it’s trading under $85 and under the 100-hourly moving average, which feels like being stuck under a bus shelter in the rain.

- A key bearish trend line has taken up residence around $85 on the hourly SOL/USD chart (Kraken data, in case you want the exact brand of gloom).

- Clearing $85 and then $90 could offer a polite nudge higher, as if coaxing Solana back onto the hiking trail.

Solana Price Faces Resistance

Solana stayed stubbornly steady and even managed a modest bounce above $72, the kind of rebound Bitcoin and Ethereum were pretending to do on a calm afternoon. It poked above the $80 mark, briefly.

There was a flirtation with the 50% Fibonacci retracement from the $106 peak to the $68 trough, a polite nod to the math department, but the bears kept watch near $90. The price has since drifted below $88, with that stubborn bearish trend line at $85 lurking on the hourly SOL/USD chart.

Solana remains below $85 and the 100-hour moving average, a double-barreled obstacle. Immediate resistance sits around $85 and that trend line; beyond that, the road rises to about $92, cohabiting with the 61.8% Fib retracement of the decline from $106 to $68.

The big resistance could be around $96. A successful close above that zone might set the pace for a slow, almost dignified ascent toward $105; push beyond that and the next target is roughly $112.

Downside Continuation In SOL?

If Solana can’t clear the $85, the downward drift could resume. Early support sits around $82, with a sturdier base near $80 waiting in the wings.

A break below $80 could push it toward $75, and a close under $75 could open the gates to around $70 in the near term.

Technical indicators

The hourly MACD is heading further into bearish territory.

The RSI sits below 50, giving Solana the mood of a person who forgot to bring a lunch and is blaming the weather.

Major supports – $82 and $75.

Major resistances – $85 and $92.

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- XRP: A Most Disappointing Turn of Events! 📉

- Bitcoin’s Sleepy Whale Wakes Up with $44M Splurge 💸🤑

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- Crypto Chaos: Market Meltdown, Trade Twists & Central Bank Confusion

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

2026-02-11 08:10