Shiba Inu persists in its modest tragedy, though there is a certain froth of emancipation creeping in: funds drifting away from the great exchange palaces and toward less fictitious custody. After failing to cling to a line of support with the ardour of a gentleman clinging to a lacy umbrella in a gale, SHIB continues its broad, somewhat apathetic descent. Fresh local lows have flirted with the scene in recent sessions, the token hovering ungratefully near the modest pence of 0.000006 dollars as the chorus of selling in the meme-coin theatre goes on.

On-chain behaviour changing

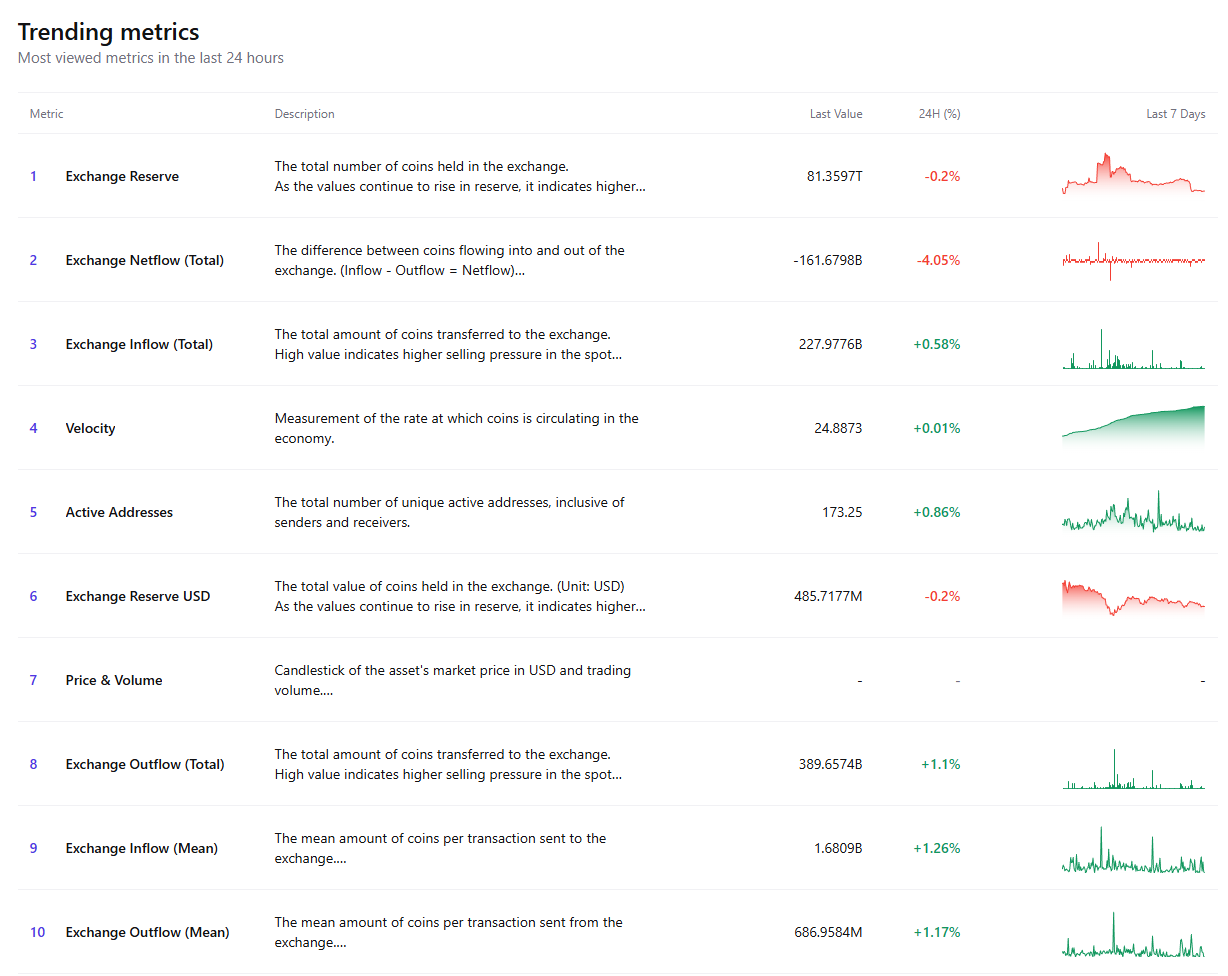

On-chain metrics, however, betray a more delicate evolution in the habits of holders beyond the arithmetic of price. The most conspicuous change is that a smaller cadre of tokens clings to centralized exchanges, as exchange reserves have slithered below the notorious 82 trillion SHIB threshold.

Declining exchange balances, in the dreary past, have often signified coins shuffling from the glare of the exchanges to the privacy of private wallets, a move commonly interpreted as a flirtation with self-custody or a prolonged residency in the long-term drawer.

Crypto Market Review: Shiba Inu (SHIB) out of Hell, Moment Ethereum (ETH) Investors Have Waited For, Dogecoin (DOGE) Zero Added

Other exchange metrics lend credence to this notion. While exchange outflow metrics have recently increased, netflows-those little elapsed moments when coins decamp from exchanges-still tell a tale of departure. Network velocity and active addresses, by contrast, remain stubbornly constant, as if the ecosystem were a decent fellow who continues to rise in the morning despite a depressed market mood.

Retailers getting active

On the surface, this might resemble a wave of withdrawals driven by the small investor-the sort who transfers funds to personal wallets when the market shows a tremor. Yet the waters are not so clean. Not all exchange outflows reflect the preferences of the retail class, since large holders and custodial platforms routinely shuffle assets between storage arrangements for security or operational prudence.

Looking forward, SHIB’s price trajectory remains largely tethered to the mood of the wider market. Technically, the asset retains a pressure that, should the present support give way, could permit further decline. Yet dwindling exchange reserves might also curtail the immediate supply for sale, potentially offering a stiffer pause to price slides when the broader market finds its feet again.

In other words, on-chain indicators hint that holders may be positioning for longer-term storage rather than urgent selling, even as SHIB’s chart continues to wear a somewhat wan smile of weakness. The furled question is answered by the next weeks’ performance of the general cryptocurrency market-whether this portends a gentle revival or merely cautious pause.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- India’s Crypto Users Are Finally Diversifying (And It’s Hilarious)

- Cardano QE6? The Big “Maybe” Prediction That’s Keeping Everyone Guessing! 😲

2026-02-10 17:11