It is a truth universally acknowledged, that a company in possession of a good stock price must be in want of a share buyback.

Galaxy Digital’s Attempt to Mend Its Financial Folly

According to the announcement, the program shall endure for a twelvemonth, during which time Galaxy may repurchase shares via open-market transactions, private negotiations, or other methods sanctioned by securities laws-though one might wonder why such a company would require permission to buy its own stock. The firm further discloses that the program may be suspended at a moment’s notice, a testament to the precariousness of its financial state.

Galaxy, in its wisdom, has deemed this initiative equivalent to 5% of its outstanding shares at the outset. Repurchases on the Toronto Stock Exchange shall require the approval of the usual suspects, while Nasdaq transactions shall abide by regulatory whims. All purchases, it is said, shall be made at prevailing market prices-unless, of course, the market is in a particularly capricious mood.

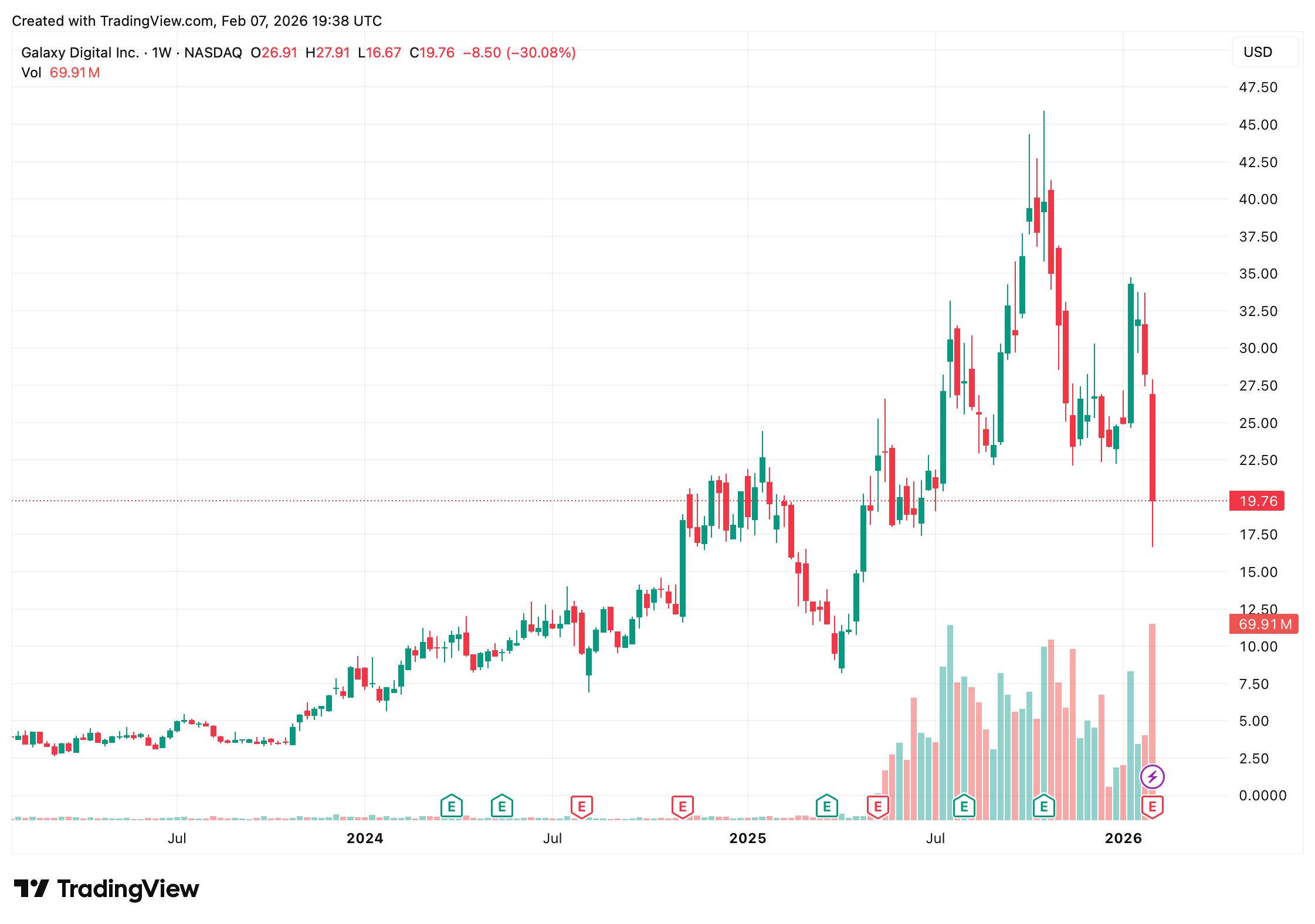

Following the announcement, shares of Galaxy experienced a most curious rebound, rising 17.34% on Feb. 6, though the stock remains a shadow of its former self, having plummeted 32% over the past five days. One might surmise that the market, like a fickle suitor, is torn between despair and hope.

The buyback, it is reported, followed Galaxy’s fourth-quarter earnings, which revealed a net loss of £482 million for Q4 2025. Yet, the company boasts a full-year adjusted gross profit of £426 million and a liquidity position of £2.6 billion, a figure that may or may not include stablecoins-those enigmatic digital assets that seem to exist solely to confuse the uninitiated.

Chief Executive Officer Mike Novogratz, with a flourish of optimism, declared that the company believes its shares do not reflect the true value of its business, citing its balance sheet and investments in growth initiatives. One might question whether this is a case of misplaced confidence or a desperate attempt to placate shareholders.

Beyond the repurchase program, Galaxy continues to diversify, expanding into data centers and artificial intelligence-a strategy that, if successful, may yet save the company from its crypto-centric fate. Yet, one cannot help but wonder if this is merely a prelude to further folly.

FAQ ❓

- What did Galaxy Digital announce?

It has resolved to embark upon a most audacious scheme of purchasing its own shares, amounting to two hundred thousand pounds. - How long will the buyback last?

The program is approved to run for a twelvemonth, commencing on the sixth of February, 2026. - Is Galaxy required to buy back all $200 million?

No, the program is discretionary, and the company may halt it at any juncture, should it deem fit. - Why did Galaxy approve the buyback?

Management claims the stock is undervalued, a sentiment that may or may not be rooted in reality.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Pi Coin Rally Heats Up as Every Group Buys In – But a Risk Lurks Below $0.29

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Vitalik’s Wild Treasury Ride: ETH, Leverage, and Uncle Sam’s Stash! 🚀💰

2026-02-08 03:17