In a curious turn of events, the crypto markets have offered a slight glimmer of hope today, as if to mock us with a gentle recovery after last week’s dramatic plunge-an event akin to a tragic opera, where Bitcoin has steadied itself, and altcoins are, oh so valiantly, attempting to establish their brief moments of stability. Among these valiant contenders is Solana, which has audaciously risen over 5% to reclaim the $85 mark after a brief flirtation with the low-$70s. But hold your applause! This movement, while relieving immediate despair, only suggests that the market is in a state of recalibration, rather than embarking on a jubilant uptrend. The looming question now is whether Solana (SOL) is truly laying down roots or simply reacting to the weary sighs of exhausted sellers.

The Chilly Winds of Solana’s On-Chain Data

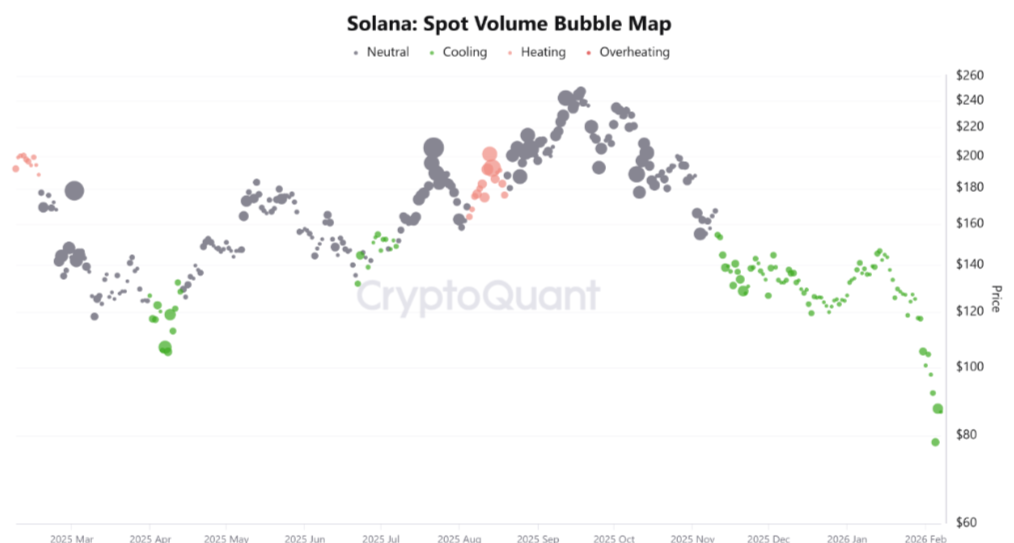

Ah, the on-chain data of Solana-a reflection of post-liquidation ennui, much like one gazing into the bottom of an empty glass after an evening of revelry. CryptoQuant’s Spot Volume Bubble Map places us squarely in a “cooling” region, reminiscent of those lazy summer afternoons when the sun dips below the horizon, signaling the end of a good day. Historically, this zone indicates that sellers have fled the scene, yet buyers seem to be enjoying a leisurely stroll, taking their sweet time before engaging in the fray. And alas, spot volume remains comically subdued compared to previous recovery attempts. One cannot help but chuckle at the notion that sustainable bottoms prefer rising participation rather than mere price stabilization. Without robust spot inflows, it appears large holders are biding their time, waiting for a sign from the heavens before diving into the market once more.

And let us not overlook the derivatives data, which adds another layer of irony to our tale. Futures volume bubble maps illustrate a sharp transition from “overheating” to “cooling,” confirming that speculative leverage has been effectively flushed away, leaving behind a faint whiff of caution. Open interest has contracted significantly, reducing liquidation risks but also suggesting that traders have retreated to the sidelines, perhaps sipping tea and contemplating the universe rather than engaging actively in the market.

Stablecoin Inflows: The Cautious Optimism

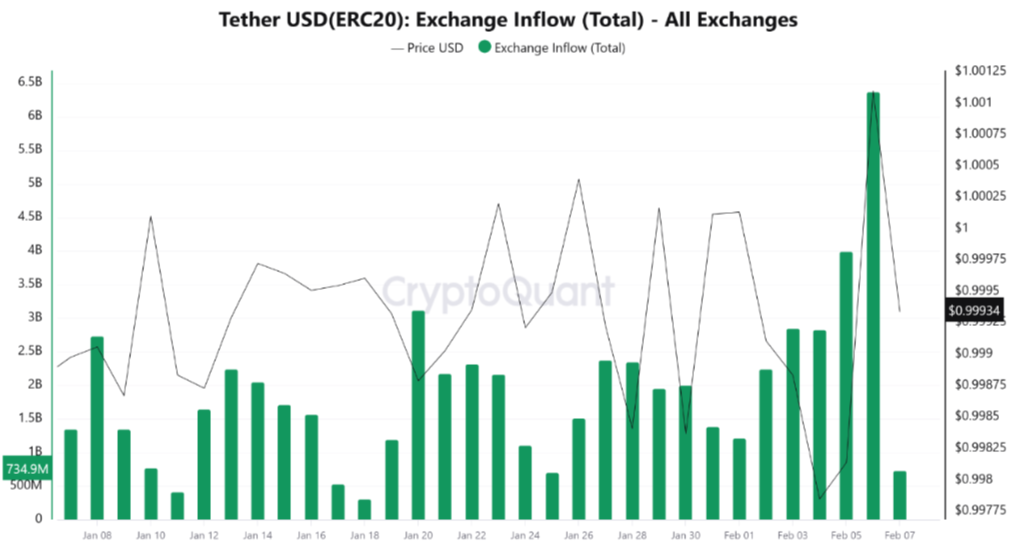

Here, stablecoin flow data adds an intriguing twist to our narrative. Recently, exchange inflows of USDT have soared to multi-week highs, conjuring images of fresh liquidity traipsing into the system. Yet, despite this newfound liquidity, aggressive accumulation of Solana remains elusive. What a delightful conundrum!

Historically, strong market bottoms emerge when rising stablecoin balances coincide with increasing spot volume and a dwindling number of assets on exchanges. Currently, however, Solana’s on-chain footprint reveals an abundance of liquidity without decisive allocation, as if capital were playing hard to get, waiting for clearer signals before making its next move. In institutional terms, one could say the market is liquid yet cautious, much like a cat eyeing a cucumber.

Solana’s Price: A Temporary Reprieve?

As Solana’s price dances back toward the $85 mark, we witness a charming short-term recovery from recent panic lows. Yet, the broader chart structure implies that this movement is corrective rather than transformative. Within the confines of a descending channel, SOL continues to be guided by the hands of determined sellers since January’s breakdown. The recent bounce, originating from a well-defined demand zone in the $70-$75 range, acted as a liquidity flush-essentially, a technical rebound triggered by short covering. Nevertheless, the rally has faltered near the mid-range of the descending channel, an area that seems to enjoy repeatedly capping upside attempts, much like a humorous jester thwarting the king’s ambitions.

The $88-$92 resistance band now looms large as the first major supply zone. This region aligns with prior breakdown levels, short-term moving averages, and the upper boundary of the declining structure. A clean daily close above this zone would be required to shift market structure and open the door toward the mythical $100. Until that moment arrives, any upward movements risk being met with an enthusiastic round of selling. On the downside, immediate support now rests near $80, followed by the broader demand block around $72. As long as SOL maintains its position above $80, the rebound structure remains intact. Should it falter back below that level, we might find ourselves on a slippery slope back toward the lower demand area. Overall, the price action of Solana reflects a stabilization following a sharp sell-off, yet confirmation of a trend reversal remains as elusive as a wisp of smoke.

Final Thoughts on this Crypto Comedy

In conclusion, Solana’s price recovery toward $85 serves as a delightful interlude, driven by oversold conditions and cooling on-chain metrics, including declining futures leverage and stabilizing spot volume. However, the exchange inflows and muted follow-through buying suggest that conviction is still gathering its strength, much like a shy performer backstage. A sustained push above the $90-$95 resistance zone, buoyed by rising spot demand and reduced sell pressure, is essential to confirm a durable trend shift rather than a fleeting rebound.

FAQs

Why is Solana (SOL) price recovering after the sell-off?

Solana is rebounding as selling pressure eased and leverage was flushed, leading to stabilization rather than strong new buying.

Is the current Solana recovery sustainable?

Sustainability depends on rising spot volume and continued demand. Without that, the move remains a technical rebound.

What is the short-term outlook for Solana price?

Short term, SOL may consolidate as the market recalibrates. A trend reversal needs stronger buying and a close above $90.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- 🤑 Saylor’s Strategy: 3% of Bitcoin? Oh, la la! 🤑

- Stablecoins: The Angelic Devil in Crypto’s Closet 👼😈

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- ETH’s Rocky Road to Riches: Will It Climb or Collapse?

2026-02-07 14:48