Ah, the enigmatic PlanB, that spectral soothsayer of the stock-to-flow model, has once again emerged from the shadows to cast his runic predictions upon the trembling altars of Bitcoin. With the gravitas of a prophet and the precision of a madman, he declares that the digital leviathan’s descent has birthed not one, but four plausible apocalypses. Behold, the markets quiver as he unveils paths ranging from the classic 80% plunge into the abyss to the audacious notion that the nadir has already been kissed.

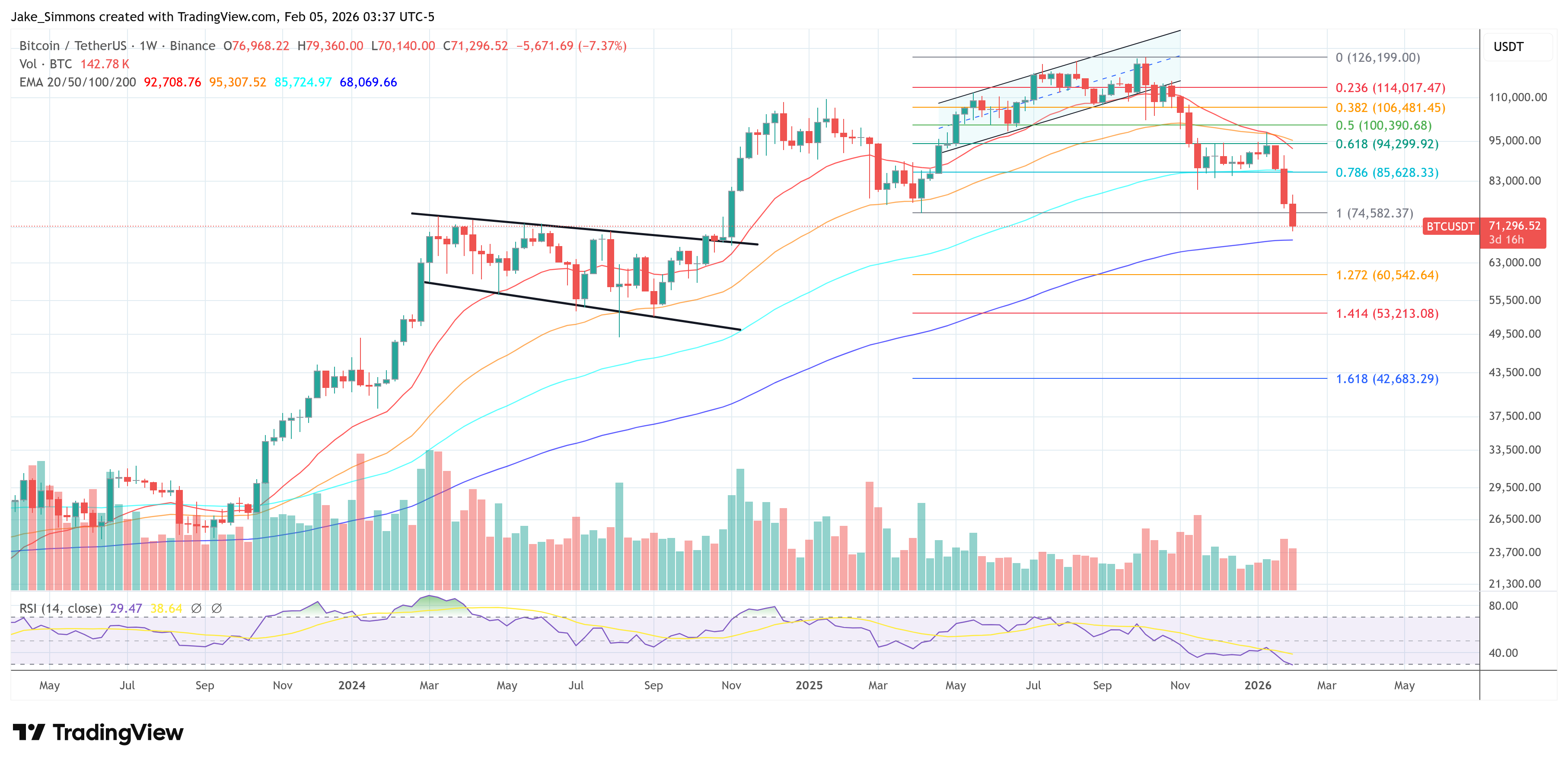

In a missive dispatched via the ethereal platform X, accompanied by a video as cryptic as a Bulgakov novel, PlanB on February 4th framed the debate with the air of a man who has conversed with both demons and algorithms. He speaks of bear-market bottoms, long-term trends, and the lethargic rally that may yet spare us a deeper purgatory. January, he notes, closed with Bitcoin at $78,000-a 40% retreat from its zenith of $126,000. His charts, adorned with the 200-week moving average at $58,000 and the realized price at $55,000, whisper of a regime shift, as the RSI languishes at 49-a number as ominous as a cat crossing your path on a moonless night.

“RSI, 49,” he intones, his voice dripping with the weight of destiny. “Below 50, it is a downtrend, a bear market, a danse macabre akin to the waltzes of 2014-15, 2018-19, and 2022-23.” One can almost hear the ghostly laughter of the markets in the background.

Four Acts in the Tragedy of Bitcoin

With the flair of a dramatist, PlanB unfurls his quartet of scenarios. The first, a historical nightmare still etched in the minds of traders: an 80% collapse from the peak. “Imagine,” he says, “$25,000-a figure as absurd as a cat reciting Shakespeare, yet there it is, lurking between the lines of my chart.”

The second, more conventional, sees the bottom nestled around the 200-week moving average and realized price-$50,000 to $60,000. He gestures to the past, to 2022 and 2015, where the RSI troughs aligned with these long-term anchors like stars in a predestined constellation.

The third scenario, shallower still, suggests a retreat to just above the previous cycle’s high, around $69,000-$70,000. “The bull market was but a shadow,” he muses, “lacking the fiery peaks of its predecessors. Thus, the bear may spare us its full fury.”

And the fourth, the trader’s fever dream: that the bottom has already been etched in stone at $72.9k. Alas, as BTC plummeted to $70,140 on Wednesday, this scenario crumbled like a poorly constructed sandcastle.

In my humble opinion, the four horsemen of Bitcoin’s bear market are:

1) -80% from ATH $126k => $25k

2) Down to 200w MA / realized price => $50k-60k

3) Down to just above previous ATH => $70k

4) Yesterday’s $72.9k was the bottomI discuss these prophecies in my new video:

– PlanB (@100trillionUSD) February 4, 2026

PlanB, ever the alchemist, revisits his stock-to-flow framework, insisting it remains steadfast at $500,000-a beacon of scarcity in a sea of volatility. Yet, he admits with a wink, “It speaks not of tops and bottoms, but of four-year averages and phase transitions.” A caveat as slippery as a Moscow fog.

His final act hints at a shifting cycle. The peak, he notes, usually arrives in the first or second year post-halving, but 2024 defied this script. “Perhaps,” he suggests, “the upside awaits us later in the cycle.” Yet, for now, his gaze remains fixed on the realized price, the 200-week average, and the low-$70,000s-a trifecta of uncertainty.

As the curtain falls, BTC trades at a price as unpredictable as the Master’s next novel.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Crypto Leverage: Uh Oh ⚠️

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- XRP’s Wild Ride: SBI, ETFs, and the Great $3.00 Chase 🎢💸

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- Whizz-Pang: The 75/25 Crypto ETF Circus Hits the S&P

2026-02-05 15:40