The crypto market is having one of those dramatic breakdowns that make you wonder if it’s time to sell your organs for fiat. Leverage is being flushed like a clogged toilet at a chili cook-off, and everyone’s pretending they didn’t see it coming.

Coinglass data reveals that between Jan 29-31, $1.5B in $BTC leveraged long positions were wiped out. Bitcoin ($BTC) is retracing faster than a cat fleeing a vacuum cleaner, triggering liquidations that make Black Friday look like a gentle yoga session. When Bitcoin sneezes, altcoins don’t just catch a cold-they develop full-blown pneumonia, complete with double-digit drawdowns that make you question your life choices.

This volatility is the crypto equivalent of a late-stage reality show breakup: dramatic, predictable, and somehow still entertaining. Over-leveraged longs are being wiped out like yesterday’s leftovers, resetting open interest in a way that’s both brutal and necessary. But market downturns are like bad first dates-they’re awkward, uncomfortable, and somehow still teach you something.

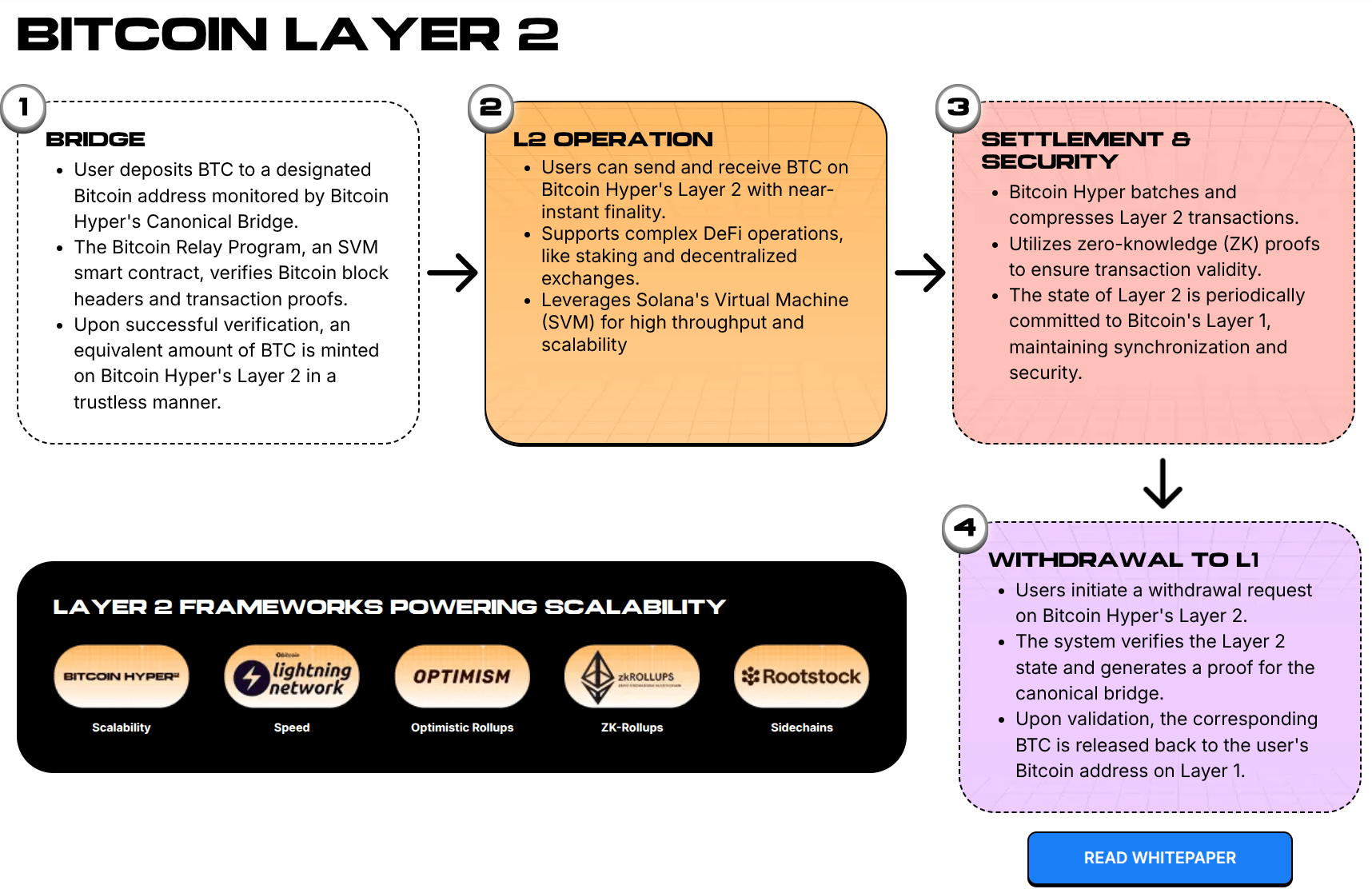

While speculative capital flees faster than a vegan at a steakhouse, smart money is rotating into infrastructure plays that actually solve problems. Traders are finally noticing Bitcoin’s scalability issues, which become as obvious as a fart in a silent room during high-volatility events. Network congestion spikes, transaction fees explode, and suddenly the base layer is about as useful as a screen door on a submarine. Enter Layer 2 solutions, the unsung heroes of this chaotic circus.

Amidst the sea of red candles, Bitcoin Hyper ($HYPER) is the odd duck maintaining upward momentum in its presale phase. It’s like the one person at a funeral who’s inexplicably cheerful. By combining the speed of the Solana Virtual Machine (SVM) with Bitcoin’s security layer, the project is attracting capital from people who want utility, not just another speculative rollercoaster ride.

The divergence between Bitcoin’s price action and inflows into $HYPER suggests investors are hedging against L1 inefficiencies. They’re betting on the infrastructure that will power the next phase of DeFi, because let’s face it, nobody wants to wait 10 minutes for a transaction while their coffee gets cold.

Solana Speed Meets Bitcoin Security: A Match Made in Crypto Heaven

The hype around Bitcoin Hyper boils down to the ‘Scalability Trilemma.’ Bitcoin is the gold standard for security, but its transaction speed is about as fast as a snail with a hangover. Solana, on the other hand, is the Usain Bolt of blockchains but lacks Bitcoin’s trust factor. Bitcoin Hyper merges these two worlds like a crypto version of peanut butter and jelly-unexpected, but somehow perfect.

The project’s mascot is adorable, but let’s be honest-it’s the mechanics that are really turning heads. By combining Bitcoin’s security with Solana’s speed, $HYPER creates a high-performance environment where developers can build dApps using Rust, while settlement remains anchored to Bitcoin. Sub-second finality and negligible gas fees? It’s like discovering your favorite coffee shop has free Wi-Fi and unlimited refills.

For DeFi users, this unlocks complex smart contracts, swaps, lending protocols, and gaming dApps on Bitcoin without the prohibitive latency. It’s the crypto equivalent of upgrading from dial-up to fiber optic internet. Want to dive deeper? Check out our ‘What is Bitcoin Hyper?‘ guide, because who doesn’t love a good explainer?

Analytically, this approach fixes the ‘programmability gap’ that’s held Bitcoin back like a stubborn toddler refusing to leave the playground. By utilizing a decentralized canonical bridge for $BTC transfers, Bitcoin Hyper lets holders put idle capital to work. The market’s reception? It’s as clear as a glass of tap water-the presale performance is accelerating even as the broader market corrects.

BUY YOUR $HYPER FROM THE OFFICIAL PRESALE PAGE. No, seriously, what are you waiting for?

Technical Resilience: $HYPER Holds Strong While the Market Loses Its Mind

While the broader market is in full-on ‘risk-off’ mode, $HYPER is demonstrating the kind of resilience usually reserved for reality TV contestants. Major L1s are crumbling like a house of cards in a wind tunnel, but the $HYPER presale has maintained its structured price increases, currently sitting at $0.013675. This stability is a psychological anchor for investors who are tired of watching their portfolios freefall like a skydiver without a parachute.

The project’s momentum is fueled by its modular blockchain architecture, which separates execution from settlement. By offloading the heavy lifting to the SVM while posting transaction proofs to the Bitcoin mainnet, $HYPER bypasses the congestion that’s currently choking other ecosystems. Wondering how to buy in? We’ve got you covered with our ‘How to Buy Bitcoin Hyper‘ guide, because we’re nice like that.

Having raised over $31.2M even as Bitcoin’s volatility index (VIX) spikes, it’s clear the community engagement for $HYPER is stronger than a barista’s coffee addiction. This suggests the current ‘flush’ is acting as a filter, removing the tourists and leaving behind high-conviction holders who see the L2 narrative as the primary growth driver for the 2026 cycle. So, what are you waiting for? Buy Your $HYPER now, before it’s too late.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 GAIN Token: Bull Trap or Divine Rebound? 🤑

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

2026-02-03 20:28