The crypto exchange-traded funds, or ETFs as they are rather haughtily dubbed, concluded the last full week of January amid considerable turbulence, with substantial losses observed across the likes of Bitcoin, Ether, XRP, and even Solana. A most persistent risk-averse sentiment precipitated one of the most dire weekly drawdowns witnessed thus far in the year.

January Concludes in Distress as Bitcoin and Ether Lead the Great ETF Exodus

The concluding week of January offered an unflinching reality check to those daring souls who had ventured into the realm of crypto ETFs. What began with a timid semblance of stabilization swiftly unraveled into a widespread selloff, leaving no significant asset class unscathed by the time Friday’s curtain fell.

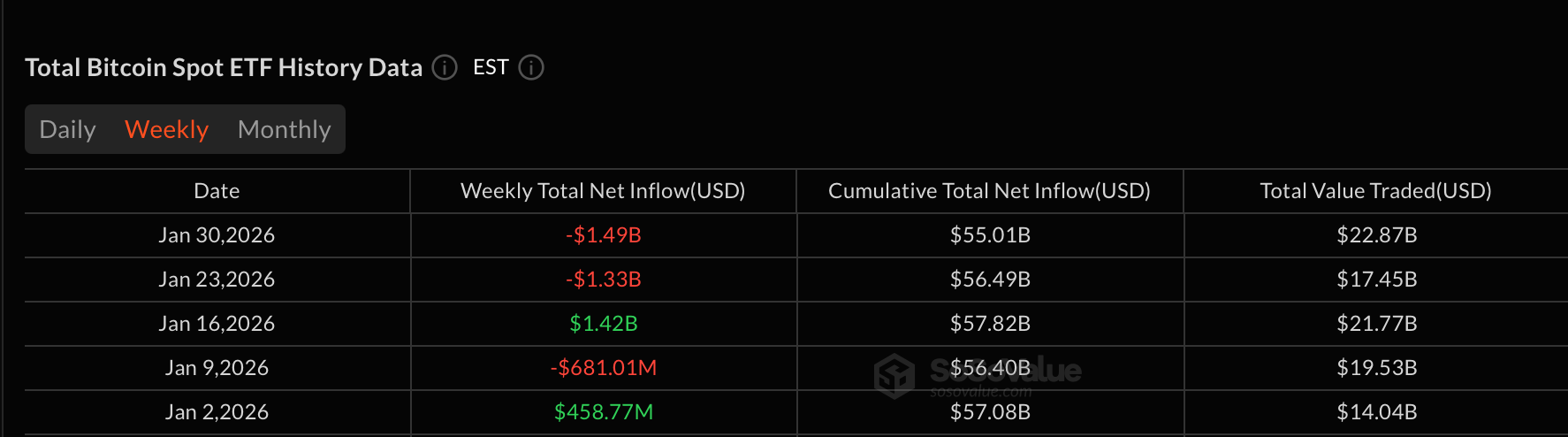

Bitcoin spot ETFs experienced an astonishing net outflow amounting to $1.49 billion-truly a feat of record proportions, marking the second-largest weekly exodus ever recorded. Blackrock’s IBIT bore the brunt of this misfortune, enduring daily redemptions that culminated in a staggering net weekly outflow of $947.17 million. One cannot help but picture the poor investors clutching their pearls in dismay.

Following closely behind was Fidelity’s FBTC, which saw a net weekly outflow of $191.59 million, burdened as it was by a relentless tide of selling pressure, despite the briefest of respites midweek. Grayscale’s GBTC, not wishing to be left out of the misery, shed approximately $119 million, whilst Bitwise’s BITB suffered a loss of $112 million. Ark & 21shares’ ARKB also exhibited notable weakness, concluding the week down $78.45 million-such delightful company they keep!

Smaller yet persistent outflows were recorded across Vaneck’s HODL, Grayscale’s Bitcoin Mini Trust, and Invesco’s BTCO. The weekly trading volume among Bitcoin ETFs exceeded a staggering $22 billion, whilst total net assets took a sharp downturn towards $107 billion-a truly remarkable display of financial gymnastics.

Ether spot ETFs recorded a net outflow of $327 million, extending January’s infamous volatility. Blackrock’s ETHA led the charge of despair with approximately $264 million in net redemptions, including two particularly dramatic exit days late in the week. Fidelity’s FETH lost around $16.92 million, while Grayscale’s ETHE and Ether Mini Trust together saw combined outflows nearing $45 million. Bitwise’s ETHW contributed further to the dismal narrative with its modest yet steady exits. The weekly trading volume across ether ETFs reached nearly $7.78 billion, while net assets slipped below $16 billion, much to the chagrin of hopeful investors.

XRP spot ETFs recorded their most significant weekly setback since inception, with net outflows of $52.26 million-a rather unfortunate record. Grayscale’s GXRP accounted for the vast majority of this calamity, posting a weekly net exit of $95.79 million, only partially offset by the steady inflows into Bitwise’s XRP ($18.71 million), Franklin’s XRPZ ($9.11 million), 21Shares’ TOXR ($8.19 million), and Canary’s XRPC ($7.53 million). Despite late-week inflows, total net assets dwindled to around $1.19 billion-a most disappointing affair indeed.

Solana spot ETFs concluded the week with a paltry $2.45 million in net outflows, bringing to an end their recent streak of inflow-what a way to dash hopes! Bitwise’s BSOL and Grayscale’s GSOL absorbed much of the pressure, while Fidelity’s FSOL attempted to provide intermittent support, though one might say it was a feeble attempt at best. Net assets dipped just below $1 billion, reflecting a posture of caution rather than outright capitulation, a sentiment most elegant in its own right.

//www.binance.com/en/price/bitcoin”>Bitcoin

and Ether bore the brunt of institutional selling, whilst

XRP

and

Solana

appeared rather less than sturdy in their defensive posture. As January drew to a close,

crypto

ETFs entered February bruised and battered, their sentiments in tatters, while the market seems ever so keen to seek a more stable footing.

Frequently Asked Queries 📉

• What caused the heavy losses in crypto ETFs during late January?

A sustained shift to a risk-off attitude instigated aggressive de-risking among institutional investors across digital assets.

• What were the weekly outflows for Bitcoin and Ether ETFs?

Bitcoin ETFs suffered losses of $1.49 billion, while Ether ETFs saw roughly $327 million in net exits.

• Did any crypto ETFs demonstrate resilience amidst the selloff?

XRP and Solana experienced partial inflows, yet both concluded the week in net outflows.

• What does this bode for crypto ETFs as we venture into February?

The sentiment appears decidedly damaged, with investors exercising caution whilst awaiting clearer macroeconomic signals.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- XRP’s Wild Ride: SBI, ETFs, and the Great $3.00 Chase 🎢💸

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- When Tech Meets Tradition: Kraken & Deutsche Börse Salsa Together

- Crypto Kidnappings: When Blockchain Meets Handcuffs 😱

- ASIC Grants Crypto Firms a Breathing Space… With a Deadline! 💸

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

2026-02-02 20:32