Should there have been any lingering hesitation about the bear making itself at home, the recent tumble of Bitcoin to a touch over $81,000 made the notion curl its moustache with eagerness. A merry caboodle of mischief-geopolitical frictions, Microsoft’s earnings hiccup, and cascades of liquidations-has been blamed, yet the old premier cryptocurrency is evidently having a jolly hard time catching even a single break, like a chap at a ballroom with two left feet.

Curiously enough, the latest decline didn’t merely shred the remnants of Bitcoin’s rosy bullish architecture; it gave the on-chain contraption a tilt toward a bleaker outlook. With both the technical bits and the on-chain doodads looking less jaunty, the bears are, by the looks, conducting the orchestra with decidedly the wrong baton.

This Metric Changes First, BTC Price Reacts Later: Crypto Founder

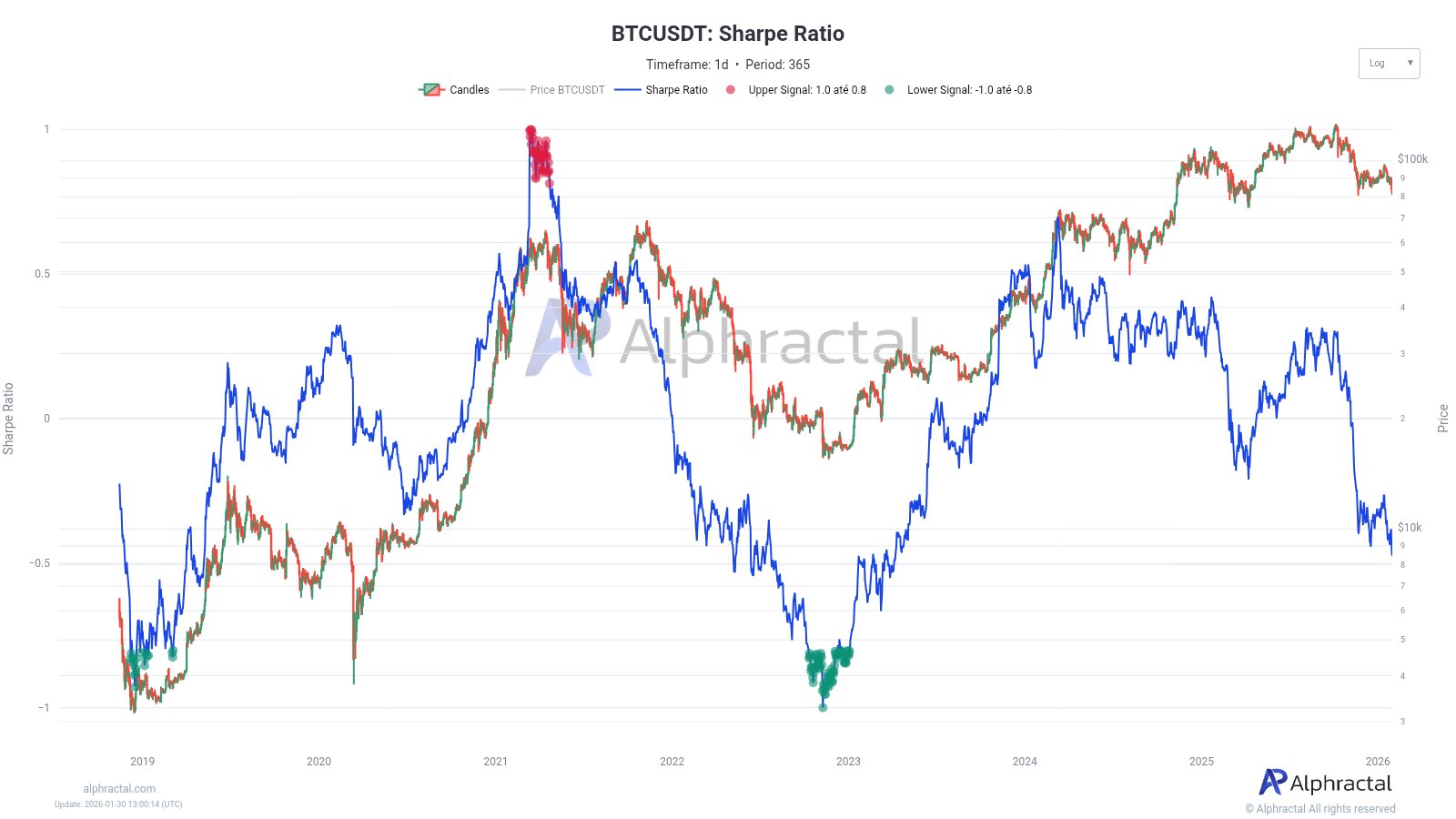

In a January 30 missive on the X platform, Joao Wedson, the founder and chief of Alphractal, declared that the Bitcoin Sharpe Ratio was sliding away faster than the price itself. The Sharpe Ratio, that handy little gauge of risk-adjusted returns for our friend Bitcoin, is the device in question.

This on-chain gadget keeps score of how much profit one gets per unit of risk-risk being measured by volatility. High numbers spell a brisk risk-adjusted performance; a negative Sharpe Ratio, on the other hand, proclaims that the returns don’t quite keep pace with the risk.

Wedson wrote in his post on X:

Simply put: the market is taking more risk for less return.

Indeed, the Bitcoin Sharpe Ratio slipped into negative territory a few days into the new year. However, BTC’s price action still enjoyed an incredible run of form-running to as high as $97,000-after this shift, placing less significance on the on-chain observation.

What’s more diverting is that the Sharpe Ratio is falling faster than the Bitcoin price. In market lore, this pace of decline has often marched hand in hand with protracted momentum loss and a price that meanders about in a sideways waltz. Wedson even concluded that the risk-adjusted metrics need to tidy themselves up before the price can be merry again.

Bitcoin Price Could Fall To $65,500 If This Happens

Should the downward spiral continue, Wedson has a target for BTC in mind. In an older post on X, the Alphractal founder had disclosed that the Bitcoin price cannot lose the $81,000 level under any circumstances.

The on-chain savant warned that a capitulation phase akin to the one seen in 2022 could unfold if the market leader breaks below the $81,000 level. Using the Fibonacci-Adjusted Market Mean Price as a compass, Wedson identified $65,500 as the next major support level.

The $81,000 came under focus as the Bitcoin price approached this level during its decline on Thursday, January 29. As of this writing, though, BTC has recovered above the $83,000 mark, with the price still down by nearly 8% on the weekly timeframe.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Bitcoin’s Speedy Upgrade: Can $HYPER Solve Bitcoin’s Slowness?

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- Pi Coin Rally Heats Up as Every Group Buys In – But a Risk Lurks Below $0.29

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Crypto Leverage: Uh Oh ⚠️

- XRP’s Dramatic Plunge – A Comedy of Errors! 🎭📉

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

2026-01-31 14:11