The crypto market tiptoes into a tense weekend, like a cat on a tin roof, what with the FOMC’s curious rate decisions, Jerome Powell’s booming voice, the fussy PPI inflation numbers, and a big, jittery vote looming over the crypto market structure bill.

And if that wasn’t enough to tingle the spectacles, a fog of uncertainty swirls as whispers of a second U.S. government shutdown drift closer, possibly on January 31, like a grouchy dragon flicking its tail.

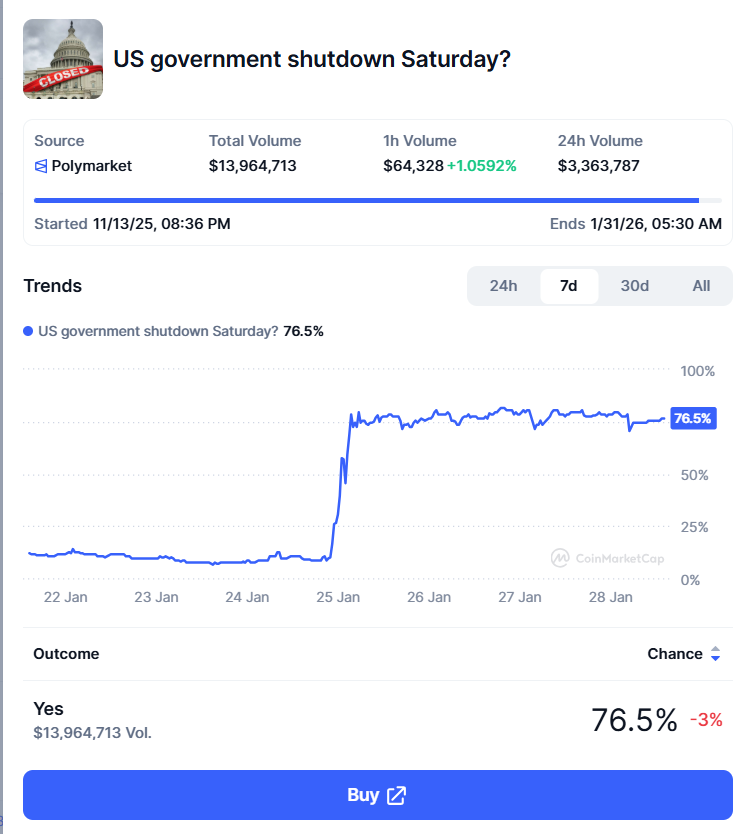

Seventy-Six and a Half Percent: A Shutdown Might Wobble In

According to Polymarket, there’s a 76.5% chance the U.S. government will shut its doors if Congress doesn’t fund in time. A towering $1.2 trillion funding package has boogied through the House already, but the party’s not over until the Senate signs the guestbook.

However, the Senate must give it the nod by midnight on Friday, January 30, or the curtain comes down and the show goes on without the fancy speeches.

If no agreement is reached, agencies like the Department of Homeland Security (DHS), FEMA, and TSA could see non-essential operations ground to a halt, like a clock that’s forgotten how to tick.

If this occurs, non-essential workers are sent home without pay, while essential staff soldier on and hope their pay catches up later, preferably before retirement becomes a scavenger hunt.

Why the Senate Vote Is a Wriggly, Snaky Puzzle

The funding bill needs 60 votes to pass the Senate. Right now, Republicans hold 53 seats, while Democrats and aligned Independents control 47, turning the decision into a proper lemon-and-sugar puzzle with a sour bite at the end.

Tension has wriggled up because of recent incidents involving federal immigration agents. In Minneapolis, federal agents fatally shot Alex Pretti, a 37-year-old intensive care nurse, during a protest against immigration enforcement. Protests have fizzed across several U.S. cities, with both parties demanding answers and accountability, as if a chorus line of questions never ends.

The issue has added political pressure ahead of the funding deadline, as lawmakers argue not only over dollars, but also how federal agencies carry out their work, like a pair of bickering uncles trying to assemble a jigsaw in the dark.

How the Crypto Circus Might React

The last major U.S. government shutdown ended in November after nearly 43 days. During that period, crypto markets swung like a gymnast on a trampoline, not collapsing entirely but dancing to the tune of volatility.

As of now, markets aren’t reacting purely to politics, but more to the loss of visibility-the fog that makes price tags look like riddles.

In past shutdowns, key data like jobs and inflation reports were delayed, making it harder for traders to price risk. Therefore, Bitcoin fell 9%, dropping from around $103,000 to $94,000, while altcoins slid 12%-25% due to lower liquidity and a general mood of “better safe than sorry.”

If another U.S. government shutdown happens, the bitcoin and crypto market will likely see another short-term tumble, a little disaster movie where the heroes forget their lines but remember to keep the coins intact-for now.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- Crypto Chaos: Market Meltdown, Trade Twists & Central Bank Confusion

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- UBS Tokenizes Funds: ETH’s Next Big Thing? 🤔🚀

- The Great Chainlink Circus: To the Moon or Back to $8? 🤡💸

2026-01-28 12:17