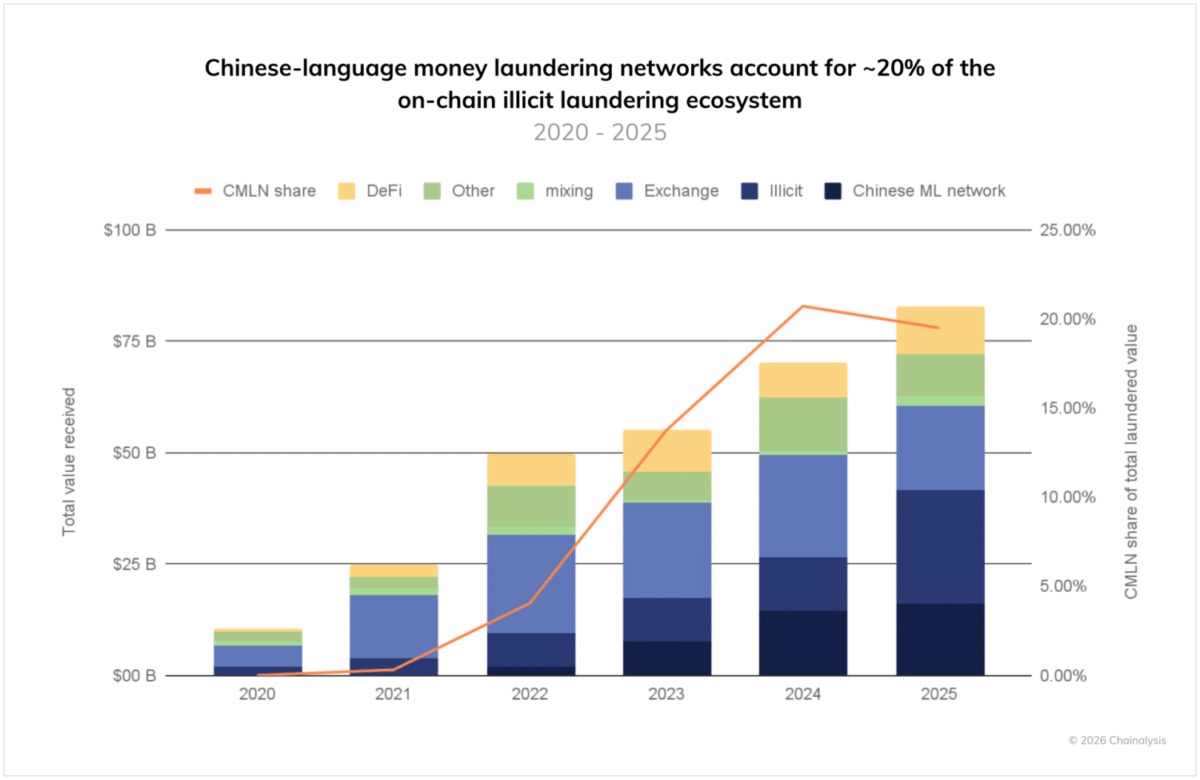

In the year of our Lord two thousand and twenty-five, the ledger-scrubbers count up a stout $82 billion in illicit cryptocurrency money laundering, a sum that makes the year 2020’s ten billion look like a dry well after a long drought. Chainalysis, that fellow with a knack for tracking the money’s ghosts, lays it out so you can squint at it through a tumbler of coffee and a sigh.

The road to riches in crypto is as slick as a peeled onion, what with easier access and more liquidity. Chinese-language money laundering networks-CMLNs, if you like a mouthful with a tough backstory-have muscled their way into the lead, processing $16.1 billion-roughly $44 million a day-across more than 1,799 active wallets, and now account for about 20% of known illicit laundering activity, according to the firm’s report.

This is growth 7,325 times faster than inflows to centralized exchanges since 2020, a pace that would make a snail wear a clock on its shell.

A graphic showing the value of money laundering from different sources and how CMLN dominates | Source: Chainalysis

How CMLNs Operate: Six Service Types Fueling Illicit Transfers

Chainalysis identifies six distinct service types within the CMLN ecosystem: running point brokers, money mules, informal over-the-counter desks, Black U services, gambling platforms, and money movement services. In plain terms, six different ways to grease the wheels of mischief.

Tom Keatinge, Director at Centre for Finance & Security at RUSI, told Chainalysis, “Very rapidly, these networks have developed into multi-billion dollar cross-border operations offering efficient, value-for-money laundering services that suit the needs of transnational organized crime groups across Europe and North America.”

The networks mainly prey on China’s capital controls, with wealthy folks trying to move money out of the vast Middle Kingdom providing the liquidity to feed organized crime. Chris Urben, Managing Director at Nardello & Co, explained that “the biggest change in Chinese money laundering networks in recent years is a rapid transition to crypto from reliance on informal value transfer systems.”

Authorities Crack Down But Networks Prove Resilient

China officially banned cryptocurrency trading in 2021, yet underground banking operations still mosey along. In 2024, Chinese authorities prosecuted 3,032 individuals linked to crypto-related money laundering cases. Earlier in January 2026, South Korean customs dismantled a $102 million crypto remittance ring that used WeChat Pay and Alipay to disguise illegal transfers, with a Chinese national in his thirties coordinating the network.

Meanwhile, Cambodia has become another focal point, with Chainalysis reporting over $49 billion in crypto transactions linked to Huione Guarantee, a platform within the Cambodian conglomerate that serves CMLN vendors.

According to Chainalysis, fighting these operations-resilient and as slippery as a frog on a slick log-requires coordinated public-private partnerships that blend law enforcement’s legal authorities with blockchain analytics know-how to raise the cost and risk of running large-scale laundering services.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Bankman-Fried\’s Wild Excuse

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

- Trump Coin ETF: Canaries Singing on Wall Street? 🏦💸

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- XRP’s Wild Ride: SBI, ETFs, and the Great $3.00 Chase 🎢💸

- When Tech Meets Tradition: Kraken & Deutsche Börse Salsa Together

2026-01-28 02:13