Ah, Kraken, that venerable leviathan of the crypto seas, has once again emerged from the depths to dazzle us with its latest concoction: DeFi Earn. Launched on the 26th of January, this marvel promises to simplify the labyrinthine world of decentralized finance, all within the confines of the Kraken app. How utterly convenient, darling!

According to the most official of communications-a thread on X, no less, and the DeFi Earn landing page-users may deposit their cash or stablecoins, which are then transmogrified into USDC, should the need arise. One then selects from a trio of vault strategies: Balanced, High, or Advanced, each offering up to 8% APY. The system, in its infinite wisdom, allocates funds to lending protocols, and rewards accrue without further ado. Simplicity itself, is it not?

“We’re making DeFi rewards simple,” they declare with a flourish.

“Meet DeFi Earn, powered by @Veda_labs, @SentoraHQ, and @ChaosLabs.”

“Earn up to 8% APY on your assets, all within the Kraken app experience you already know and trust.”

“No complicated setup. No technical steps. Just start earning ⤵️…”

– Kraken (@krakenfx) January 26, 2026

Remarkably, this feat is achieved through the embedded wallet infrastructure of Privy, rendering seed phrases and manual transaction signatures as obsolete as last season’s fashion. The vaults, crafted by Veda Labs on the Ink Network-Kraken’s Ethereum Layer 2 (L2)-are overseen by the vigilant eyes of Chaos Labs and Sentora. How reassuring!

Rewards, we are assured, stem from the genuine demands of borrowers on such illustrious DeFi platforms as Aave, Morpho, Tydro, and the Sky Ecosystem. No token subsidies, no temporary boosts-just pure, unadulterated financial gain. Kraken, ever the modest intermediary, levies a mere 25% fee on rewards. Withdrawals, typically instant, may occasionally tarry if protocol liquidity is low. The drama of it all!

DeFi Earn graces 48 states of the US, Canada, and the European Economic Area, with further expansion on the horizon. How very cosmopolitan.

Kraken’s Grand Ballet into DeFi

This offering is but a single step in Kraken’s grand ballet to merge traditional and decentralized finance. In November 2025, the exchange unveiled Auto Earn, a program for passive yields on crypto holdings sans lock-ups, as reported by the ever-vigilant Coinspeaker. Prior to this, Kraken introduced commission-free stock and ETF trading in select US states in April 2025 and the Krak Card for unified crypto banking in December. Such ambition!

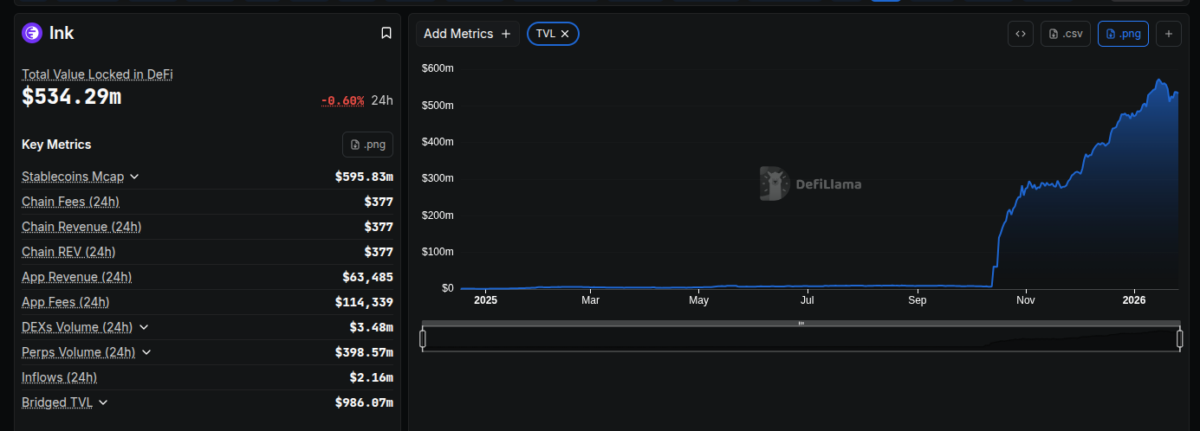

Kraken also persists in its development of the Ink blockchain, originally heralded as a gateway to expanded DeFi access. Data from DefiLlama reveals that Ink already ranks 14th by TVL, rubbing shoulders with such luminaries as Sui, which holds the 13th position. Ink boasts $534 million in total value locked and a $595 million stablecoin market cap, with Circle’s USDC dominating at 43%. How très chic!

Ink DeFi data as of January 26, 2026 | Source: DeFiLlama

The ecosystem experienced a veritable explosion of growth in early October last year, buoyed by Kraken’s formidable user base and market share. This latest offering may well amplify this growth, with its promise of easier onboarding and an enhanced user experience. Bravo, Kraken, bravo!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- XRP’s Wild Ride: SBI, ETFs, and the Great $3.00 Chase 🎢💸

- XRP: A Most Disappointing Turn of Events! 📉

- Will Stellar (XLM) Dance Back to $0.50? The September Spectacle Awaits! 💃✨

- Bankman-Fried\’s Wild Excuse

- Bank of Russia Puts Foot Down: No Crypto Allowed for Domestic Payments! Get Ready for Digital Ruble!

- ETH’s Rocky Road to Riches: Will It Climb or Collapse?

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

2026-01-26 22:03