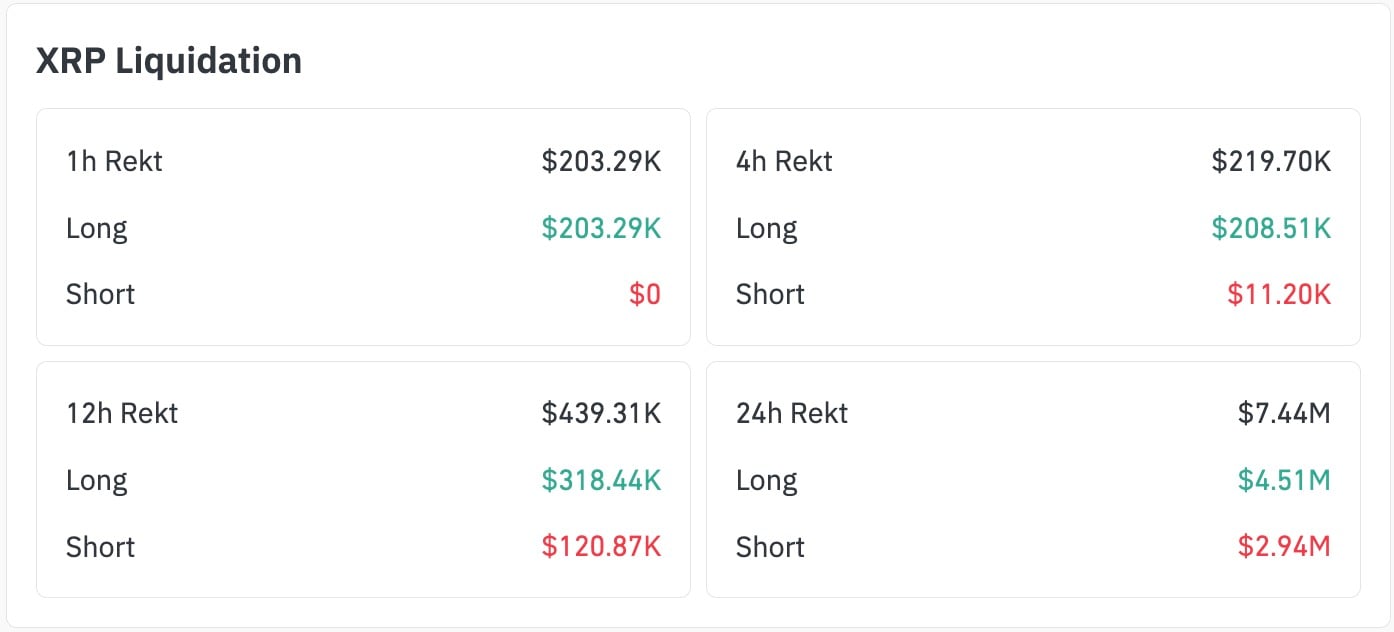

Dearest reader, it appears that our friend XRP has succumbed to a most rare and inexplicable quirk in its liquidation feed. In an hour so singularly peculiar, the short sellers, those brave souls who dwell in the shadowy corners of the market, did not suffer the slightest loss, whilst the long liquidations gallantly surpassed a staggering sum of $203,000. Surely, this cannot be attributed to mere happenstance, yet it does imply that the short sellers have taken a most prudent respite from their endeavors.

As per the esteemed reports of CoinGlass, within the last twenty-four hours, XRP endured liquidations amounting to a grand total of $7.44 million-$4.51 million attributed to the longs, and $2.94 million to the shorts. Remarkably, during the past twelve hours, the losses incurred by the shorts reached a notable sum of $120,870; however, in the latest hourly plunge, that number has been reduced to a delightful zero. How splendidly odd!

The price movements of XRP confirm this curious phenomenon: it descended rather swiftly from $1.957 to $1.942, unceremoniously sweeping away the longs who had overstepped their bounds, whilst the shorts appear to have made a hasty exit or, perhaps, artfully evaded the calamity entirely.

This behavior is decidedly uncharacteristic. When shorts vanish like polite company during a downturn, it often indicates a state of either caution or a most palpable fear of reversal. In such volatile conditions, coupled with a rather flat liquidation profile on the short side, one might find oneself amidst asymmetric risks akin to walking a tightrope over a pit of alligators.

Brace Yourselves: The Fates of XRP May Take a Tumultuous Turn

At present, the XRP price is languishing at approximately $1.934, ensnared within a narrow corridor between a failed recovery and an incomplete breakdown. The critical level to observe is $1.950; should it be attained, the short sellers will undoubtedly be compelled to re-enter the fray, opening the pathway towards $1.975 with all the grace of a ballroom dancer.

Beneath the threshold of $1.930 lies a modicum of short-term support, yet should it falter, the next level of concern looms around $1.905-a most troublesome prospect indeed.

Until the short positioning returns to a semblance of normalcy, the direction of prices shall likely be swayed more by the gaps in positioning than by the weighty fundamentals. Should liquidity remain scarce on either side, even the smallest of movements could spiral into chaos faster than one can say “market mayhem.”

Let us keep our gaze steadfastly fixed upon the pivotal $1.95-it is, without a doubt, the trigger point that could unleash a torrent of excitement!

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- BNB PREDICTION. BNB cryptocurrency

- Silver Rate Forecast

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- XRP Surpasses Bitcoin? Here’s Why It’s the New Crypto King 🚀💰

- Bitcoin’s Descent: Powell’s Words Trigger Market Panic 📉💸

- Bank of America Finally Embraces Bitcoin, Will Let Clients Allocate 1-4% of Their Portfolios

2026-01-22 17:46