In a move that would make a Victorian novelist blush, BlackRock has declared tokenization one of its top investment themes for 2026. Meanwhile, Binance’s CZ, that indefatigable crypto evangelist, has been charming a dozen governments into conversations about tokenizing their assets-perhaps next they’ll tokenize the Queen’s corgis.

The world’s largest asset manager and crypto’s most flamboyant figure now agree on one thing: the future is blockchain, or as the papers call it, “the next big thing.”

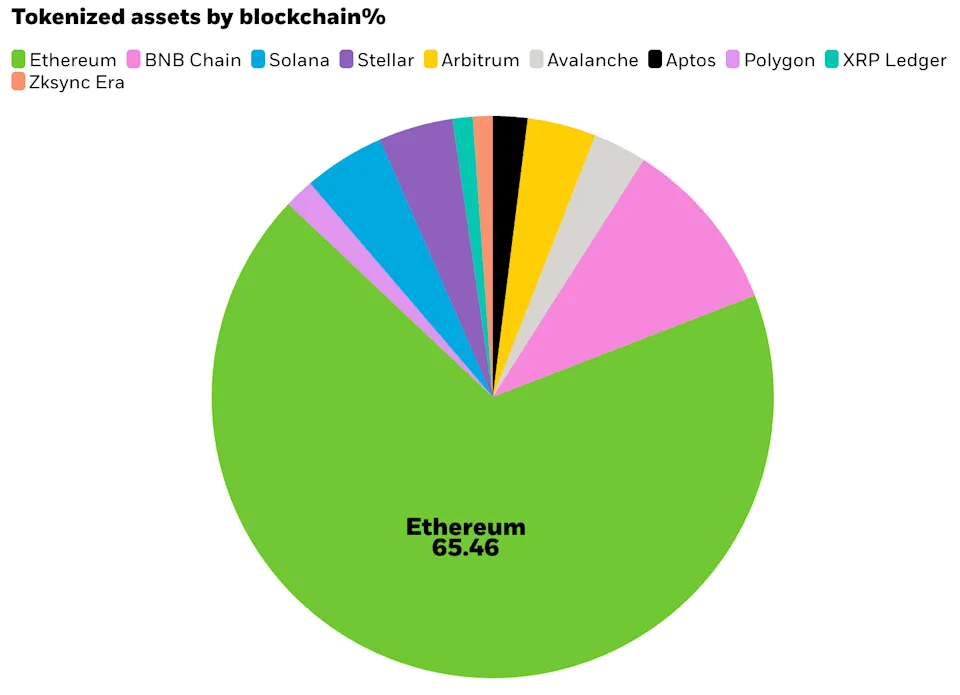

BlackRock’s 2026 Thematic Outlook, penned by the ever-ambitious Jay Jacobs, lauds blockchain as the latest tool for modernizing access to traditional assets. The report, which reads like a particularly optimistic grocery list, notes that Ethereum commands over 65% of tokenized assets, leaving Solana and its ilk to peddle their wares in the shadow of Ethereum’s gilded blockchain.

“As tokenization ascends to its inevitable crescendo, so too will the opportunity to access assets beyond cash and U.S. Treasuries via the blockchain,” the report proclaims, as if this were a divine decree rather than a speculative ledger.

Stablecoins: The New Tea Party Currency

BlackRock’s iShares Bitcoin Trust (IBIT), hailed as the fastest-growing ETF since sliced bread, now boasts over $70 billion in assets. Meanwhile, stablecoin volumes hit $8 trillion last year-a staggering figure that makes one wonder if the global economy has been quietly funding a very expensive cup of tea.

BlackRock, ever the arbiter of what constitutes “real-world use,” insists this proves blockchain’s utility beyond mere speculation. One imagines a future where stablecoins replace actual coins in piggy banks and perhaps even in pockets.

CZ: The Alchemist of Davos

At the World Economic Forum in Davos, CZ, that indefatigable crypto booster, claimed he’s advising a dozen governments on tokenization strategies. One suspects he may also be offering them advice on how to monetize national monuments, though the details remain hazy.

“I’m talking with probably a dozen governments about tokenizing some of their assets,” he declared, “This way the government can actually realize the financial gains first and use that to develop those industries.” A bold plan, assuming the industries in question aren’t already being developed by people who don’t require blockchain to do so.

CZ also waxed poetic about three sectors he expects to thrive: tokenization, crypto-backed payments, and AI agents. He added that AI systems will likely use crypto as their native currency because “they’re not going to swipe credit cards.” One must wonder if they’ll also refuse to pay rent in fiat or simply demand payment in dogecoin.

Ethereum’s Promised Land

BlackRock, with the solemnity of a man announcing the discovery of fire, has singled out Ethereum as a beneficiary of tokenization’s growth. Citing its role in decentralized apps and token infrastructure, the firm seems to suggest Ethereum is the Switzerland of blockchains-neutral, reliable, and slightly overrated.

With institutional backing and governmental flirtations now aligning like a particularly well-organized dinner party, Ethereum’s position in the tokenization race appears stronger. Whether it remains so in 2026, one might ask, depends on whether the world decides to tokenize its socks or not.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- BNB PREDICTION. BNB cryptocurrency

- Silver Rate Forecast

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- XRP Surpasses Bitcoin? Here’s Why It’s the New Crypto King 🚀💰

- Bitcoin’s Descent: Powell’s Words Trigger Market Panic 📉💸

- Bank of America Finally Embraces Bitcoin, Will Let Clients Allocate 1-4% of Their Portfolios

2026-01-22 14:07