Ah, dear reader! Gather ’round, for the tale of Bitcoin traders is one that would make even the most stoic of souls chuckle. Recently, like a plucky little fellow who has found his way back to the warm embrace of his mother’s arms after a long day of mischief, the sentiment among these traders has seen a sprightly improvement as the market stages its delightful recovery surge.

Behold! The Bitcoin Fear & Greed Index Approaches the Land of Neutrality!

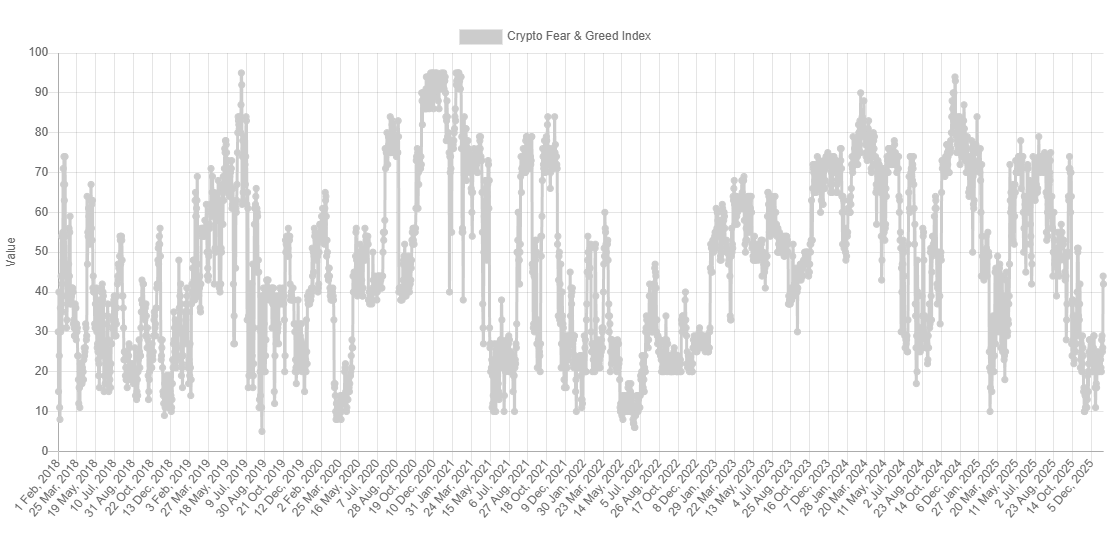

Now, let us speak of this wondrous contraption known as the “Fear & Greed Index.” A creation of Alternative, it serves as a barometer of sorts for the average trader’s emotional weather in the bustling bazaar of Bitcoin and its cryptocurrency kin. It endeavors to decipher the mental gymnastics of investors using five curious factors: trading volume, volatility (a charming little rascal), market cap dominance, social media sentiment, and Google Trends-yes, indeed, those very trends that decide the fates of many a hapless soul.

This index, oh how it tickles the mind, operates on a scale from zero to one hundred, depicting the sentiments of our dear traders. Values below 47 signal a stormy sea of fear, while those above 53 herald the wind of greed billowing through their sails. And lo! The neutral territory lies between these two thresholds, akin to a comfortable hammock swaying gently in the breeze.

Now, what news arrives concerning our dear Bitcoin’s sentiment? Let me unveil the mysteries of the Fear & Greed Index:

As you witness, the index currently rests at a modest 42, suggesting a collective shiver of fear among the masses. But fret not! This value hovers close to the neutral zone, indicating that the grip of fear is not too heavy. Only recently, the index had ventured deep into the treacherous waters of extreme fear-oh, what a sight it was!

In fact, the metric dipped so low it could have been mistaken for a subterranean creature! Yet, as fate would have it, the winds of change have swept in, carrying Bitcoin and its digital companions on a joyous recovery rally. Should this bullish push persist, who knows? Trader sentiment might just waltz back into neutrality or tiptoe ever-so-slightly into the realm of greed.

Historically speaking, cryptocurrencies, like Bitcoin, have an uncanny knack for zigzagging in precisely the opposite direction of what the crowd expects. The probabilities of a surprising turn become particularly tantalizing in those extreme territories of fear (25 and under) and greed (above 75), where major bottoms and tops have formed like curious mushrooms after the rain. Indeed, the bottom reached in November occurred when the market was gripped by extreme fear-quite the ironic twist, wouldn’t you say?

Now, as the Fear & Greed Index flirts with neutrality, we find ourselves in a peculiar limbo; sentiment may no longer dictate the market’s next escapade, for traders are caught in a delightful disagreement. In such whimsical times, the chances of movement in either direction seem to dance merrily, much like a couple at a ball, unsure whether to step left or right!

BTC Price: The Ever-Changing Tale

Our dear Bitcoin broke above the majestic $94,000 earlier this week, only to take a brief respite and now finds itself lounging back at $92,000, as if pondering the meaning of life itself.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- The XRP Secret: When Network Activity Talks, Prices Listen 📈🤫

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- USD GEL PREDICTION

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- LINK’s $60 Dream: A Tale of Money Supply & Madness!

2026-01-08 07:33