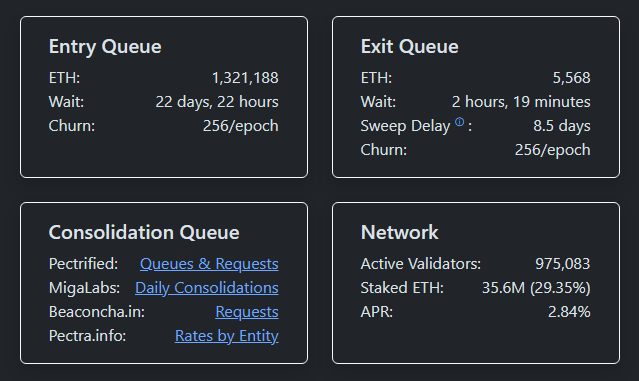

Ah, the Ethereum. That digital chimera, forever promising something just beyond reach. Now, they tell us the queue for those seeking egress – the validators, the sensible ones, perhaps? – has dwindled to a mere 32 ETH. A minute, they say, a single minute separates one from freedom. Such efficiency! Though one wonders what urgent appointments require such punctuality in the world of decentralized finance. 🧐 It was, not so long ago, a veritable ocean of longing – 2.67 million ETH! – practically a digital Siberia. Gone now, vanished, like a politician’s promise.

The Empty Exit, A Curious Phenomenon

They claim this lack of a queue reduces “nervous selling.” Nervous selling! As if digital assets are prone to fits of anxiety. They earn rewards while waiting, you see. Rewards! Like a gilded cage. Though a badly behaved validator risks penalties. Oh, the indignity! But the bottleneck, that insidious delay…it has evaporated. Poof! As if conjured by a particularly inept magician.

The partial payouts continue, of course. A trickle to soothe the masses while the big players…well, they have other plans. Plans involving billions, naturally.

A Flood of Newcomers & The BitMine Menace

But do not rejoice yet! For while the door is opening for some, others are frantically trying to push their way in! A queue of 1.3 million ETH, they shriek! A veritable stampede of credulous investors. And leading the charge, that behemoth, BitMine. 82,560 ETH on December 26th, casually tossing around sums that would make Croesus blush. Now they possess a tidy 659,219 ETH, valued at north of $2.1 billion. A mere trifle, I’m sure. 💸

They hold over 4.1 million ETH in total – 3.4% of the entire supply! – worth a cool $13 billion. Such concentration of power. One begins to wonder if decentralization isn’t just a politely worded illusion. But yes, it creates demand. Demand! As if demand were in short supply in this…environment.

Empty Exchanges & Shifting Sands

The exchanges, predictably, are emptying. Fewer coins to sell, they say, makes panic selling harder. As if panic has any respect for logistical challenges. It’s all very…tidy. Too tidy, perhaps. One suspects hidden currents, clandestine trades, whispers in dimly lit server rooms.

“Basically empty,” they declare. “Selling pressure is drying up.” Such certainty! It’s enough to make one crave a long, strong drink. Still, the market is a fickle beast. Derivatives, lending desks, the shadowy realm of off-exchange trades – they can all move the furniture around without so much as disturbing a dust mote on the staking queues.

BULLISH: $ETH surpasses Netflix to reclaim its position as the 36th-largest asset by market cap.

– CoinGecko (@coingecko) January 6, 2026

And then, the crowning absurdity. Ethereum has overtaken Netflix in market capitalization! Ethereum! Above Netflix! 🤦♂️ A momentous occasion, to be sure. Though I suspect the viewers of cat videos and binge-watchers of dramas are largely unconcerned.

Valuation rankings shift, you see. They are mirages shimmering in the desert of finance. Driven by impulse, by speculation, by the eternal human longing for…something. Something that, more often than not, remains just out of reach.

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- USD PKR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin Bonanza: Metaplanet Goes All In, Buys 780 More BTC 🤑

- Misfortunes of Shiba Inu: When Meme Coins Cry 😢

- Chainlink’s 2025 Hype? It’s a Wild Ride! 🚀

- Mark Twain’s Take on Crypto: XRP, SHIB, and the Mighty Ethereum

- Ethereum: Queue Chaos & Billions Staked! 🤯

2026-01-07 08:28