So, apparently, Venezuela’s been playing crypto Monopoly while the rest of us were stuck in fiat traffic. 🤑 According to some super-spy-level reports (think James Bond but with more spreadsheets), the Venezuelan regime has been hoarding Bitcoin and Tether like it’s the end of the world. Why? To dodge sanctions, of course! Because nothing says “screw you, international rules” like a shadow reserve of digital gold. 🕶️✨

- Venezuela’s been crypto-shopping via gold swaps, oil trades, and USDT settlements. 🛒💸

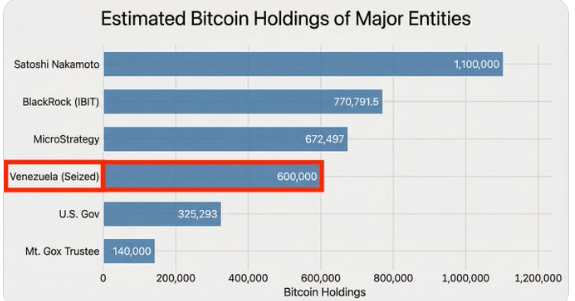

- We’re talking 600,000 to 660,000 BTC – that’s $55B+ in today’s money. 🤑💫

- If the U.S. grabs it, expect a freeze-fest, not a fire sale. ❄️🚫

- Less Bitcoin on the streets? Prices could soar like my anxiety at a family reunion. 📈😬

All this drama resurfaced when Nicolás Maduro was like, “Not guilty, your honor!” in a New York courtroom, facing narco-terrorism charges. Naturally, everyone’s now eyeing Venezuela’s offshore stash like it’s the last slice of pizza. 🍕👀

The Crypto Heist No One Saw Coming

Apparently, Venezuela started its crypto journey back in 2018, when traditional banking was like, “We’re full, bye.” 🏦🚫 So, they got creative: gold swaps, oil-for-crypto deals, and forcing everyone to settle crude exports in USDT. It’s like a financial soap opera, but with more blockchain. 🧼⛓️

Estimates are all over the place, but some say their Bitcoin and USDT stash is worth $60B+. That’s 600,000 to 660,000 BTC, folks. And get this – they might’ve turned $2B in gold into Bitcoin when it was $5,000. Today? That’s $35B. Someone’s been eating their crypto Wheaties. 🥣💪

Oh, and remember the Petro? Yeah, that flopped harder than my New Year’s resolutions. So, they pivoted to Tether for oil deals, then swapped some into Bitcoin because, you know, stability. Plus, they allegedly mined some coins domestically – because why not? 🏭⛏️

What If Uncle Sam Says, “Mine Now”?

Everyone’s buzzing about the U.S. potentially grabbing this crypto treasure. Analysts are serving three hot takes: 🍿

1. The Freeze-a-Thon: Bitcoin gets locked up in legal limbo for years. No selling, just a giant crypto time-out. ⏳❄️

2. The Strategic Hoard: The U.S. keeps it as a rainy-day fund. Because who doesn’t want a national Bitcoin piggy bank? 🐖💰

3. The Fire Sale: Unlikely, but if it happens, expect a crypto market tantrum. 🎢😱

The Real Tea: Bitcoin’s the Star Here

While everyone’s obsessing over oil and geopolitics, Bitcoin’s the unsung hero. If 600,000 BTC gets locked away, that’s 3% of the total supply – aka a supply squeeze, not a sell-off. Short-term chaos? Maybe. Long-term moon mission? Probably. 🚀🌕

So, if you’re holding Bitcoin, this could be your moment to shine. Or panic. Or both. It’s 2026 – who knows anymore? 🤷♀️✨

Disclaimer: This is not financial advice. Don’t @ me if you lose your life savings on meme coins. Always DYOR and consult a professional (or a magic 8-ball). 🪄🔮

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- USD TRY PREDICTION

- Will the Crypto Circus Repeat? Or Is This Just the Act Before the Altseason Entertains?

2026-01-06 11:00