Well, dash it all, the crypto markets have decided to be frightfully optimistic today. Bitcoin, Ethereum, and XRP – those chaps – have been rather smartly climbing, clearing hurdles with a bit of a flourish, you know. One can’t help but observe that while the world is being generally beastly (US-Venezuela tensions, old bean!), things haven’t gotten completely ghastly, which suits the crypto crowd just fine. It seems a few rather specific reasons are responsible for this cheerful uptick. 🙄

Derivatives Reset Reduced Downside Pressure

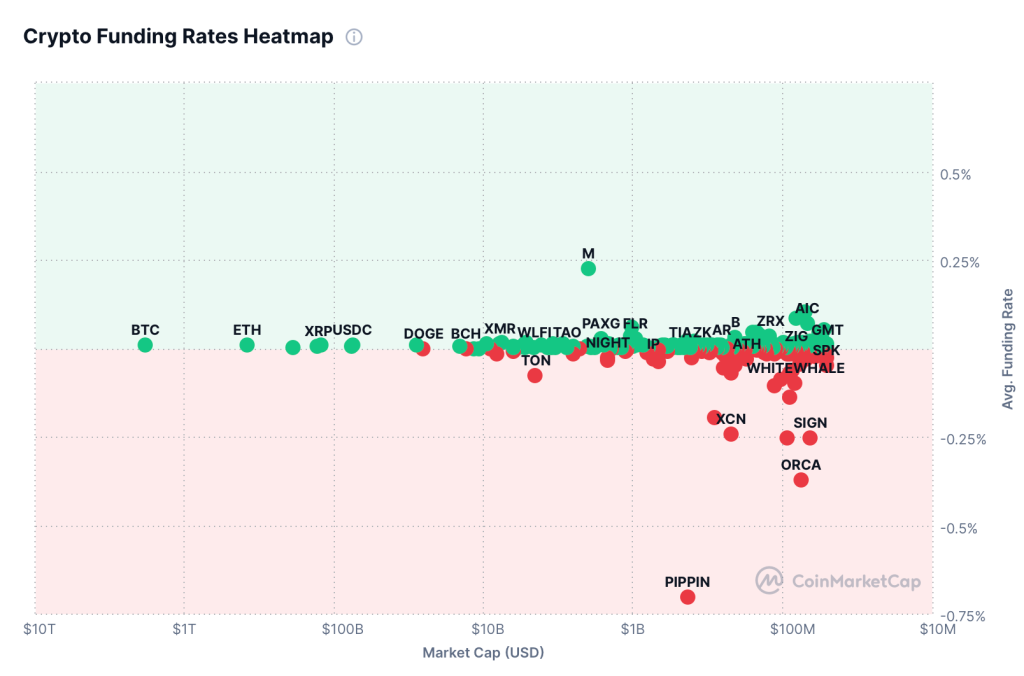

Apparently, a bit of cooling in the derivatives department is the culprit. Funding rates, those terribly complicated things, have calmed down after a spot of overheating, and open interest hasn’t gone completely mad. A rather important point, you see, is that this upward jiggle wasn’t caused by a scrum of short-sellers being squashed. Rather civilized, what?

Observe, if you will, the chart above. Funding rates are positively rosy for Bitcoin, Ethereum, XRP – even Dogecoin is getting in on the act! 🎉 This is jolly good news, as rallies built on desperate liquidations tend to vanish faster than a biscuit at a tea party. Today’s gains, however, are fueled by voluntary risk-taking, implying traders are rather keen to open their wallets. A most peculiar and, dare I say, encouraging development.

ETF Records Highest in 30 Days

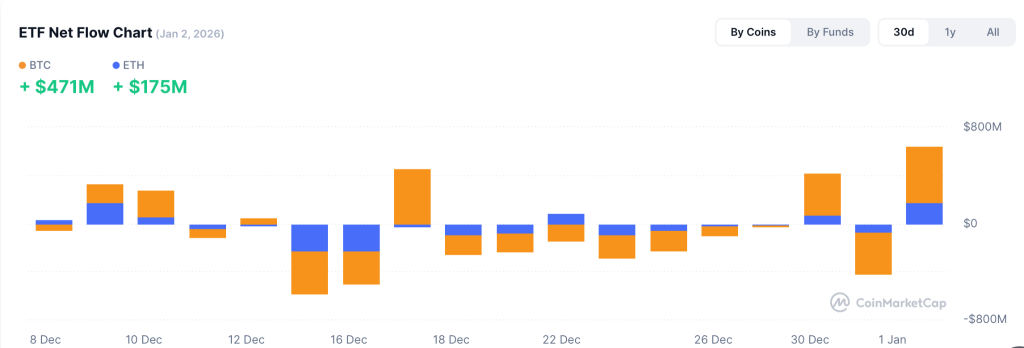

Instead of making a beeline for the exit, funds are rotating within crypto. Bitcoin’s dominance has paused for breath, while Ethereum and XRP are receiving a smidge of attention. No stampede to stablecoins, mind you, suggesting a definite preference for risk. It seems we’re seeing spot-buying rather than panicked exits, with ETFs enjoying a rather substantial inflow – the biggest in a month! 🧐

Inflows have surged past $645 million, with Bitcoin snagging over $470 million and Ethereum a respectable $175 million. This internal shuffling is a classic sign of a ‘risk-on’ mood, where investors are casting their eyes toward lesser-known cryptos. And, naturally, institutions are piling in, keeping the volume rather buoyant. One suspects there’s a bit of speculation involved, of course.

Will the Markets Remain Bullish Throughout the Week?

The geopolitical scene, naturally, remains a bit of a kerfuffle, so both traditional and crypto markets are predicted to be as wobbly as a pudding this week. Various events are looming, which might give the BTC price a bit of a shake-up. Keeping an eye on the US labour market, inflation, and the Fed’s rate-cut plans will be vital, you see.🧐

Furthermore, a rather large number of tokens are about to be unlocked – RWA being the chief offender, with Ondo leading the charge. Tokenomist informs us that HYPE, ENA, APT, LINEA and MOVE, among others, are also releasing tokens. A small smattering of SOL, DOGE, TRUMP, AVAX and ASTER are also in the mix. A bit of a free-for-all, really.

Looking ahead, whether this jolly good mood continues hinges on whether things stay as they are. As long as leverage remains sensible and demand holds, the buyers are in control. But should funding rates become aggressive again, volatility spike, or some macroeconomic disaster strike, the whole thing could come crashing down rather quickly. One shudders to think! 😱

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Solana Whales Dance: ETF Drama & $210’s Fatal Attraction! 🐳💸

- Company Buys More Bitcoin, Because Hyperinflation or Something 🚀

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- TRX PREDICTION. TRX cryptocurrency

- How Trump Turned Bitcoin into a Shooting Star & Made Shorts Cry 😜🚀

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

2026-01-05 09:22