Well, I say, old bean, it appears the tale of the Bitcoin whales making a splashy comeback is about as reliable as a wet umbrella in a monsoon. According to the chaps at CryptoQuant, those claims of big fish reaccumulating Bitcoin are as exaggerated as Aunt Agatha’s stories of her youth. The numbers bandied about on social media, you see, are as distorted as a funhouse mirror, thanks to those meddlesome exchange moves rather than fresh buying sprees.

Whale Tales: All Foam, No Fish? 🐋

Now, here’s the kicker: exchange firms, in their infinite wisdom, often merge funds from a gaggle of small accounts into fewer, larger wallets-all for the sake of operational efficiency or compliance, don’t you know. When this happens, onchain trackers, bless their cotton socks, mistake these consolidated addresses for “whales,” inflating the apparent number of deep-pocketed holders like a puffed-up peacock at a garden party.

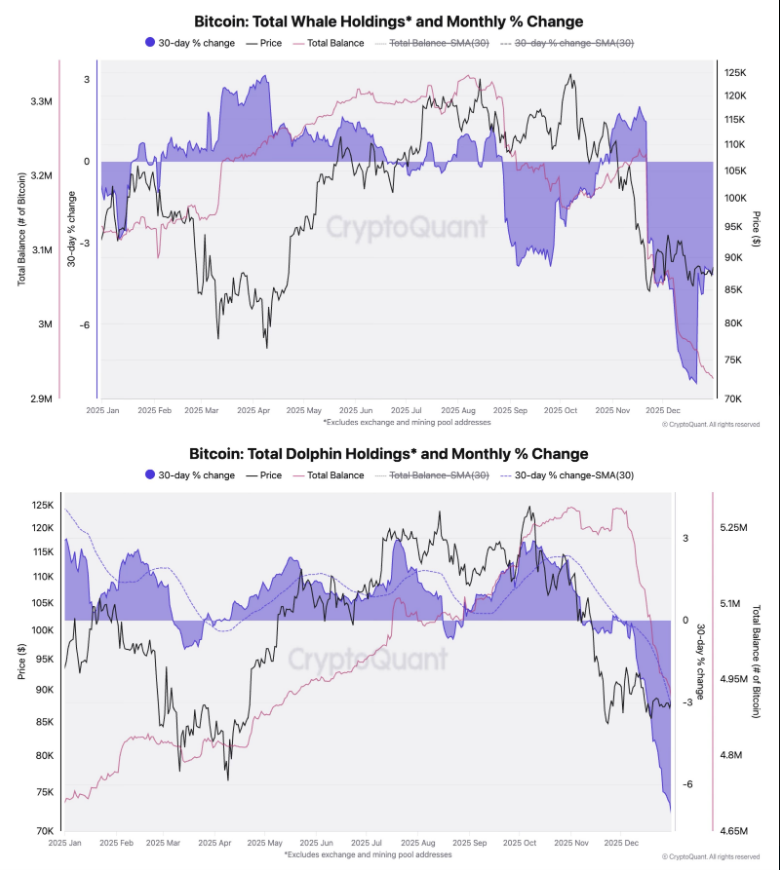

Julio Moreno, the head of research at CryptoQuant, chimes in with a dash of cold water: once those exchange-related shenanigans are sifted out, the balance held by genuine large holders is still on the wane. Addresses holding between 100 to 1,000 BTC have taken a tumble, a trend that dovetails neatly with outflows from spot ETFs. As Moreno puts it with a wink and a nudge:

“No, whales are not buying enormous amounts of Bitcoin. Most Bitcoin whale data out there has been ‘affected’ by exchanges consolidating holdings into fewer addresses, making it look like whales are on a shopping spree.”

– Julio Moreno (@jjcmoreno) January 2, 2026

Long-Term Holders: The Quiet Accumulator Club 🧐

Meanwhile, in a twist that would make Jeeves raise an eyebrow, another group has changed its tune. Matthew Sigel, the head of digital assets research at VanEck, reports that long-term holders have turned net accumulators over the past 30 days, after what was their most prodigious selling spree since 2019. This shift, while not a guarantee of a rally, does take some wind out of the sails of the bears, softening the notion that a single group is driving prices into the dirt.

Markets, as we all know, are as fickle as a debutante at a ballroom dance, reacting to who’s buying and who’s selling. This move by long-term holders is like a soothing balm on a sunburned market, reducing one major source of selling pressure.

Price Action: A Game of Mixed Signals 🎢

Bitcoin, that wily old beast, has been loitering around the $90,000 mark during the thin holiday trading, as if it’s waiting for a bus that may never arrive. At the time of this scribbling, the price was hovering at about $89,750 on Saturday, with 24-hour volume near $52 billion. The token sits roughly 2.8% below a recent high of $90,250, with a market capitalization of about $1.75 trillion based on a circulating supply close to 20 million BTC. Trading has seen sharp moves up and down, but volume has been as weak as a cup of tea without biscuits, meaning moves lack the conviction for a clear breakout or breakdown.

Since US spot Bitcoin ETFs became the talk of the town in early 2024, the ownership landscape has shifted like a game of musical chairs. ETFs now hold a hefty share of on- and off-chain demand, which can muddle where Bitcoin is stored and how flows appear on onchain charts. Reports suggest that ETF outflows have played a hand in lowering balances in the 100-1,000 BTC band, while some long-term holders are quietly snapping up coins like they’re going out of fashion.

Taking it all in, the evidence points to consolidation rather than a new bull run or a dramatic crash. Claims of a massive whale reaccumulation wave were as overblown as Bertie Wooster’s ego, failing to account for exchange consolidation. Yet, the story isn’t entirely one-sided. Long-term holders have shown a buying interest, even as large non-exchange addresses continue to trim their holdings. The future price direction, old sport, will likely hinge on whether ETF flows return with gusto and whether trading volume picks up enough to confirm any move.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- BNB: To $1,000 or Total Chaos? 🤯

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Ethereum’s Fusaka Upgrade: Will It Save ETH or Just Make It Fancier? 🎉

- CNY JPY PREDICTION

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

2026-01-03 22:39