Ah, dear reader, gather ‘round as we unravel the grand tale of Ethereum spot ETFs, which, lo and behold, recorded a rather astonishing $174.43 million in net inflows on the second day of January! Yes, you heard that right-January 2! A day when most souls are still struggling with their New Year’s resolutions, yet these financial instruments decided to break free from the dreary chains of year-end redemptions. 🥳

In this marvelous spectacle, let us summarize our findings:

- The Ethereum ETFs went from crimson to emerald, recording a whopping $174M in inflows, defying December’s dismal redemption trend!

- Leading the charge were Grayscale and BlackRock, who apparently couldn’t resist the siren call of fresh investments as weekly flows turned positive again. Who knew they had such a flair for dramatic returns?

- Bitcoin ETFs, not to be outdone, mirrored this financial ballet with a magnificent $471M in inflows. Bravo! 👏

Now, our valiant hero, Grayscale’s ETHE, led the way with a staggering $53.69 million in inflows, while its pint-sized counterpart, the mini ETH trust, added an impressive $50.03 million. One must wonder if they had a secret stash of magic beans or merely a knack for attracting attention!

Meanwhile, BlackRock’s ETHA danced gracefully into the spotlight with $47.16 million, while Bitwise’s ETHW and VanEck’s ETHV managed to scrape together $18.99 million and $4.56 million, respectively. It seems everyone wanted to join the party, albeit some with more enthusiasm than others. 🍾

Alas, Fidelity’s FETH, Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH merely observed from the sidelines, recording absolutely zero flow activity. Perhaps they were engaged in a profound philosophical discussion about the meaning of investments? 🤔

The First Weekly Ethereum ETFs Inflow Since Early December!

On that fateful January 2, our newfound inflows propelled weekly totals to a jubilant $160.58 million! This marked the first positive week since December 12, when Ethereum ETFs attracted a whopping $208.94 million. A true renaissance, wouldn’t you agree?

In stark contrast, the week ending December 26 was met with a sigh, showcasing $102.34 million in outflows, while the week prior saw an astonishing $643.97 million in redemptions. Talk about a rollercoaster ride! 🎢

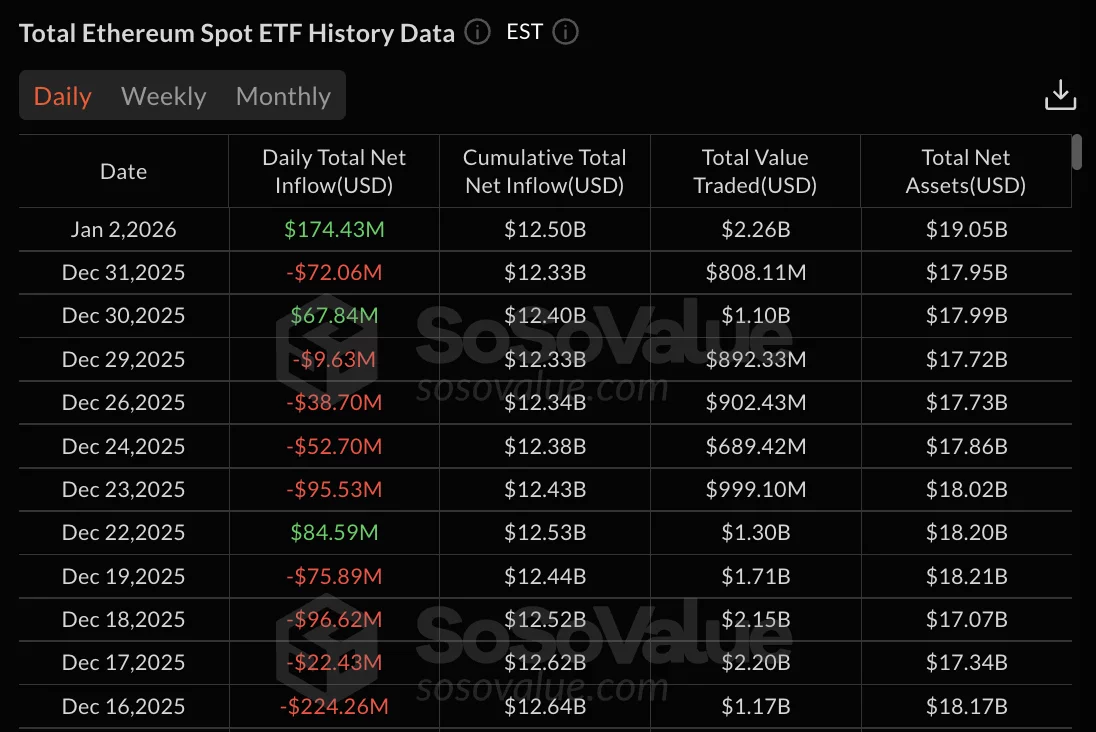

Let us not forget the tumultuous daily flows of late December-December 31 alone witnessed a staggering $72.06 million in outflows, while the day before, December 30, lured in $67.84 million in inflows. The drama! The suspense! December 29 even posted $9.63 million in withdrawals, as if it were a tragic play unfolding before our very eyes.

But fear not, dear investors! As the holiday festivities came to an end, the selling pressure reversed with a dramatic flourish on January 2. Total value traded skyrocketed to $2.26 billion, a majestic leap from the mere $808.11 million of December 31. Where were you, dear money, hiding all this time?

Total net assets under management climbed to a respectable $19.05 billion on January 2, up from $17.95 billion the previous trading day. Even the numbers seemed to celebrate the new year! 🎊

As a grand finale, the cumulative total net inflow across all Ethereum ETFs reached $12.50 billion, rising triumphantly from $12.33 billion on December 31. A round of applause, if you please!

However, not all was rosy in the garden. Grayscale’s ETHE holds a rather sad -$5.00 billion in net outflows since converting from a trust structure. Meanwhile, BlackRock’s ETHA maintains a robust $12.61 billion in cumulative inflows. Fidelity’s FETH, however, has only accumulated a mere $2.65 billion in total inflows. Such is the fickle nature of fortune!

Bitcoin ETFs Post $471M in Matching Strength

As if choreographed in perfect harmony, Bitcoin spot ETFs matched Ethereum’s exuberance with a remarkable $471.14 million in net inflows on January 2. This delightful twist of fate reversed the prior outflows of $348.10 million witnessed on December 31. Ah, how the tides can change! 🌊

In this dance of dollars, BlackRock’s IBIT led the Bitcoin brigade with approximately $287 million in inflows-surely a testament to their allure!

As the curtain rose for Bitcoin ETFs, total net assets reached an impressive $116.95 billion on January 2, climbing from $113.29 billion just a day earlier. Cumulative total net inflow, forever the overachiever, climbed to $57.08 billion from $56.61 billion. Bravo! Bravo!

Finally, let us not overlook the January 2 trading session, where a staggering $5.36 billion in total Bitcoin ETF volume was witnessed! Nearly double the $2.83 billion of December 31! If only we could bottle this enthusiasm!

And thus concludes our whimsical journey through the world of Ethereum and Bitcoin ETFs. Until next time, may your investments flourish like wildflowers in spring! 🌼

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Starknet’s $365M Staking Spree: Bitcoin Meets Chaos!

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- CNY JPY PREDICTION

- BNB: To $1,000 or Total Chaos? 🤯

- Fear and Greed Index Hits 5-Month Low as BTC Drops to $109K – Warning or Buying Opportunity?

2026-01-03 20:10