December has tucked a faint frost into Bitcoin‘s tale: a 5.5% retreat for the month, and the chart wears the weary smile of a provincial stage. People lean forward, squinting at the lines and wondering what comes next. So we asked the crowd, not out of bravado but habit, and listened to today’s most lively prediction markets-the little theaters where numbers pretend to predict the weather. 😅

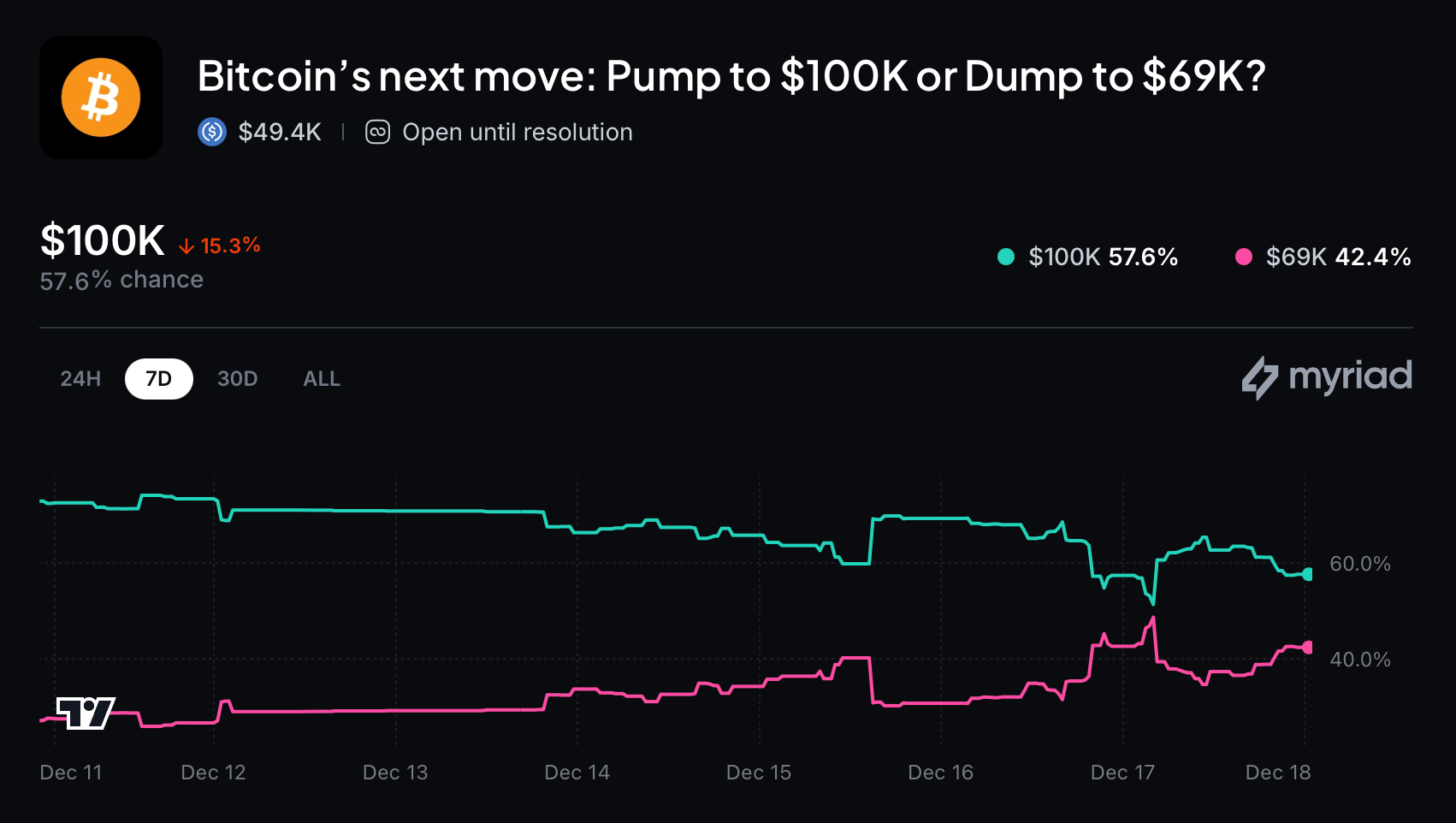

Myriad Bettors Still Favor $100K, but the Margin Keeps Shrinking

On Dec. 18, 2025, bitcoin (BTC) sits just above $85,000 after a brisk rise and a quiet retreat in the same session. To read the tea leaves, we consulted the Myriad marketplace wager titled “Bitcoin’s next move: Pump to $100K or Dump to $69K?,” which has chalked up 49.4K in USDC volume today. The crowd assigns a 57.6% chance to $100K and 42.4% to $69K-a small edge, like a waiter who’s certain but not certain enough to quit his day job. Over the past week, belief in $100K has faded by 15.3 percentage points, a quiet shrug that says, perhaps, not all dreams end in champagne. 🍷

The rules are plain as a dusty ledger: the market remains open until bitcoin either touches $100,000 or slides to $69,000-no extensions, no ambiguities. Put differently, bettors are buckled in, watching the chart as if it were a stagecoach rumbling down a bad road, hoping to hear which side the horse will choose and what that choice says about someone’s conviction. 😌

For the moment, the six-figure dream keeps the upper hand, though the gap narrows and the tension grows more noticeable with every tick of the clock.

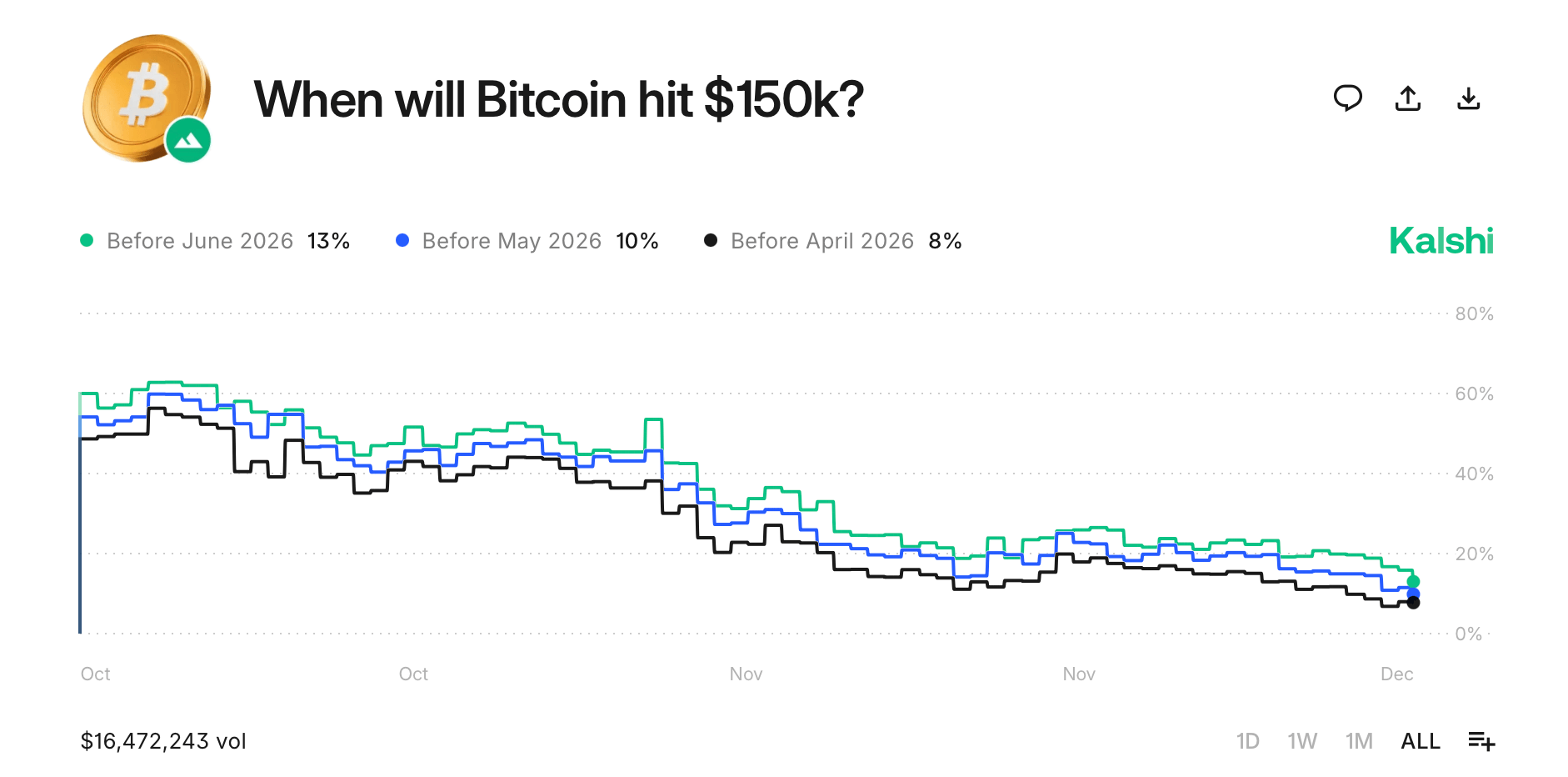

Big Targets Stay Intact on Kalshi, but the Timeline Keeps Stretching

The Kalshi market asking “When will Bitcoin hit $150K?” has logged roughly $16.47 million in volume, and the odds drift rather than dance. Mid-December 2025 finds the most optimistic camp-before June 2026-at a mere 14%, down two points. Narrowing the window trims confidence further: 12% before May 2026 and 8% before April 2026. Anything sooner than that? Barely registers, like a rumor that refuses to become a story. 😬

Looking at the timeline, the message grows louder: probabilities drift lower from October into December, suggesting traders have cooled on the idea of bitcoin sprinting to $150K anytime soon. The pricing tells the same tale-“Yes” contracts remain cheap, while “No” dominates the board as if it owned the room. The lesson, if one must draw one with a tired quill, is this: patience has replaced bravado.

Bottom line: Kalshi’s bettors aren’t denying $150K outright, but they’re penciling it in for later rather than sooner. Patience, not champagne, seems to be the trade of choice. 🥂

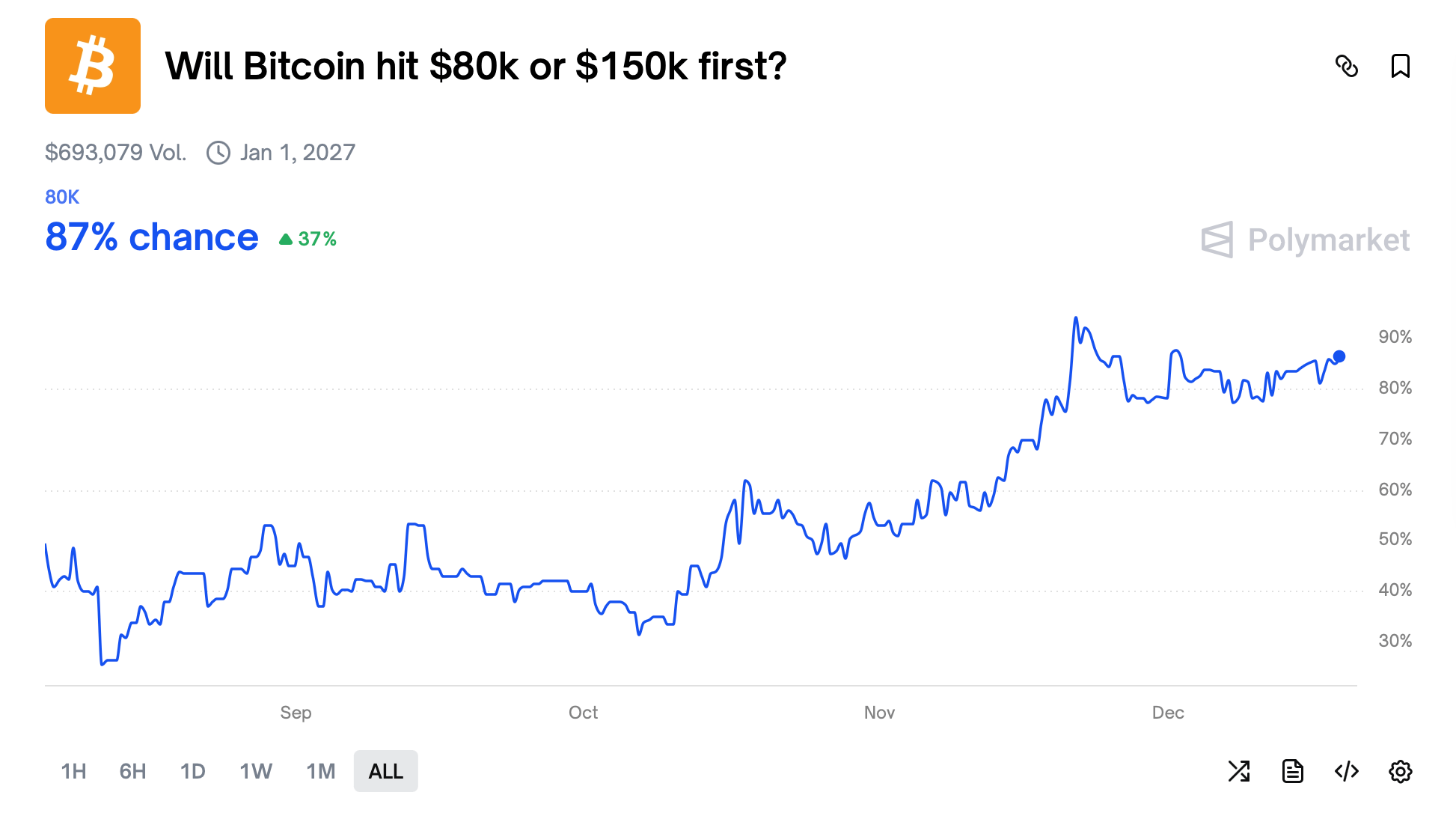

$80K Dominates Polymarket’s Board as the Near-Term Outcome

Polymarket’s crowd isn’t hedging; they’ve already decided and marked the page with a stubborn permanent marker. In the wager “Will Bitcoin hit $80K or $150K first?” nearly $693,000 in volume has accumulated, and the verdict is unmistakable. $80,000 commands an 87% probability, a confidence boost of 37 percentage points, leaving $150,000 to be the scenic route rather than the next exit. The chart narrates a steady ascent from October to December, as if bettors keep buying the same doubt and returning to the same bet. 🎭

The takeaway is blunt: Polymarket traders see $80K as a pit stop, not the finish line, and they’re betting bitcoin will arrive there long before any six-figure fireworks beyond $100K. In this contest, $80K isn’t just favored-it’s the house’s favorite, with a smug little wink. 🤷♂️

Bitcoin’s Next Chapter Is Priced With Caution, Not Cheers

When you step back from the individual wagers, a clear mood emerges: confidence has not vanished, but it has been trimmed. Prediction markets keep sketching higher paths, yet those routes wear longer timelines and fewer bold declarations. December hasn’t sparked panic-it’s inspired restraint, the kind that shows up when conviction meets reality and decides to slow the pace. 🧭

What ties these markets together is a preference for caution over spectacle. Short-term bets lean defensive, big-number targets slide into the distant calendar, and certainty proves hard to secure. Right now, prediction markets aren’t chasing bragging rights-they’re pricing in patience, second thoughts, and a bitcoin landscape content to keep everyone guessing a little longer. 🕰️

FAQ ❓

- What are prediction markets signaling for bitcoin right now? Traders lean cautiously bullish but are trimming confidence on fast moves to higher price targets.

- What is the Myriad market betting on? It’s wagering on whether bitcoin hits $100,000 or drops to $69,000 first, with six figures still narrowly favored.

- What do Kalshi traders think about $150,000 bitcoin? Most see it as a later event, not something likely in early 2026.

- How does Polymarket compare? Polymarket bettors overwhelmingly expect bitcoin to revisit $80,000 before making any serious run toward $150,000.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- How Ripple’s Saudi Adventure Might Just Redefine Your Morning Coffee

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- Circle’s USDC Surpasses $75B: A Triumph of Modern Finance?

2025-12-19 10:04