Ah, Bitcoin, thou fickle mistress of the digital realm! Behold, as thou dost languish beneath the lofty $90,000 mark, thy bulls, once valiant, now quiver in defense of their meager demand zones. After a most precipitous fall from thy recent zenith, thou hast entered a phase of consolidation, a masque of tranquility that doth deceive the unwary eye. Volatility, that tempestuous companion, hath retreated, leaving naught but the whisper of short-term price movements, as though the market doth pause to catch its breath, rather than succumb to utter ruin. Yet, mark my words, this serenity is but a farce! 😈

Lo, the sages at CryptoQuant, through their XWIN Research Japan, proclaim that on-chain data doth reveal a peril most dire beneath this veneer of calm. The Inter-Exchange Flow Pulse (IFP), that noble metric which tracks the peregrinations of Bitcoin betwixt exchanges, hath turned as red as a jester’s nose. A harbinger, perchance, of structural risk most grave! 🛑

In such a theater of folly, price movements grow sharper than a wit’s retort, and orderliness is but a distant memory. Though diminished exchange balances may stay the hand of immediate selling, they also amplify the chaos of sudden demand or forced liquidations. A slowdown in capital’s circulation doth ensue, and liquidity, once abundant, now fragments like a shattered mirror. 🪞

The Inter-Exchange Flow Pulse: A Tale of Structural Fragility

Pray, consider the IFP, that barometer of Bitcoin’s internal vitality. When it soars, capital doth dance with agility, arbitrage opportunities vanish like a thief in the night, and liquidity providers keep the order books deep as the ocean. Yet, when it falters, the market’s lifeblood doth stagnate, and prices grow as sensitive as a courtier’s ego. 🩸

This liquidity, once the market’s bulwark, now wanes alongside exchange balances at historic lows. Though a reduced sellable supply may briefly buoy prices, it also leaves order books as thin as a courtier’s excuse. Should prices move with conviction, slippage shall reign, and volatility shall gallop forth like a wild stallion. 🏇

With leverage still rampant in the derivatives markets, instability doth arise not from conviction, but from the magnitude of forced reactions. History doth teach us that when IFP turns red, corrections are abrupt, and price swings are as wild as a carnival. The peril today is not mere distribution, but structural fragility. Until inter-exchange liquidity doth mend, Bitcoin remains a sitting duck for sudden, outsized moves, rendering leveraged positions as risky as a duel at dawn. ⚔️

Bitcoin’s Price: A Consolidation Below the Stars

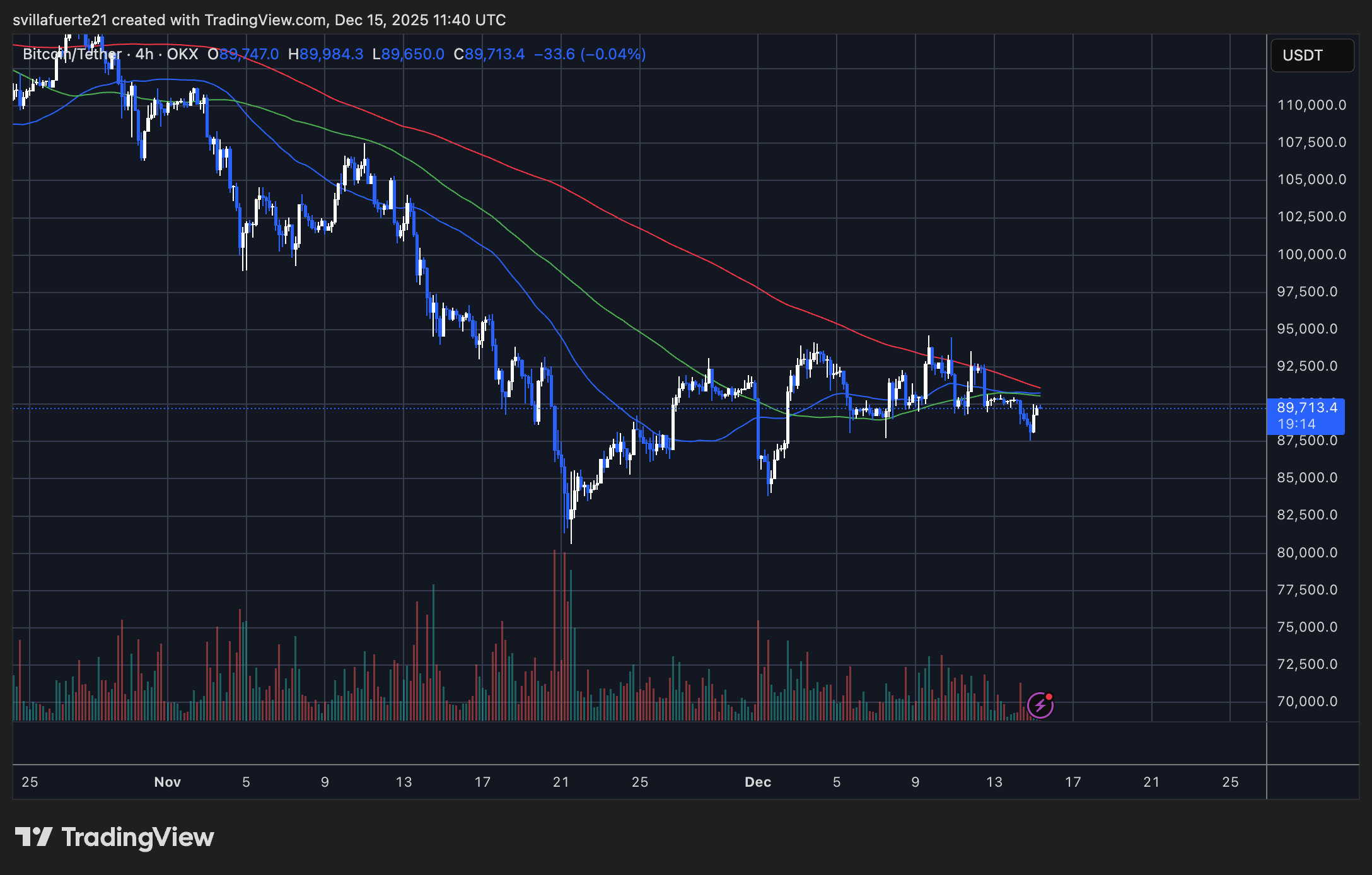

Cast thine eyes upon the 4-hour chart, and thou shalt behold a market ensnared in consolidation, following a corrective move as sharp as a barber’s razor. After the November sell-off, BTC found solace near the $82,000-$83,000 zone, where demand, like a knight in shining armor, triggered a rebound. Yet, this recovery lost its luster, and now the price ranges below a descending cluster of moving averages, as though trapped in a labyrinth. 🌀

At present, Bitcoin trades near the $89,000-$90,000 level, repeatedly failing to reclaim the 200-period moving average, a fortress it cannot breach. The 50 and 100 moving averages, sloping downward like a scoundrel’s grin, act as dynamic resistance, reinforcing the bearish structure. Each attempt to ascend is met with selling pressure, as though the bulls have lost their gusto. Volume, too, hath contracted, a sign of trader indecision, which oft precedes a volatility explosion, especially when price compresses beneath major resistance. 🧨

Structurally, BTC remains vulnerable so long as it trades below the $92,000-$94,000 zone, once a bastion of support, now a ceiling that caps its ambitions. On the downside, the $87,000-$88,000 range emerges as immediate support. Should it falter, the path to $84,000 may reopen. Until a clear breakout occurs, Bitcoin dangles in a precarious balance between distribution and base-building, a comedy of errors in the crypto realm. 🎭

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- STX PREDICTION. STX cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- FLOKI’s Price Breaks Out: $0.000087 or a Fall?

- BNB’s Big Gamble: $160M Bet or Just Another Rich Kid’s Allowance? 💸🚀

- ETH to $7.6K? Really? 🙄

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- Bitcoin’s $90K Dream: A Tale of Technical Traps 📉💥

2025-12-15 23:23