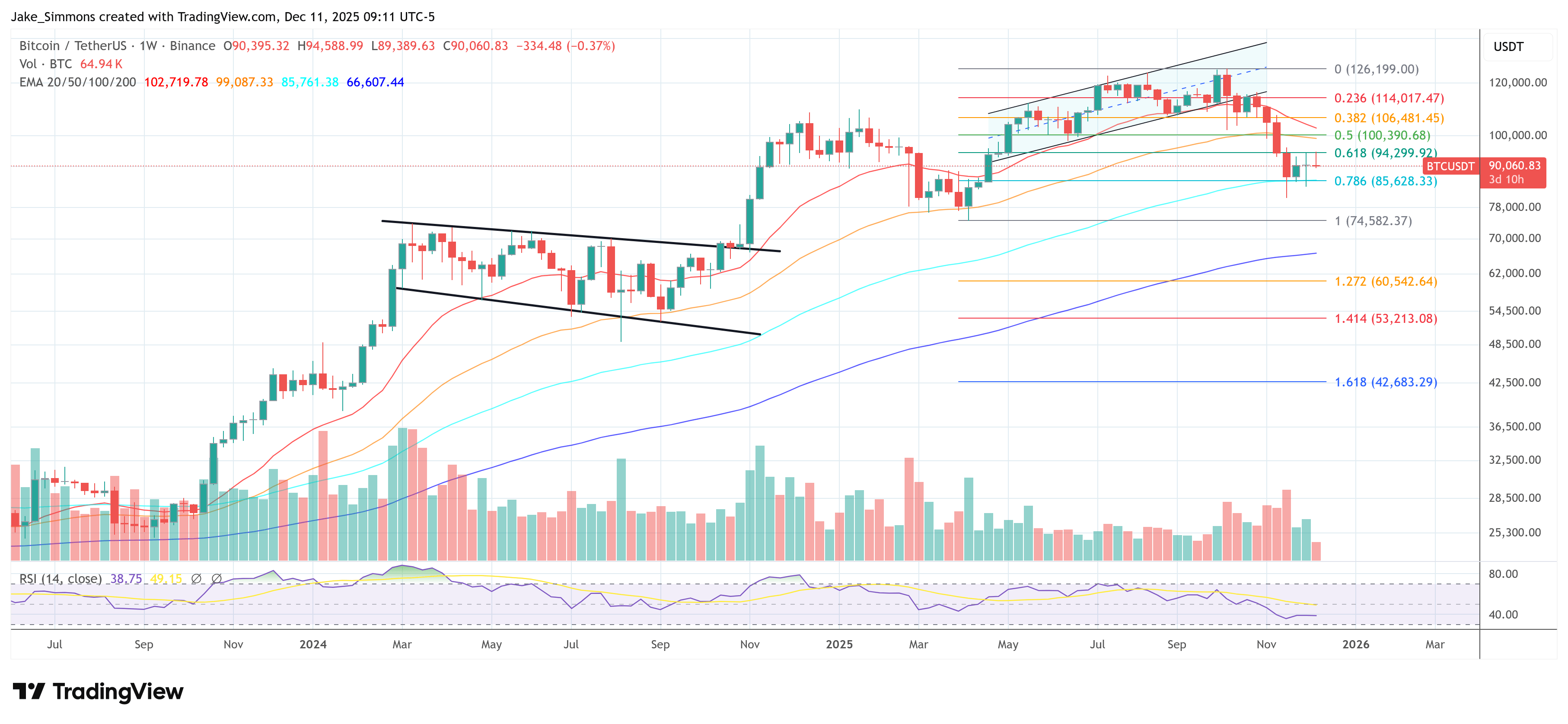

Well, bless my stars and garters, if it ain’t the wild west of Bitcoin again, where the headlines holler “bull” and “bear” like a couple of drunks in a saloon, while the market itself sits there, as cool as a cucumber in a pickle jar, refusing to play along. After shootin’ up to the moon at $124,000-$126,000 back in October, ol’ BTC decided to take a tumble, shedding a third of its value faster than a gambler loses his shirt in a poker game. Now it’s sittin’ pretty in the low-$90,000s, still the king of the hill but lookin’ a mite winded.

Into this mess strides the mysterious plur daddy (@plur_daddy), a crypto sage so wise he doesn’t even need a real name. He reckons the market ain’t in a bull or bear phase at all. “It’s just maturin’,” he drawls, like a cowboy explaining why his horse won’t gallop. “What if we’re in an extended consolidation window, where the big boys are just passin’ the bag around?” he muses on X. Well, slap my knee and call me surprised! 🧐

He points to gold, that old reliable, which “chopped between $1,650-2,050 from April 2020 to March 2024,” and figures BTC’s gonna start actin’ all grown up and gold-like. In other words, it ain’t dead, it ain’t euphoric-it’s just stuck in a fat, liquidity-soaked range, where the weak hands pass the baton to the strong hands, and traders raised on halving cycles are about as patient as a cat in a room full of rocking chairs.

At the top end, plur notes, sellers come out swingin’ like they’re in a bar brawl whenever the price hits $120k. Are they spooked by the four-year cycle meme? Or just plain old age, price, liquidity, and tail risks? Who knows? But if BTC revisits that zone, plur figures folks’ll front-run it faster than a hound after a rabbit, reinforcin’ the range. Classic reflexivity: history repeats itself, first as tragedy, then as farce. 🎭

On the downside, plur ain’t singin’ doom and gloom. “The lows might be in,” he says, with all the confidence of a man who’s seen a few rodeos. Liquidity’s improvin’, he adds, so there’s room for a bounce-just don’t go bettin’ the farm on a new regime. Or, as he puts it with a wink, “I’d be cautious about callin’ this a revolution.”

Bitcoin Market Scratches Head: QE or Not QE? 🤔

Yesterday’s FOMC meetin’ threw a wrench in the works, with a 25-basis-point rate cut and a surprise announcement of $40 billion a month in “reserve management purchases” (RMPs) of short-dated Treasuries. The Fed swears it ain’t QE, just a little technical tweak to keep the repo markets from goin’ belly up. But macro voices on X are squabblin’ like a bunch of hens in a coop.

Plur Daddy chimes in: “This ain’t QE, but they’re takin’ some duration out, which means it’s more bullish than a bull in a china shop.” Miad Kasravi (@ZFXtrading) insists it’s just balance sheet expansion, nothin’ to see here, folks. But LondonCryptoClub ain’t buyin’ it. “The Fed’s printin’ money like it’s goin’ out of style,” he declares, backin’ Lyn Alden’s remark that it’s “QE-lite, whether they admit it or not.” Peter Schiff, predictably, is soundin’ the inflation alarm, yellin’ “Got gold?” like a street preacher on judgment day.

Lyn Alden nails it

Markets are tiein’ themselves in knots arguin’ over semantics

Yet they’re printin’ money and monetizin’ the deficit

It’s all the same song, just a different verse. QE-lite…for now. 🎶

– LondonCryptoClub (@LDNCryptoClub) December 10, 2025

So, What’s the Takeaway, You Ask?

Well, plur reckons these operations are expandin’ bank reserves and easin’ repo stress, but they’re also creepin’ closer to “QE-lite” than pure plumbing. It’s good news for risk assets, and it’s comin’ just in time for the year-end liquidity drought. For Bitcoin, the uncomfortable truth is that both things can be true: the “debasement trade” is alive and kickin’, while the price action behaves like a semi-institutional asset digestin’ a wild ride and a macro shock. Another six to eighteen months of rangebound churn? “Wouldn’t be strange at all,” plur says, shruggin’ like a man who’s seen stranger things. Whether you call it bull, bear, or purgatory is just a matter of narrative. Markets’ll trade it the same either way. 🤷♂️

At press time, BTC’s tradin’ at $90,060. So, there you have it, folks-Bitcoin’s in limbo, and we’re all just along for the ride. 🌪️💰

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- CNY JPY PREDICTION

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

- TRX PREDICTION. TRX cryptocurrency

- BNB: To $1,000 or Total Chaos? 🤯

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

2025-12-12 00:33