Ladies and gentlemen, prepare your champagne glasses (or tea, if you’re more my style) because Australia’s financial watchdog has thrown a lifeline to crypto companies. On December 9, 2025, ASIC declared, “Let’s all take a collective deep breath” and rolled out new measures to ease the regulatory pressure cooker. 🎉

The exemptions? They’re like a spa day for stablecoin distributors, wrapped token intermediaries, and digital asset custodians. But here’s the catch: Companies have until June 30, 2026, to secure licenses before these temporary measures vanish like my willpower during a chocolate sale. ⏰

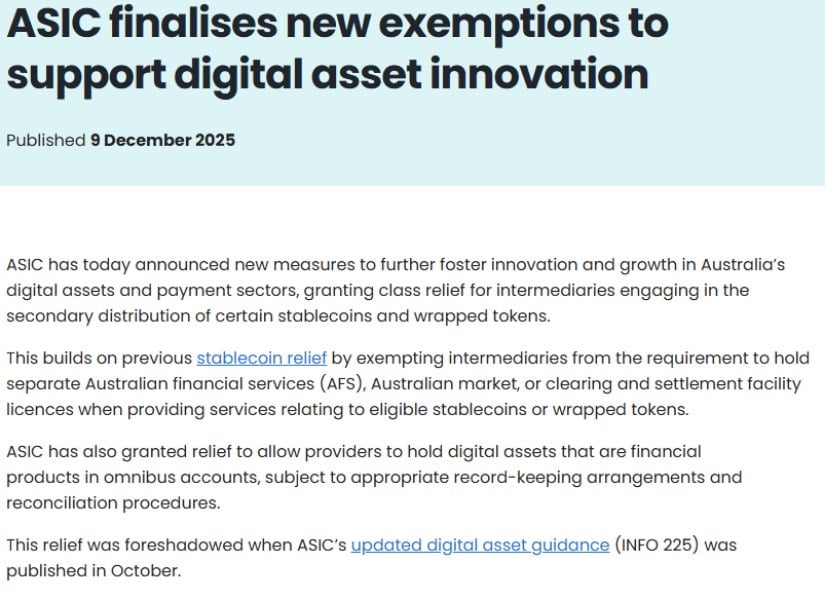

New Exemptions Target Key Digital Asset Services

ASIC’s latest relief package is basically saying, “We know crypto is confusing, so let’s remove some licensing hurdles for now.” Distributors of certain stablecoins and wrapped tokens can skip the Australian Financial Services license circus for now. Phew! 🙌

Omnibus accounts for custody? Think of it as a digital piggy bank where providers can pool clients’ assets. Just don’t forget to keep detailed records-ASIC isn’t exactly known for leniency. 🐷

These measures are like adding extra cheese to your pizza-they build on previous stablecoin relief by letting issuers who applied for licenses join the party, not just those who already have them. ASIC listened to the industry’s whining (five submissions, no less) and expanded eligibility. 👂

Industry Consultation Shapes Final Rules

ASIC didn’t just roll out these rules from a dusty old spreadsheet. Oh no, they actually listened to the crypto crowd! Five submissions later, the regulator decided to throw some clarity into the mix. Industry participants begged for clearer definitions, and ASIC delivered… sort of. 🤷♀️

The final rules are like a well-timed joke-principles-based record-keeping gives companies wiggle room, but don’t expect a free pass. Flexibility is nice, but ASIC still wants to see results. 📚

Commissioner Alan Kirkland, looking ever the crypto enthusiast, declared, “Distributed ledger tech is the future, darling! ASIC’s guidance is the glitter glue that lets firms innovate without tripping over red tape.” ✨

Broader Digital Asset Framework Taking Shape

Australia’s crypto rules are evolving faster than my ability to finish a Netflix series. The Corporations Amendment Bill, introduced on November 26, 2025, is basically the rulebook for digital asset platforms. Operators now need licenses and must play nice with efficiency and fairness. Small-scale platforms get a break if they’re not processing $5,000 per customer or $10 million annually. 🧾

Stablecoins, wrapped tokens, tokenized securities, and wallets? All financial products now. ASIC’s making it clear: no licenses, no playdate. 🚫

No-Action Period Provides Transition Time

ASIC’s granting a “no-action” period through June 30, 2026-basically a grace period for unlicensed providers who are trying to comply. But here’s the kicker: You must join the Australian Financial Complaints Authority and register as a foreign company if you’re not Australian. Lending products and derivatives? Still off-limits. 🚨

ASIC will review past conduct but will still slap wrists for serious misconduct. It’s like a school teacher who’s lenient but still deducts points for chewing gum. 🤖

Global Competition Drives Regulatory Clarity

Australia isn’t playing hide-and-seek with crypto regulations anymore. While the world’s crypto capitals like Singapore and the EU are busy setting the pace, our Aussie regulators are serving up a “Wait for it…” moment. 🤷♂️

Stablecoins are the new cash, and Australia wants to be in the game. By creating a framework that balances innovation with protection, they’re aiming to snare a slice of the global pie. 🥧

The Road Forward

Australia’s crypto exemptions are like a bridge made of Legos-carefully constructed but with clear expectations. Companies have until mid-2026 to get licensed, which is just enough time to avoid panic (but not too much). 🕒

ASIC hinted at potential growth as more issuers get licenses. So, while we sip lattes and watch the show, Australia’s crypto scene might just become the next big thing. 🚀

Bottom Line: Temporary Bridge to Permanent Framework

Australia’s regulatory exemptions are the equivalent of a “Do not fold” sticker on your favorite jeans-temporary relief with a deadline. It’s a clever way to support innovation while keeping consumers safe. Other countries might just copy-paste this model. 📋

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Bankman-Fried\’s Wild Excuse

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- BTC’s $93k Gamble: A Bull Cycle’s Last Dance 🐆💸

2025-12-09 23:10