Ah, the timeline for our dear President Trump’s new Federal Reserve chair-uncertain, as ever, like the weather in a comedy of errors! 🌩️

Jerome Powell, the current chair, will end his term in May 2026, like a weary actor leaving the stage, while Trump, ever the drama queen, prepares to announce a successor, according to U.S. Treasury Secretary Scott Bessent. 🎭

- Trump, ever the drama queen, is expected to announce Powell’s successor before Christmas, thereby accelerating uncertainty like a poorly timed punchline. 😅

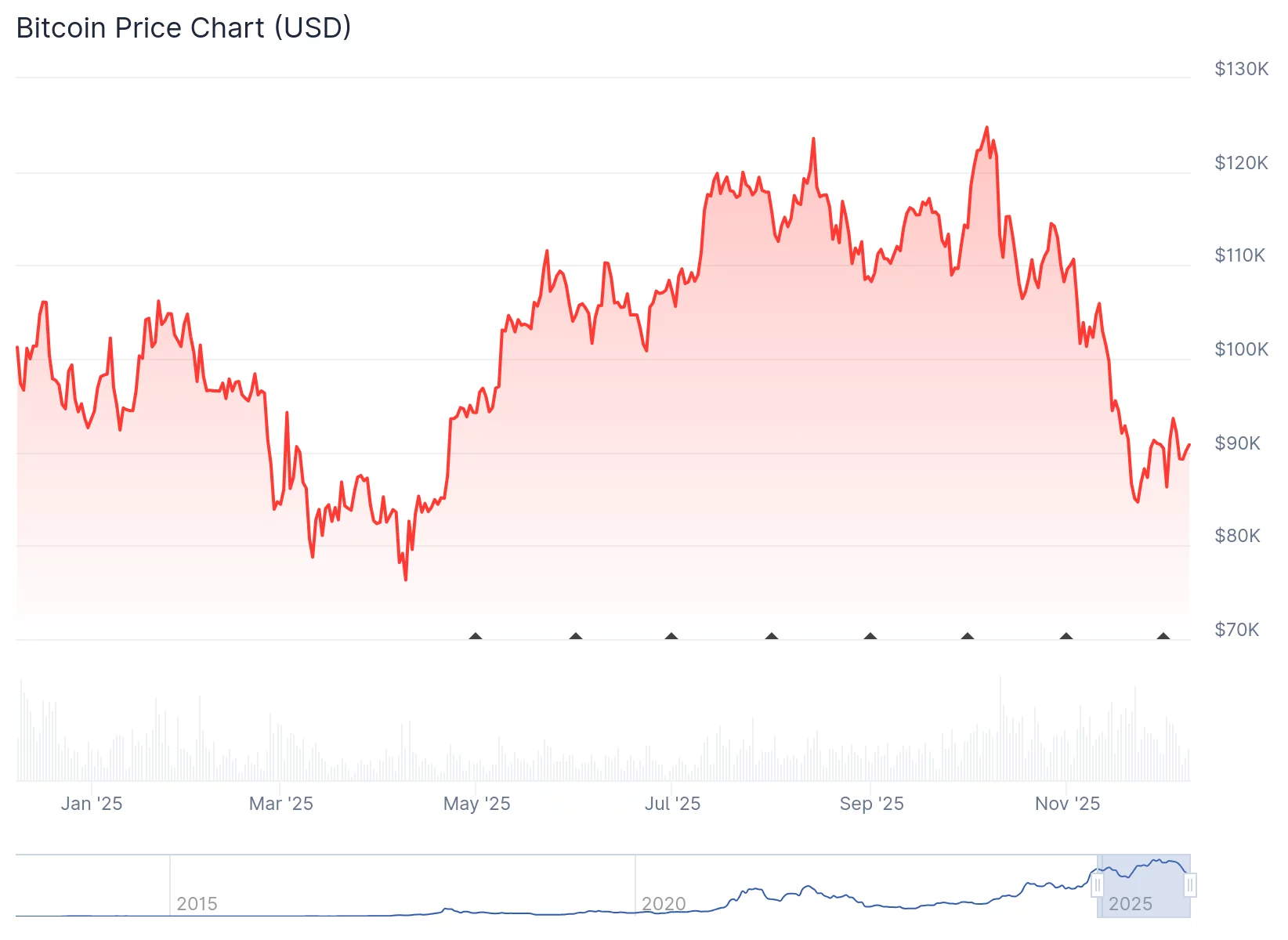

- Bitcoin and broader markets, ever the fickle lovers, react to expectations of rate cuts and Trump’s pro-crypto stance, with analysts noting strong historical links between Fed decisions and crypto performance. 💸

- Kevin Hassett, a leading candidate, raises questions about how a potentially crypto-friendly central bank leader might shape monetary policy. Will he be a friend or a foe? 🕵️♂️

On Nov. 25, Bessent said, “there’s a very good chance that the president will make an announcement before Christmas.” A statement so certain, it’s almost as if he’s reading from a script! 📜

Five days later, Trump said he made his pick. By Dec. 2, the New York Times reported that Trump said his announcement could come “early next year.” A promise as fleeting as a comet’s tail. 🌠

Bitcoin, meanwhile, continues to demonstrate historical correlation with Federal Reserve interest rate policies, with prices typically declining during rate increases and rising during rate cuts. A dance as predictable as a waltz. 💃

And according to a 60 Minutes interview with Trump on Nov. 2, crypto is the president’s primary concern. “I only care about one thing-will crypto be number one in America?” Trump declares, a question so profound, it leaves even the Fed scratching their heads. 🤔

Either way, crypto bulls are likely waiting with bated breath. A new Fed chair nominee could signal a shift toward more favorable monetary policy. Or, as the saying goes, “Hope for the best, but expect the worst.” 🤞

Historically, lower interest rates have boosted crypto prices by increasing market liquidity and reducing borrowing costs. With Powell’s term ending, a new nominee could reduce policy uncertainty and potentially advocate for rate cuts, which are typically bullish for cryptocurrencies. A dream, or a nightmare? 🌟

Additionally, Trump’s past support for crypto suggests the new chair might create a more favorable regulatory environment for digital assets. Still, crypto regulations in 2025 have been extremely friendly and yet, Bitcoin is in the red. A paradox as baffling as a riddle wrapped in an enigma! 🧩

- Another candidate is Fed Governor Christopher Waller, who is known for his hawkish monetary policy stance and inflation control focus. A true hawk, indeed! 🦅

- Vice Chair of the Federal Reserve Michelle Bowman and BlackRock executive Rick Rieder are also candidates. A cast of characters as diverse as a Shakespearean play! 🎭

What’s next?

A 25-basis-point rate cut is expected at the Dec. 10 Fed meeting, but analysts warn the real market drivers will be the Fed’s economic projections and Powell’s remarks. A game of chess, with the stakes higher than a royal flush! 🃏

While the cut is widely anticipated, risks of a “hawkish cut” loom, with potential dissents from hawkish officials. The Fed may be nearing the end of its easing cycle, pivoting to a slower, more cautious approach. A slow dance, indeed! 💃

Market volatility is expected due to growing disagreements within the Fed, weaker guidance, and uncertainty about future policy moves. A rollercoaster, if you will! 🎢

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- FET PREDICTION. FET cryptocurrency

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Meme Coins: September’s Silent Revolution? 🤑

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Why Cardano’s Next Move Might Make You Say ‘Wow’ or ‘Oh No’

2025-12-09 02:13