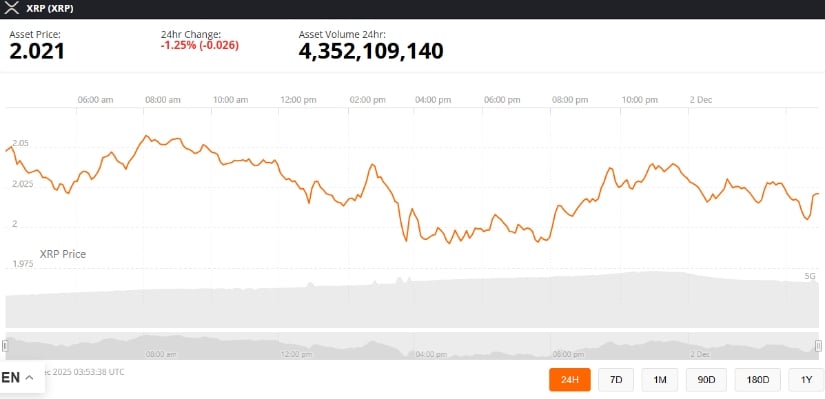

Ah, XRP, the plucky little coin that refuses to let go of its precious $2 mark, much like a certain wizard might cling to his staff (or perhaps a certain hat to its wearer). TradingView’s spot data reveals XRP hovering around $2.02, after a brief dip that was swiftly met with buyers who apparently decided, “Nah, we’re not letting this one go.” 🤑 Despite the market’s best efforts to push it down, XRP stands firm at the $2 support zone, a line in the sand that’s been more reliable than a Discworld tavern’s closing time.

This minor retracement, as the eggheads call it, comes just as the bigwigs are getting their hands on XRP. Coincidence? Probably. But it does add a bit of spice to the whole affair, like a pinch of dragon’s breath in your morning tea. ☕

Wyckoff’s Wacky Patterns: Is XRP Having a Spring Clean?

Technical wizards (the ones with charts, not wands) have spotted a Wyckoff re-accumulation pattern, a multi-month saga that’s more convoluted than a Lancre coven’s meeting minutes. XRP is currently in Phase C, where it’s allowed to have a little wobble-a “spring,” if you will-before bouncing back. Think of it as a coin having a quick nap before it’s ready to party again. 💤

One chart-reading sage insists these dips are just the market’s way of shaking out the weak hands, like a troll shaking a bridge to see who’s really committed. So, if you’re still holding, congratulations-you’re either a genius or a glutton for punishment. 🤓

Long-term, XRP is sitting pretty above its 20-month EMA at $1.94, a line that’s been more reliable than Death’s appointment book. And let’s not forget the $2.05 zone, which has historical significance akin to the Battle of Koom Valley-though hopefully with fewer casualties. ⚔️

Long-Term Outlook: Mixed Like a Witch’s Brew

While XRP is facing resistance on shorter timeframes (because even coins need a bit of drama), the monthly chart looks as constructive as a dwarf building a bridge. Analysts note that XRP is below the 21 EMA on daily and weekly charts but above it monthly, suggesting the accumulation phase is still on. It’s like the coin is taking a leisurely stroll while everyone else is sprinting. 🏃♂️

One long-term strategist quipped that as long as the monthly structure holds, higher valuations are as possible as a sourcerer’s promises-technically feasible, but don’t bet your last penny on it. Just keep an eye on those macro support zones, or you might end up in the financial equivalent of the Ramtops. 🏔️

ETFs: The New Shiny Toy in Town

The XRP narrative is shifting faster than a wizard’s allegiances, thanks to spot XRP ETFs making it easier for the big boys to get in on the action. Fund filings show significant net inflows, which is financial speak for “people are throwing money at it.” 💼

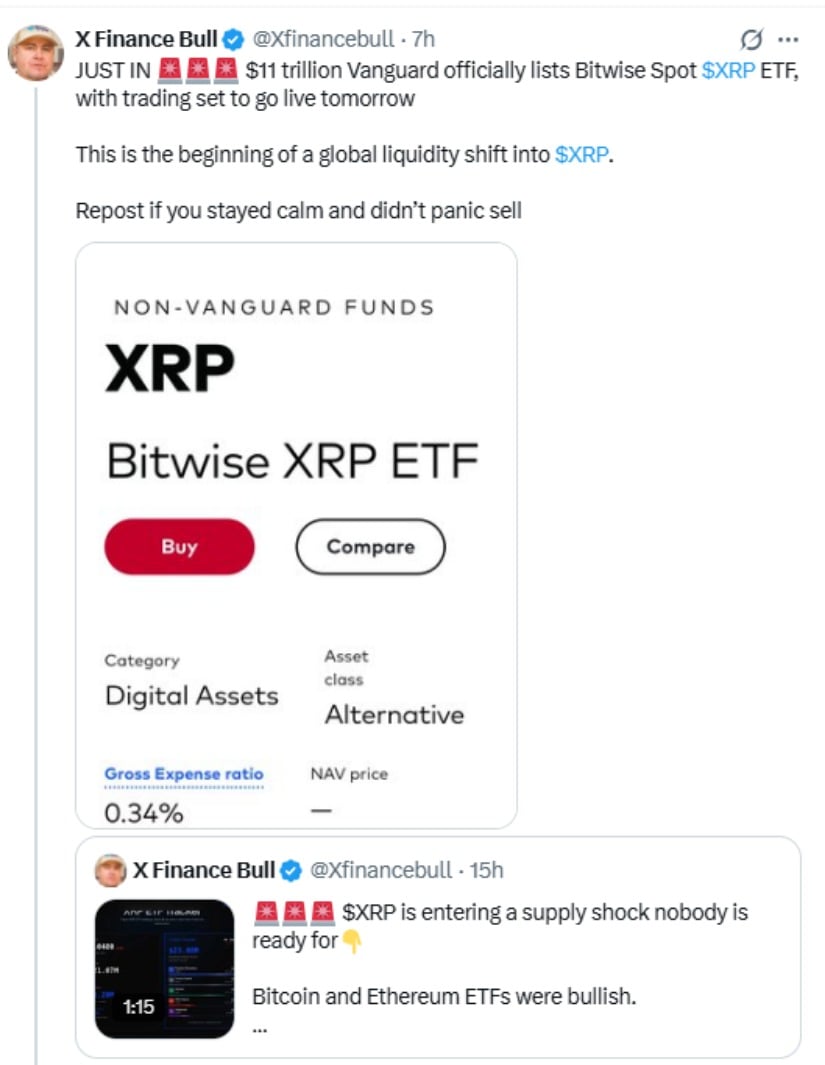

Vanguard, the financial giant, has listed the Bitwise Spot XRP ETF, potentially opening the floodgates for institutions managing more money than a dragon’s hoard. With an expense ratio of 0.34%, it’s cheaper than a pint in the Mended Drum-though probably less likely to give you a headache. 🍺

While some structured products are holding XRP, the impact on liquidity is as clear as a troll’s explanation of quantum physics. Bitcoin ETFs have historically shaken things up, so XRP might follow suit-though comparing the two is like comparing a wizard’s staff to a witch’s broomstick. Both fly, but one’s got more flair. 🧹

Technical Levels: Where the Magic Happens

XRP is respecting a descending trendline like a well-trained familiar, forming lower highs that signal short-term selling pressure. A recent rejection near the trendline, EMAs, and Fibonacci retracement zone suggests the coin is having a bit of an identity crisis. 🌀

On the downside, $1.8476 is the liquidity zone to watch-a level that could make or break the coin’s recovery. To bounce back, XRP needs to reclaim the trendline and sustain above the Fibonacci “golden pocket,” a zone as mystical as the Unseen University’s library. 📚

Neutral Takeaway: XRP’s Balancing Act

XRP’s defense of $2 remains the focal point for everyone from traders to long-term holders. If this level holds and ETF inflows keep coming, liquidity could stabilize faster than a witch finding her broom. 🧙♀️

But if $1.85-$1.90 gives way, it’s downside risk city, and recovery might take longer than a wizard’s apprenticeship. XRP is in a transitional phase where institutional adoption meets technical wobbles-a bit like a wizard trying to learn modern magic. It’s messy, but potentially brilliant. ✨

Read More

- Gold Rate Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- EUR CHF PREDICTION

- STX PREDICTION. STX cryptocurrency

2025-12-02 22:46