Artemis, a blockchain analytics platform that probably has a better grasp on human futility than a therapist, recently dropped a hot take: sure, people have tried to make stablecoins in other currencies-euros, yen, rand, the Zimbabwean dollar (okay, maybe not that last one)-but it’s basically been a global game of “Sorry! (Not the board game. Though that might be more fun.)”

Artemis: Non-USD Stablecoins Are Virtually Non-Existent, Euro Stablecoins Show Consistent Growth

The Facts (Also Known As: “The Inevitable Triumph of American Cultural Imperialism, Now With Blockchain!”)

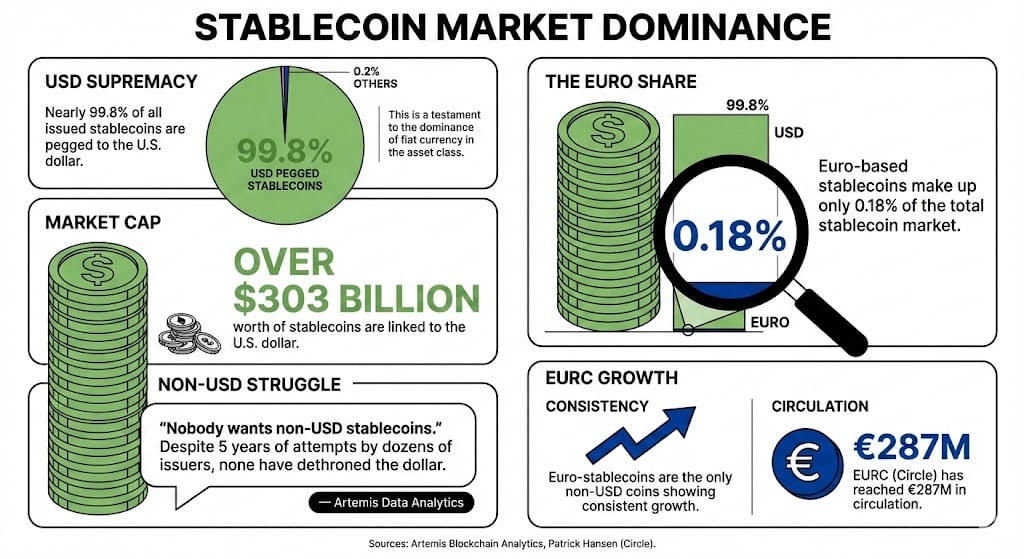

According to Artemis, which sounds like a surveillance AI from a dystopian Netflix show but is actually in the business of counting digital dollars, a whopping 99.8% of stablecoins are tied to the good ol’ U.S. dollar. That’s right-less than 0.2% of this trillion-dollar party is even trying to speak another language. It’s like showing up to a potluck with za’atar and pita only to find 99 people brought variations of mac and cheese. Impressive? Sure. Diverse? Not even close. 🧀🇺🇸

There’s over $303 billion in dollar-pegged digital popcorn floating around cyberspace. Meanwhile, every other currency’s stablecoin dreams are gathering dust next to unused gym memberships and unplayed ukuleles.

On X (formerly Twitter, formerly a functional platform), Artemis put it bluntly:

Nobody wants non-USD stablecoins. Five years, dozens of new issuers, every major currency tried, and none have made any progress in dethroning the dollar.

Which is basically the financial version of: “We tried to make Eurostablecoin famous, but it kept refusing to leave the house.”

Speaking of Eurostablecoin (or “Poor Man’s Dollar™”), it currently holds a princely 0.18% of the market. That’s not quite rounding error territory-but if this were a high school popularity contest, it would be the kid who brings their own lunch and reads Camus behind the bleachers.

But! There’s a glimmer of hope-or perhaps just a reflection off a very small puddle. Circle’s Patrick Hansen, who apparently still believes in love and possibly unicorns, claimed that euro-pegged stablecoins are “the only non-USD ones showing consistent growth.” 🚀 Or as I like to call it: “Not dead yet.” EURC, in particular, has ballooned to €287 million in circulation. That’s enough to buy approximately 14 Lamborghinis or one Brooklyn brownstone with questionable plumbing. Progress?

Why It Is Relevant (Or: “Why Should I Care About Electronic IOUs?”)

Look, the U.S. dollar’s dominance in stablecoins is less about crypto and more about global psychology. It’s the financial equivalent of everyone in the world watching Friends reruns, even if they don’t like Joey. Why? Because it’s familiar. It’s safe. It doesn’t make you think too hard. 🛋️😭

Stablecoins basically let people in countries with iffy finances hold digital dollars without having to smuggle Benjamins in their socks. So when your local currency collapses faster than a soufflé in a wind tunnel, you can just… hop on the USD train. Wheeeee! 🚂💨

And because these digital dollars inherit the U.S. dollar’s rep as a bulwark against inflation (debatable, but let’s play along), people treat them like emotional support currency. “It’s okay, my country’s bank is underwater-I’ve got $20 in USDT. I’m basically Rockefeller.” 💼🐦

Looking Forward (Or: “Will Europe Ever Be Cool?”)

Short term? The dollar’s reign won’t be challenged unless someone invents a stablecoin backed by free healthcare and decent public transit. (Spoiler: they haven’t.)

But longer term? Euro-pegged stablecoins might finally get their turn in the sun-especially if the EU stops making everything so confusing with regulations that look like they were written in iambic pentameter. If more countries start using national stablecoins for payments (looking at you, France, with your three-hour lunch breaks), maybe-just maybe-the euro can go from “background character” to “supporting role.” 🎭🇫🇷

FAQ (Frequently Avoided Questions)

-

What percentage of stablecoins are pegged to the U.S. dollar?

Nearly 99.8%. Yes, that means if stablecoins were a graduating class, 99 of them are American, one is European, and the rest are “undocumented.” -

How much value do dollar-pegged stablecoins represent?

Over $303 billion. That’s enough to buy every Starbucks in Lithuania three times over. And still have change for a muffin. 🧁 -

What is the market share of euro-based stablecoins?

A measly 0.18%. Impressive growth! Still less than the number of times I’ve said “I’ll start my diet tomorrow.” -

What trends are emerging for euro-pegged stablecoins?

They’re growing! Slowly! Like a fern in a dim apartment! EURC has hit €287M. At this rate, they’ll surpass the dollar by… 2057. Maybe. 🌱💸

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- XRP Staking: A Tale of Tension and Tokens 🚀

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

2025-11-29 10:10