Ah, Ethereum (ETH), that fickle mistress of the digital realm, has once again plunged into the abyss, trading below $2,700 after a precipitous fall from its August 2025 high of $4,950. A 45% correction, you say? Merely a flesh wound, a trifle, a momentary lapse in the grand ballet of greed and despair. Analysts, those soothsayers of the charts, whisper of “key technical areas” that may cradle the fallen giant and hoist it back to glory. Traders, ever the optimists, adjust their spectacles and proclaim a longer cycle, higher peaks, and dreams of untold riches. 🤑

Daily volume? A paltry $50.3 billion. ETH, down 10% in 24 hours, nearly 15% in a week. Yet, in this maelstrom of numbers, hope flickers like a candle in a storm. The price has retreated to zones where buyers once roared, their wallets open, their hearts aflame. Will they return? Or is this but a cruel jest, a prelude to further ruin? 🤡

The Waves of Folly

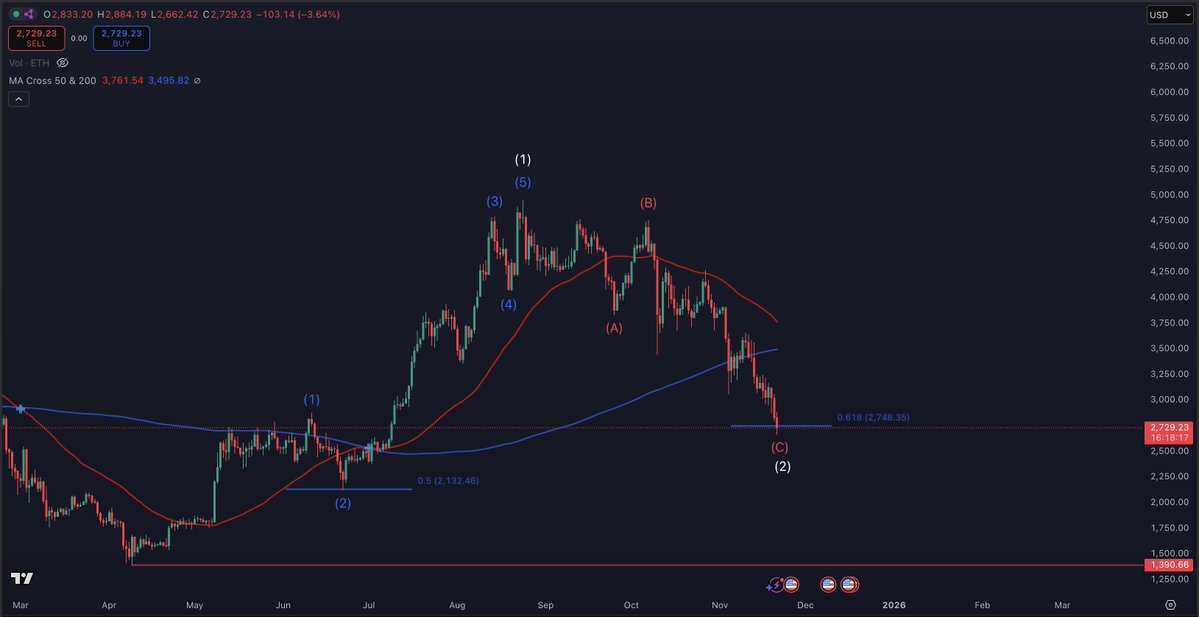

StockTrader_Max, that modern-day Cassandra, has unveiled an updated Elliott Wave count, declaring ETH has breached its Wave 1 range. Wave 4? A mere phantom. Wave 2? Ah, now we are in the realm of retracement, a dance of correction that typically graces the early stages of a cycle. “ETH is already at the 0.618 FIB,” the analyst intones, “a place where lows are born.” 🌊

“ETH is already at the 0.618 FIB… this is an area where I expect to see a low form,” the analyst noted, his voice dripping with the gravitas of a man who has seen too many charts.

The 0.618 level, a mere $2,748, stands as a bulwark against the chaos. From here, Wave 3 could surge to $8,800, supplanting the modest $6,000 once foretold for Wave 5. But is this not the very essence of speculation-a game of mirrors and smoke? 🪞

The Abyss Gazes Back

Bleeding Crypto, ever the harbinger of doom, presents a chart of ETH ensnared in a Fibonacci support zone. The 0.618 at $2,748, the 0.706 at $2,433, the 0.786 at $2,147-a trilogy of potential salvation or damnation. These zones align with a range where ETH once meandered, a sideways shuffle that now looms as a lifeline. The correction, deep yet familiar, echoes past cycles. Will it hold, or shall we plunge further into the void? 🕳️

Ash Crypto, another voice in the chorus, notes that ETH has filled a CME gap on the daily chart, a void lingering for four months between $2,850 and $3,000. “Most CME gaps are filled before a big move,” the post declares, a statement as cryptic as it is ominous. Is this the calm before the storm, or merely another twist in the tale? 🌩️

“Most CME gaps are filled before a big move,” the post said, its words hanging in the air like a prophecy.

Traders, ever vigilant, watch volume and structure, their fingers hovering over buy and sell buttons. The price teeters in a key area, a precipice between hope and despair. Will it rise like a phoenix, or crumble like a house of cards? 🃏

The $2,800 Mirage

Ted, that sage of the markets, observes ETH’s fall below $2,800, a level once revered as support, now a resistance to be reckoned with. “If ETH doesn’t reclaim $2,800 soon,” he warns, “expect a drop to $2,500.” This zone, where realized prices converge, carries the weight of history. Will it hold, or shall we descend further into the abyss? 🌀

“If ETH doesn’t reclaim the $2,800 level soon, expect a drop towards the $2,500 level,” he wrote, his words a dagger to the hearts of the faithful.

And so, we stand at the crossroads, the air thick with anticipation. Will Ethereum rise again, or is this but another chapter in the endless saga of human folly? Only time will tell, dear reader, only time. ⌛

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Telegram’s Blockchain Gambit: From Messengers to Billion-Dollar Unicorns!?🤯

- When a $300 Bet Turns Into Millions: Binance’s Coin Outshines Banks and Whales Wake Up! 🐋💸

- How Low Will XRP Price Crash?

- Solana’s October Drama: Bulls, Whales, and ETF Teases 🍿

2025-11-22 18:35