Hold onto your hats, folks! Bitcoin has dipped below $90K again. Cue the panic! 🚨

Bitcoin Dips Below $90K and Paper Hands Start Panic Selling, Glassnode Says

And just like that, Bitcoin has decided to make another dramatic exit below the $90K threshold. Because why not? Crypto markets, ladies and gentlemen! 💸 According to Glassnode, the crypto analysis firm that loves to keep us on the edge of our seats, investors with “paper hands” are now scrambling for the hills as they bail out in droves. This is the kind of thrill ride you don’t need a seatbelt for. 🎢

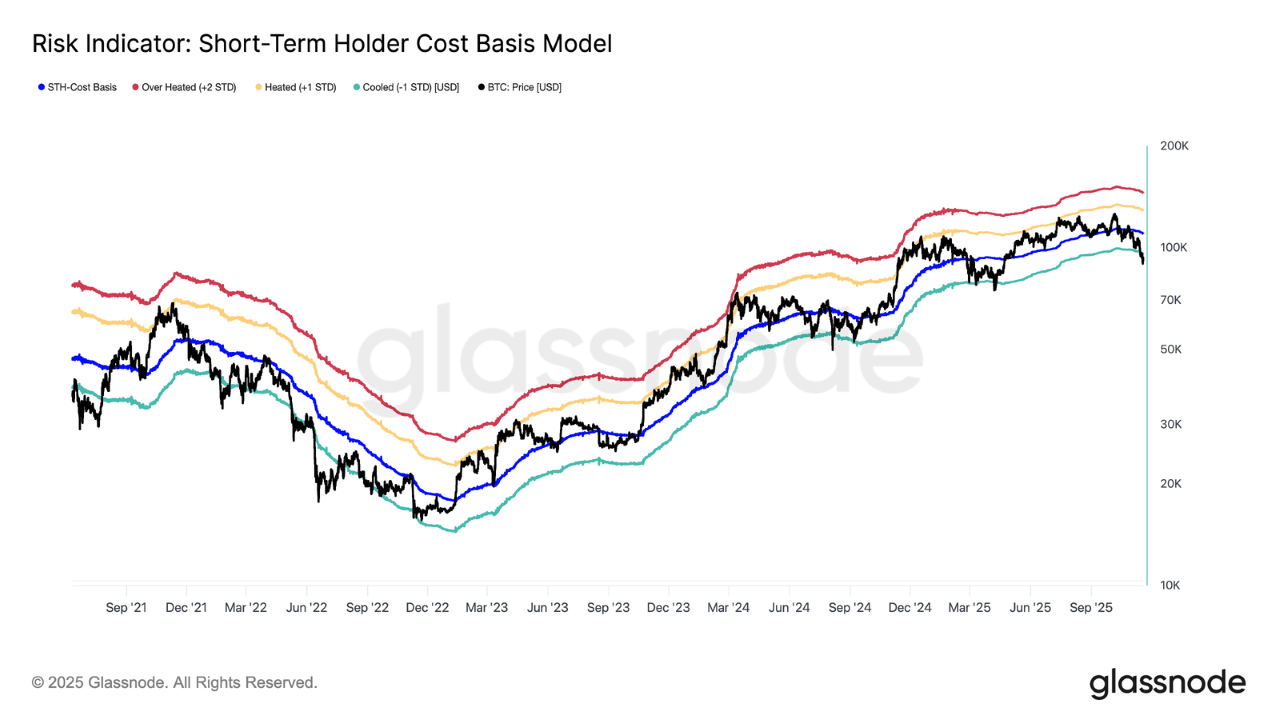

So, what’s the deal? Well, apparently this is the third time since early 2024 that Bitcoin has dipped below its “short-term holder cost-basis model.” I mean, seriously, how many dips do we need before someone starts handing out therapy sessions for these traders? 😅 Glassnode points out that this time around, the panic levels are even higher. Go figure.

So, it turns out that anyone who bought Bitcoin between June 17 and now (aka the last 155 days) is now staring at a sea of red. Back then, Bitcoin was strutting its stuff at around $104K, a whole $15K higher than today’s sad little price.

But wait, panic selling is just one part of the drama. According to Glassnode, we’ve also got weak demand, high ETF outflows, heightened volatility, and a shift from pure speculation to a more cautious approach. Yep, traders are now more into “hedging” than hunting for profits. A total plot twist. 💀

Bitcoin ETFs? Oh, they’re seeing net outflows of nearly $3 billion. Just a casual $3 billion, you know? Add to that the fact that Bitcoin derivatives trading has dried up like your grandma’s Thanksgiving turkey, and you’ve got yourself a recipe for disaster. Glassnode notes that implied volatility is now up there with the chaos we saw during the October 10th liquidation event. Yikes! 😬

So, can we blame the “paper hands” crowd for bailing out? Of course not. With all these factors applying pressure on Bitcoin, it’s practically begging for a nap in bear market territory. 🐻

As Glassnode so wisely puts it, stronger demand needs to step in to save the day, or we’ll be stuck in a longer, deeper accumulation phase. Hold onto your coffee, it’s gonna be a wild ride.

Overview of Market Metrics

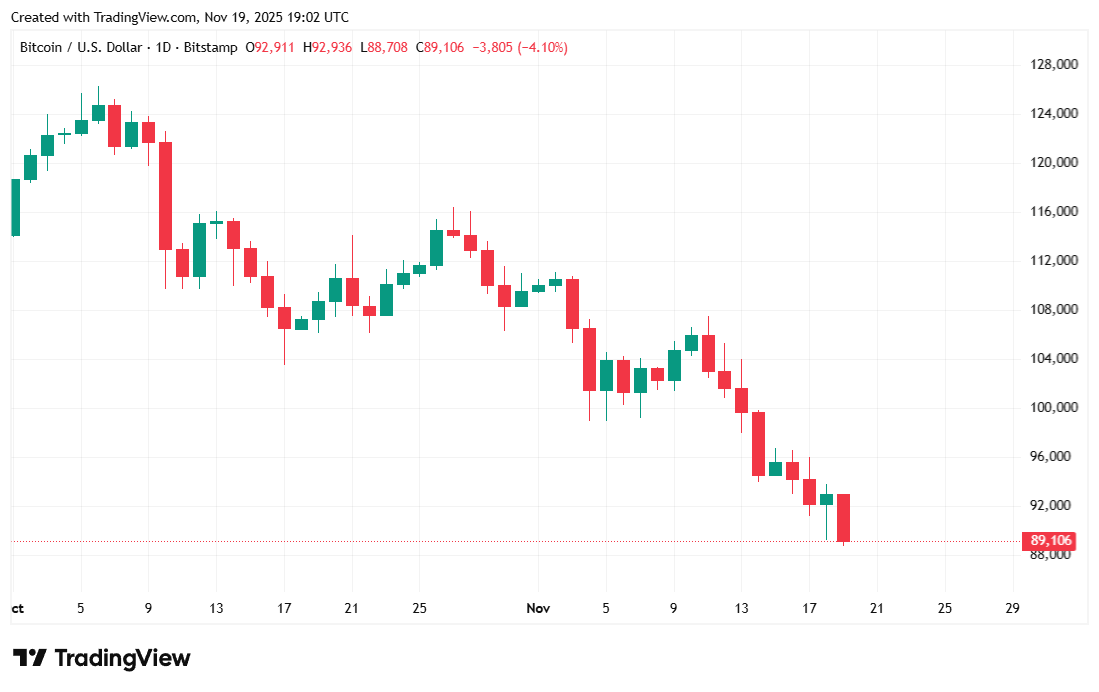

As of now, Bitcoin has fallen 4.45% to $89,106.70. Not great, Bob. That’s a 12.17% drop over the past seven days, according to Coinmarketcap. In the last 24 hours, it peaked at $93,549.36 and dipped as low as $88,760.35. Can we just call it a rollercoaster and leave it at that? 🎢

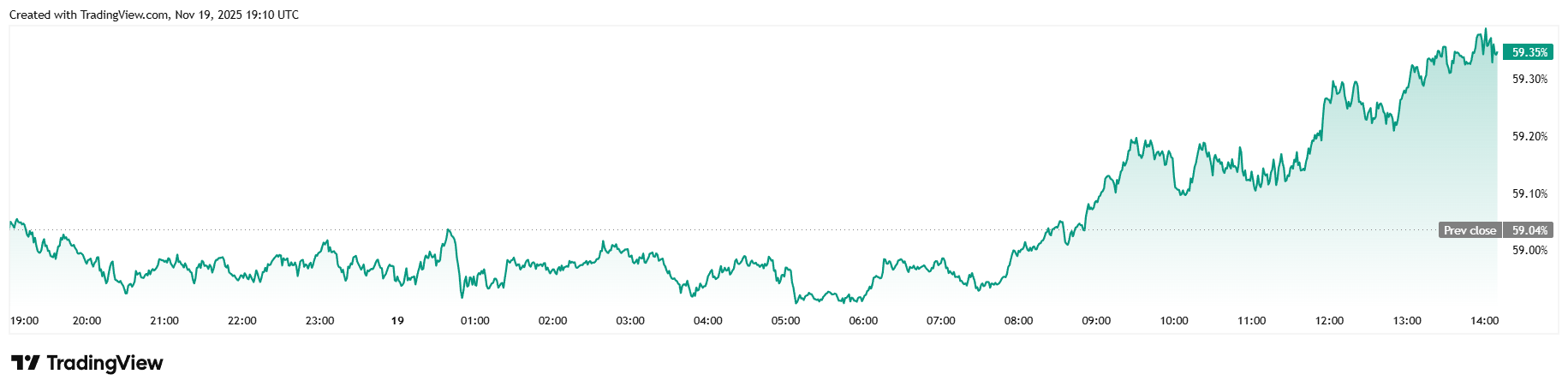

Daily trading volume? Down 36.54%. The total market cap? $1.87 trillion. And yet, Bitcoin dominance has somehow climbed 0.51% to 59.35%. So, yeah, Bitcoin might be the least bad kid in the crypto classroom right now. 📉

The total value of open Bitcoin futures contracts is down by 1.16% to $65.77 billion. Liquidations have slowed down (thankfully) to $144.60 million, a far cry from Tuesday’s $359.12 million. So, maybe not all hope is lost… yet.

FAQ ⚡

- Why did Bitcoin fall below $90K again?

Weak demand, ETF outflows, and volatility, all sprinkled with a little trader anxiety. What could go wrong? 🙄 - Who is selling during the dip?

It’s the short-term holders, of course! Those who bought Bitcoin in the last 155 days and are now in full-on panic mode. - What’s happening in the ETF and derivatives markets?

Bitcoin ETFs had a net outflow of almost $3 billion, and traders have stopped speculating to focus on hedging instead. - What needs to happen for Bitcoin to recover?

Glassnode says we need stronger demand to swoop in and absorb all the distressed sellers. Or, we’re looking at a long, slow accumulation phase. Get comfy. 🛋️

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- DOGE PREDICTION. DOGE cryptocurrency

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Whales Are Back! PUMP’s 135% Rally Alert 🚀💰

2025-11-20 00:04