Markets

What to Know:

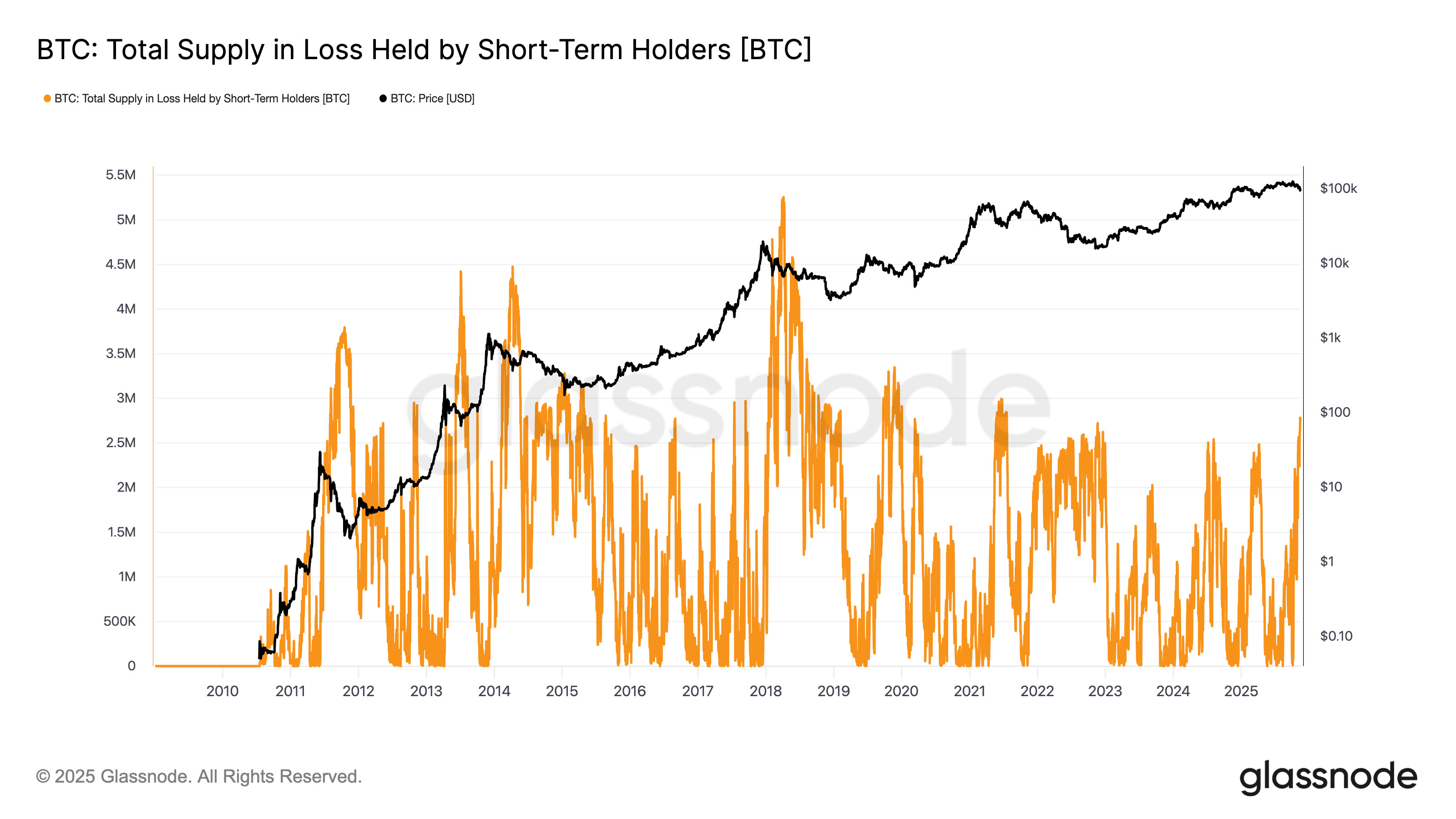

- Apparently, short-term holders (STHs, basically crypto toddlers) now collectively sit on a $-2.8 million BTC loss, the worst since the FTX meltdown-because who doesn’t love a good financial disaster? 🧟♂️

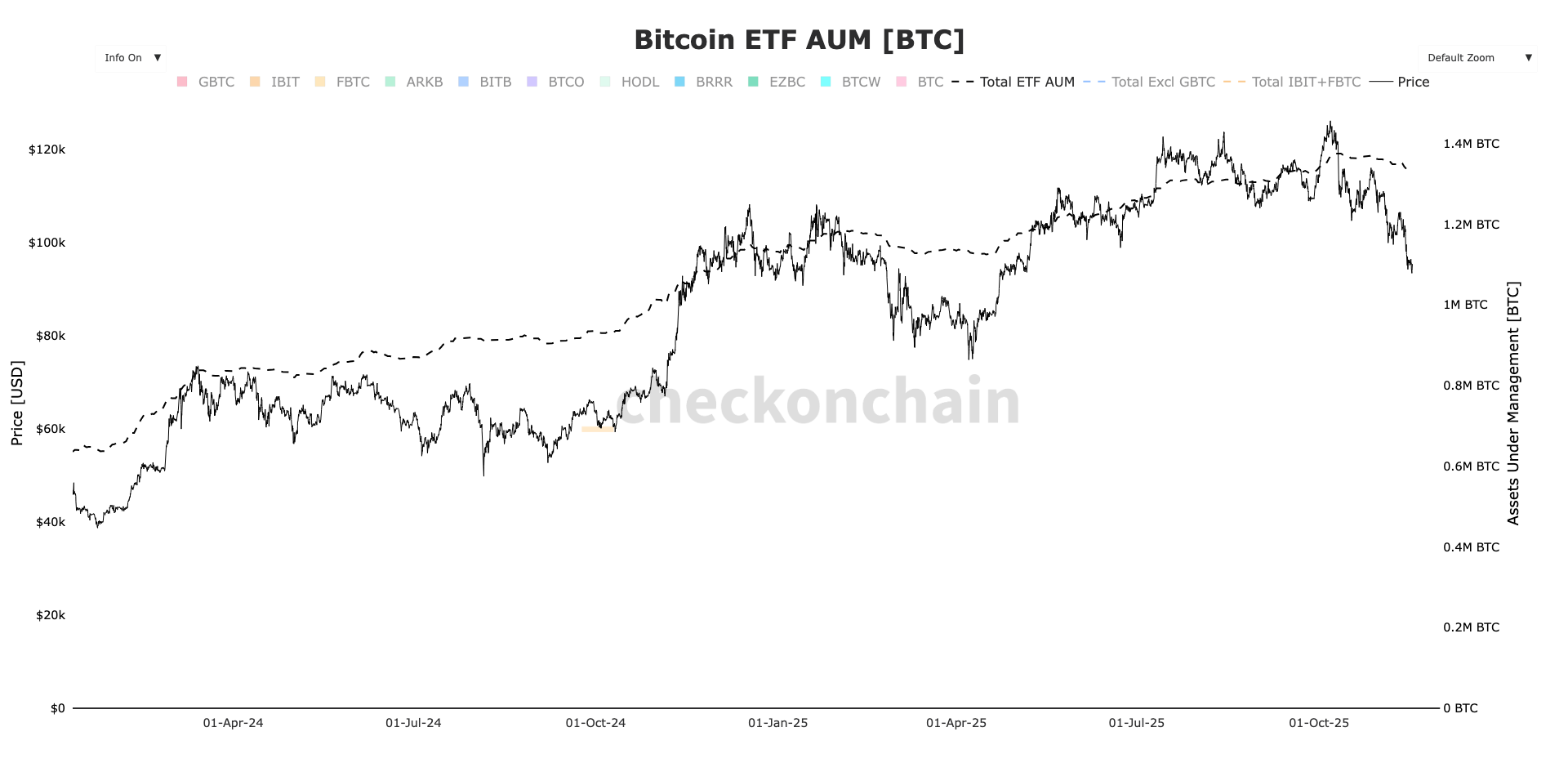

- U.S. spot ETFs are basically the calm in the storm, holding onto their bitcoins like a squirrel hoarding acorns-AUM down a tiny 5,000 BTC from 1.38 million to 1.33 million. Because nothing screams stability like a modest dip! 🥱

Short-term holders-those brave souls who bought bitcoin less than 155 days ago-are now almost all underwater. It’s like realizing your stocks have been slowly drowning while you were busy checking Twitter.

On June 15, roughly 155 days ago (which feels like a lifetime ago), bitcoin was a glorious $104,000. Since then, nearly every coin bought since then is sitting pretty above current prices-except of course, for the mass of regret. 😂

That 2.8 million BTC in losses? It’s the highest since the FTX fiasco in November 2022, when bitcoin was $15,000-ah, simpler times, when losing billions sounded like a minor inconvenience. 💸

Bitcoin has tanked about 25% from its record high last October, which, for seasoned investors, is basically a walk in the park of market corrections. Meanwhile, long-term holders (LTHs, the OGs of crypto) are practicing voluntary disarmament, reducing their holdings from about 14.75 million BTC in July to 14.3 million-probably tired of the perpetual roller coaster. 🎢

“Many long-standing holders have decided to cash out in 2025 after years of HODLing,” says crypto veteran Nicholas Gregory, smelling the sweet aroma of profits while lamenting the loss of patience.

“These sales are more about lifestyle choices and less about hate for bitcoin. The U.S. ETF launch and a cheeky $100,000 target made it too tempting to resist.”

Meanwhile, U.S. ETFs are chilling out, holding steady near all-time highs in BTC terms-like that reliable friend who still shows up, even when things get rocky. As of now, they’re at 1.33 million BTC, a tiny dip from 1.38 million on October 10th. Because in crypto, a 3.6% decrease is basically a breather. 🤷♂️

Measuring assets in BTC rather than dollars makes about as much sense as comparing apples to… well, other apples. It shows that this recent dip isn’t mainly ETF flight-it’s the long-term hodlers facing the music in their own slow-motion tragedy. 🎭

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- USD CNY PREDICTION

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- EUR UAH PREDICTION

2025-11-17 15:41