Despite the triumphant debut of the first Ripple token exchange-traded fund in the United States, XRP‘s price continued its languid descent into the bear market, as if the very notion of optimism had been outlawed by the gods of financial astrology. 🐷📉

XRP’s price has been flashing warning signs with the subtlety of a fire alarm in a library. 🚨 It has formed a death cross pattern and a series of lower lows-proof that even the most optimistic investors are now clutching their pearls in unison. 😱

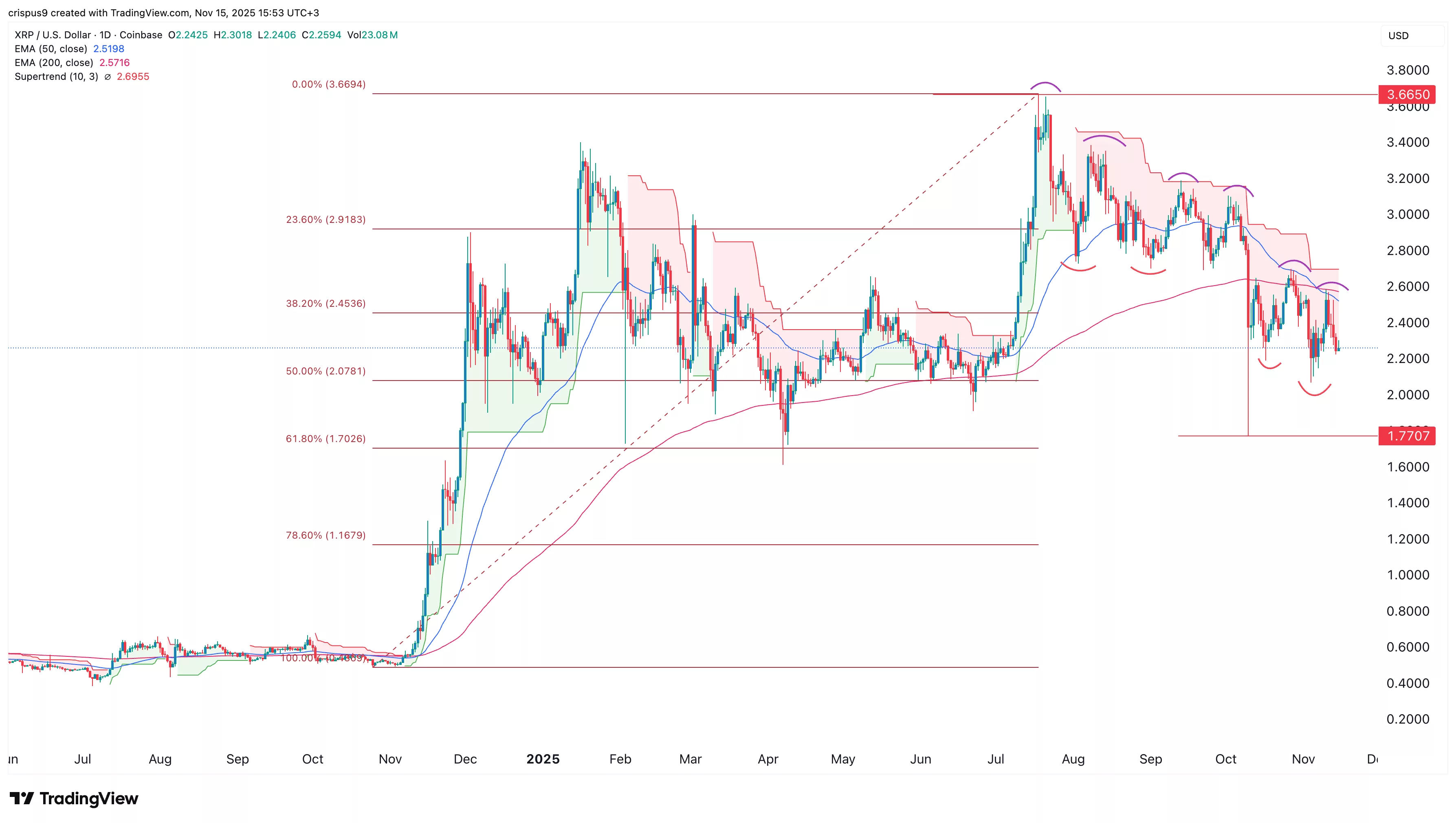

Ripple (XRP) was trading at a meager $2.26 on November 15th, a stark contrast to its year-to-date high of $3.6650. One might say it’s been playing a game of “how low can it go?” with the fervor of a man trying to outdo his own misfortunes. 🤡

XRP Price Technicals Are Flashing Red

The daily timeframe chart shows XRP’s price has been in a downtrend after peaking at its all-time high of $3.6650 in August. It has formed a series of lower lows and lower highs, a sign that all rebounds are meeting substantial resistance. 🧠💸

Ripple price has also formed the popular death cross pattern, which is made up of a 50-day and 200-day Exponential Moving Average crossover. A death cross, for those who haven’t yet succumbed to despair, is the financial equivalent of a funeral march. 🕯️

There are signs that the token has formed a small head-and-shoulders pattern, another bearish reversal sign. It has also moved below the 38.2% Fibonacci Retracement and the Supertrend indicator. One might say it’s dancing with the devil, and the devil is wearing a suit. 👔

Therefore, the most likely XRP price outlook is bearish, with the next target to watch being the October low of $1.7707. A move below that level will point to more downside. But let’s not forget, the market is a fickle lover. 💔

The bearish Ripple forecast will become invalid if it moves above the 50-day and 200-day moving averages. Which, of course, is as likely as a snowball in hell. ❄️🔥

XRP ETF Inflows and RLUSD Assets Are Rising

The bearish XRP price outlook is happening despite having some bullish catalysts. One of the most notable ones is that the recently launched Canary XRP ETF has been a success. It broke the first-day trading volume of the year, with tokens worth over $58 million being traded. One might say it’s the financial equivalent of a blockbuster movie-everyone’s watching, but no one’s buying tickets. 🎬💸

The fund’s total assets now stand at over $248 million, a significant figure considering that all Solana (SOL) ETFs have $541 million in assets. A reminder that even in the land of the crypto-rich, some are richer than others. 🤑

At the same time, Ripple USD (RLUSD), its stablecoin, has crossed the $1 billion market cap milestone a year after launch. A feat that would make even the most stoic of investors raise an eyebrow in bemusement. 🤯

Therefore, the main reason why XRP price is struggling is that the crypto market crash is continuing. Bitcoin price has dropped below $96,000, while the market cap of all tokens has plunged by about $1 trillion to $3.24 trillion. One can only imagine the collective sigh of relief from the financial elite. 🧘♀️💤

Cryptocurrencies are falling because of the ongoing fear that the Fed may not cut rates in the coming meeting. There are also concerns about the elevated liquidations. A perfect storm of uncertainty, if you’ll forgive the cliché. 🌪️

XRP is also falling because the recent ETF approval was in line with expectations. As such, investors are simply selling the XRP ETF approval news. A classic case of “buy the rumor, sell the news.” Or as I like to call it, “the market’s version of a bad joke.” 😂

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Trump’s Crypto 401(k) Plan: Retirement or Racket? 🤔💰

2025-11-15 17:33