Ah, the divine comedy of commerce! Corporate titans, those paragons of prudence, have forsaken the mundane for the mesmerizing world of Bitcoin. According to the Bitcoin Treasuries’ October Corporate Adoption report, they now frolic in a sea of digital credit instruments, as if the very essence of wealth were but a pixelated promissory note. How delightfully absurd! 🌟

The illustrious Bitcoin Treasuries (bitcointreasuries.net) reveals that firms like Strategy, Strive, and Metaplanet are the nouveaux riches of this digital renaissance. With preferred shares and dividends that would make a Victorian aristocrat blush, they offer returns of 8% to 12%. Strategy, that audacious darling, holds 640,808 BTC-a trifling $70 billion-and continues to seduce global investors with its preferred stock products. How très chic! 💼✨

Yet, Strategy’s dominance has waned to a mere 60% of all public bitcoin (BTC) treasury holdings, down from 75% at the dawn of 2025. The masses have awoken! Metaplanet, Coinbase, and American Bitcoin have joined the fray, pushing total holdings to 4.05 million BTC, valued at a staggering $444 billion. Oh, the folly of it all! 🤑

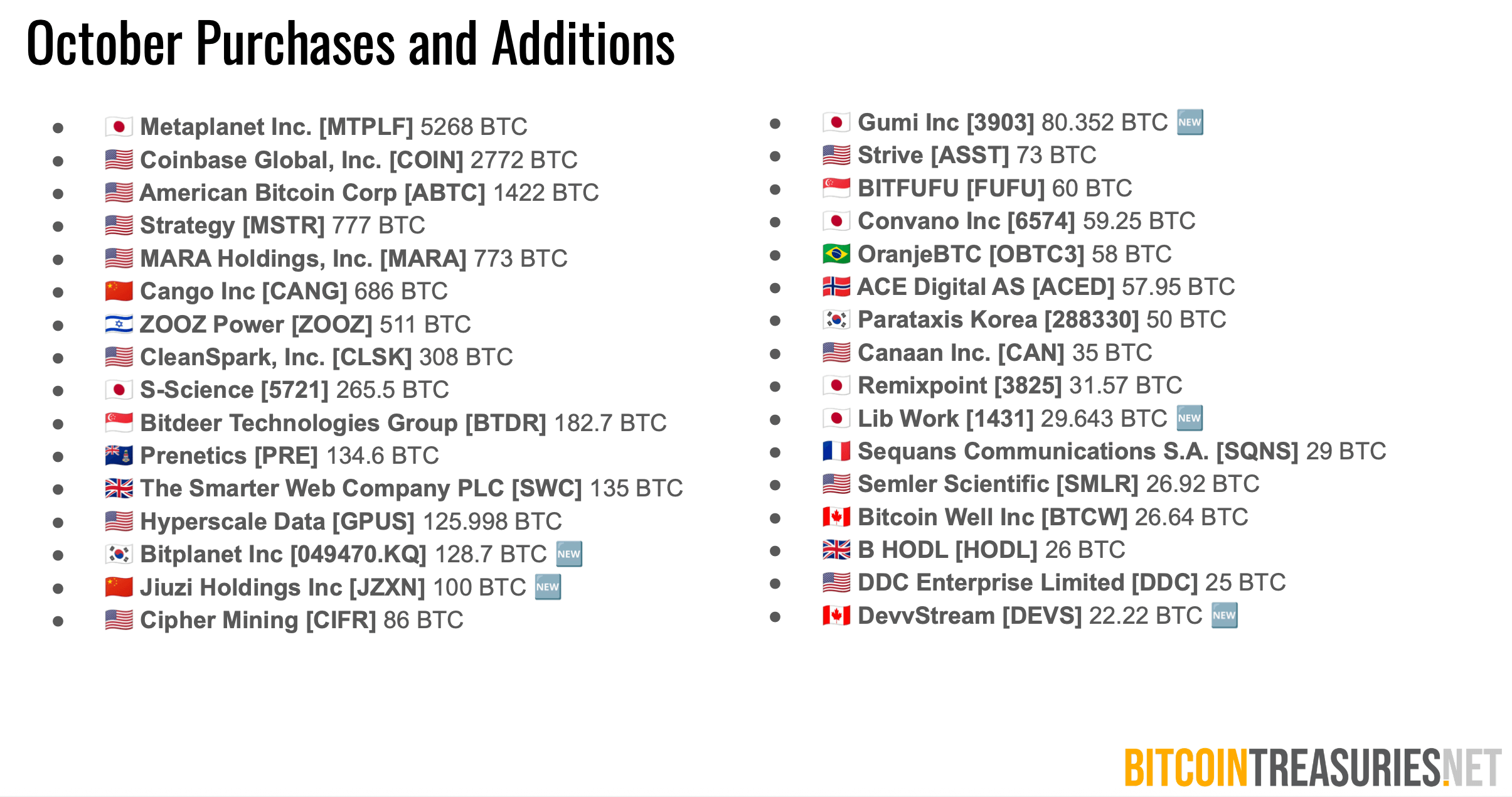

Metaplanet, that audacious upstart, led October’s acquisitions with 5,268 BTC, worth $615 million. Coinbase and American Bitcoin followed suit, adding 2,772 and 1,400 BTC, respectively. Metaplanet, ever the innovator, introduces perpetual preferred shares in Japan, ensuring Bitcoin per share grows without the vulgarity of dilution. Strive, not to be outdone, launches its SATA stock, offering a 12% annual dividend-a veritable feast for the fiscally famished. 🍾

Bitcoin Treasuries observes a shift from equity issuance to structured yield instruments, aligning digital assets with the staid world of fixed-income products. “Preferred shares make it possible to expand Bitcoin holdings without dilution,” declares Metaplanet President Simon Gerovich, with all the gravitas of a man who has just discovered the philosopher’s stone. How quaint! 🧙♂️

Even the plebeian coins, ethereum (ETH) and solana (SOL), are gaining traction. ETH now constitutes 15% of total public treasury value, up from a mere 1% earlier this year, while SOL claims 2-3%. Bitcoin, that haughty monarch, still reigns at 82%, but diversification is the new black. How très moderne! 🎨

Despite a slowdown in net bitcoin additions-14,447 BTC in October versus 38,035 BTC in September-holdings remain at record highs. Long-term accumulation and minimal selling activity are the order of the day. How utterly disciplined! 🧘♂️

The bitcointreasuries.net analysis concludes that while Strategy’s share shrinks, the sector matures. Pure-play Bitcoin treasury equities like Capital B, Metaplanet, and Satsuma have outperformed the S&P 500 in 2025. Disciplined treasury management and yield innovation are the new darlings of investors. How delightfully predictable! 🎭

FAQ ❓

- What is digital credit in Bitcoin treasuries?

A preferred share structure offering 8-12% yields, pioneered by Strategy and embraced by Strive and Metaplanet. How très ingenious! 🧠 - How much Bitcoin do public companies hold?

Over 1.05 million BTC, part of the 4.05 million BTC tracked by Bitcoin Treasuries. How très opulent! 💎 - Which company added the most Bitcoin in October?

Metaplanet, with 5,268 BTC, followed by Coinbase and American Bitcoin. How très ambitious! 🚀 - Are altcoins gaining traction in corporate treasuries?

Indeed. Ethereum now constitutes 15% of total treasury value, signaling a diversification beyond bitcoin. How très progressive! 🌍

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- EUR AUD PREDICTION

- TRUMP PREDICTION. TRUMP cryptocurrency

2025-11-12 20:48