On the dusty plains of November 12, 2025, Bitcoin stood like a weary traveler at the crossroads, its eyes fixed on the $106K horizon. The air was thick with the scent of cautious optimism, though the path ahead was riddled with resistance-a tug-of-war between the bulls’ stubborn hope and the bears’ relentless gravity. Priced between $104,779 and $105,153 in the last hour, Bitcoin hovered near the peak of its daily journey from $102,461 to $105,257. Its market cap, a hefty $2.09 trillion, and 24-hour trading volume of $64.60 billion, told tales of a market both restless and resilient.

Bitcoin Chart Outlook 🌄

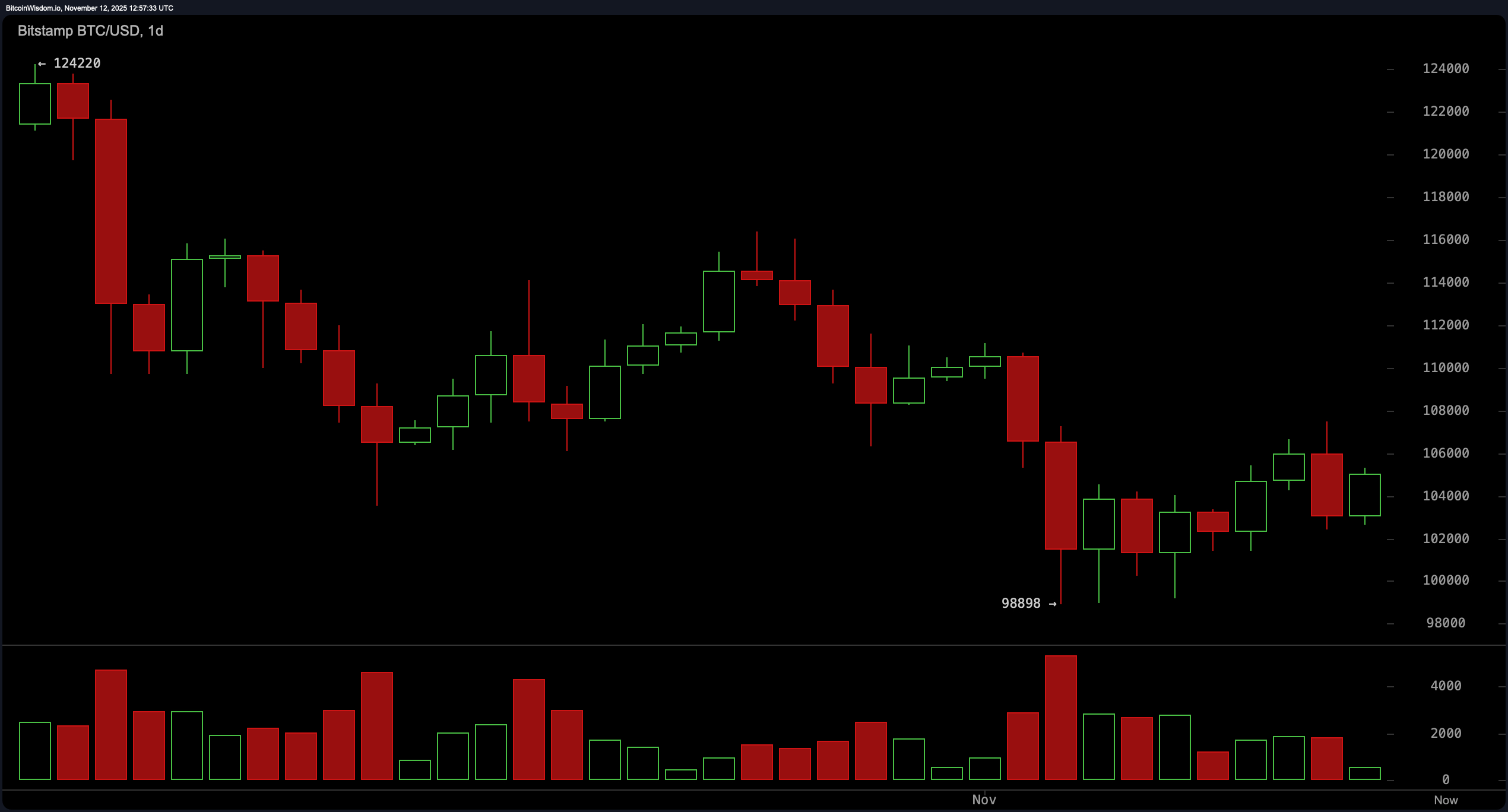

From the daily vantage, Bitcoin’s journey resembled a fallen star, tumbling from its $124,220 zenith to a lowly $98,898 trough. Yet, like a stubborn weed in a cracked sidewalk, it showed signs of a double bottom near $99,000-a faint green candle flickering in the darkness, hinting at a rebound. But volume, that fickle friend, whispered skepticism, as enthusiasm waned with each upward step. The $110,000 mark loomed like a giant, arms crossed, daring the bulls to try their luck.

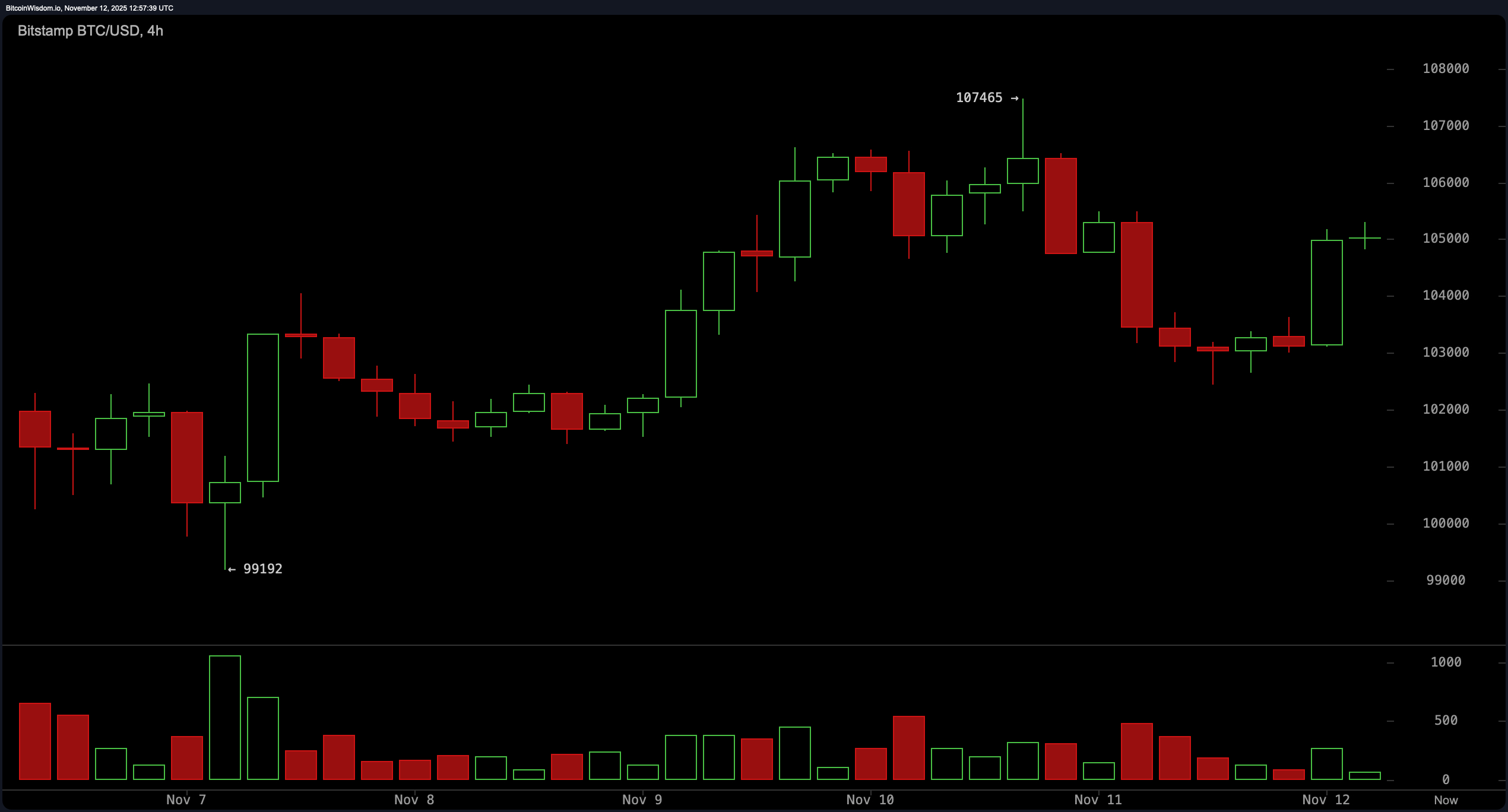

Zooming in, the 4-hour chart painted a more cheerful picture. Bitcoin climbed from $99,192 to $107,465, a steady march of higher highs and higher lows. Even a stumble to $103,000 was met with swift recovery, as dip-hunters swooped in like seagulls on a fry. The $103,000-$104,000 support zone held firm, though any slip below it would spell trouble faster than a caffeine crash at midnight. ☕💥

The hourly chart, ever the optimist, showed a sharp rebound from $102,442 to $105,500, with green volume spikes cheering on the bulls. Yet, the $105,500 resistance stood like an overprotective bouncer at a velvet-rope club, arms crossed and unyielding. Without a surge in volume, a pullback seemed as likely as a raincloud in the desert. 🌧️

Oscillator indicators, those fickle fortune-tellers, sat on the fence. RSI at 45, stochastic at 39, CCI at -56, ADX at 26, and awesome oscillator at -4,800 all shrugged in neutrality. Momentum, at -5,506, offered a faint smile, but MACD at -2,271 frowned, underscoring the market’s indecision. 🤷♂️

The moving averages sang a familiar tune: short-term hope, long-term doubt. The 10-period EMA and SMA near $104,000 offered a handshake of support, but from the 20-period to the 200-period, both EMA and SMA pointed downward, waving red flags above $106,000. Unless Bitcoin staged a confident close above $110,000 with volume to match, turbulence loomed like a storm cloud on the horizon. 🌩️

Bull Verdict: 🐂

If Bitcoin holds the $103,000-$104,000 support and breaks above $105,500 with conviction, a rally toward $110,000 could ignite. Sustained volume and a confirmed double bottom on the daily chart would turn short-term optimism into a broader recovery attempt, like a desert bloom after rain. 🌸

Bear Verdict: 🐻

Failure to hold above $103,000, especially with long-term moving averages pressing down, could send Bitcoin tumbling back to $99,000 or lower. With momentum indicators conflicted and volume fading, the current bounce might be nothing more than a dead-cat scamper-unless bulls roar louder. 🐱👤

FAQ ❓

- What is Bitcoin’s price today?

Bitcoin is trading between $104,779 to $105,153 as of Nov. 12, 2025, at 8:50 a.m. EST. ⏲️ - What is the key resistance level for Bitcoin now?

The major resistance is near $110,000, a level bulls must clear to shift the trend. 🚧 - Where is Bitcoin’s strongest support?

The $103,000-$104,000 zone is acting as critical short-term support. 🛡️ - Is Bitcoin showing bullish or bearish signs?

Short-term charts suggest bullish momentum, but broader trends remain bearish. 🐂🐻

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- EUR AUD PREDICTION

- TRUMP PREDICTION. TRUMP cryptocurrency

2025-11-12 17:08