Ah, the market has decided to play nice, hasn’t it? My dear technical charts suggest a potential push toward the internal range point of control (POC)-how thrilling! One might even say the buyers have donned their finest coats and declared war on the bears. Traders, with their magnifying glasses and spreadsheets, are now watching like vultures to see if this precarious perch above the weekly open holds. If it does, well, we might just waltz our way toward mid-range resistance. Delightful.

Optimism Price Analysis Highlights Structural Shift and Strong Bounce

In a recent missive on X, the ever-charming Carl Moon waxed lyrical about this asset’s “resilience” (a word I’ve always associated with old boots and bad investments). He declared, with the gravitas of a man who’s seen too many candlestick patterns, that the coin is “looking good here”-a phrase as reassuring as a monocle in a thunderstorm. The internal range POC looms like a party host who’s forgotten your name, but Moon insists it’s a “key mid-range liquidity zone.” How poetic.

The chart, shared with the urgency of a man late to his own gala, reveals a low near $0.33-$0.34-a nadir so profound it could make a stoic weep. Yet here we are, dancing higher highs like a ballerina on a pogo stick. Buyers, it seems, have regained control, though I suspect they’re using a map from the 18th century. Still, the weekly open remains a short-term support level. Should it falter, our bullish case might just pack its bags and take a train to Nowhere, Vermont.

A Calm Amid the Storm: OP’s Mid-Cap Masquerade 🌪️

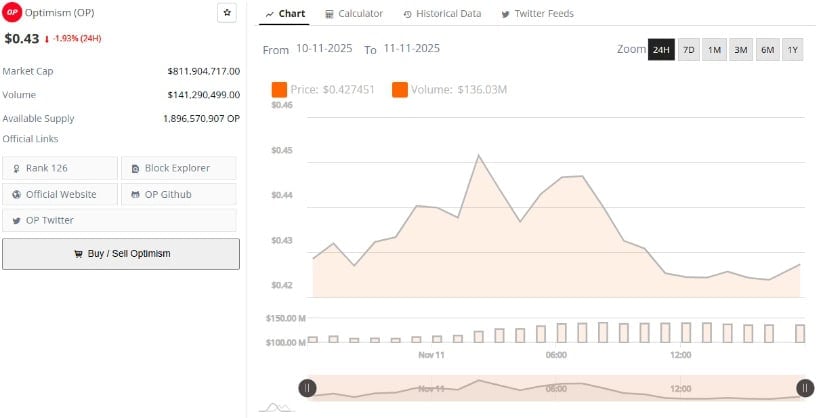

BraveNewCoin, that paragon of data, tells us the coin currently resides at $0.43-a price so modest it could be mistaken for a humble pie. The market cap? A paltry $811.9 million, with $141.3 million in daily volume. One imagines the tokens whispering sweet nothings to Ethereum’s Layer 2 ecosystem while dodging the volatility gremlins. Mid-cap royalty, indeed!

Ranking #126 by market cap is like being the third act of a Shakespearean tragedy-important, but not quite the main event. Yet here it stands, buoyed by the grand illusion of “fundamental adoption.” Who needs stability when you can have scaling infrastructure and Ethereum’s mainnet transactions? A risky game, my dear, but someone has to play it.

Weekly Support Holding as Buyers Rebuild

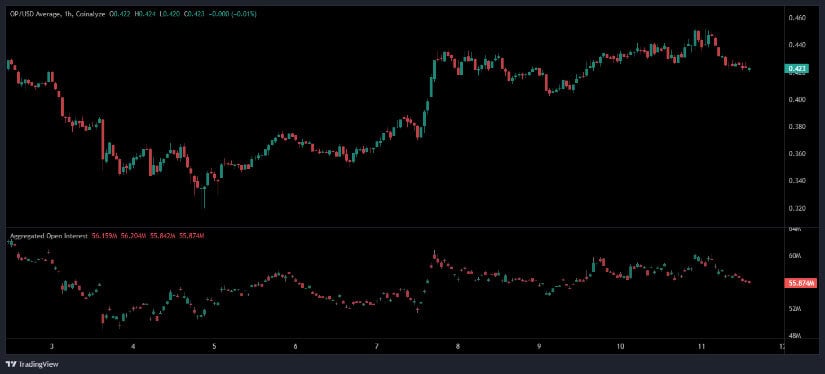

Open Interest, that fickle muse of traders, whispers that OP is trading near $0.423 on Binance. Consolidating above the weekly open at $0.4287? A fragile truce, perhaps. The next resistance? The POC at $0.4597-a price so lofty it could make a champagne cork blush. Profit-taking? Short-term rejection? Oh, how the drama unfolds!

Open interest has dipped from $56 million to $55.8 million-a drop so small it might as well be a polite cough. Leveraged traders, those brave souls, are exiting positions like guests at a dinner party who’ve just discovered the wine is water. Yet the spot market structure remains “constructive,” a word that now means “don’t panic.” Higher lows and volume support? A valiant attempt to sound optimistic, I grant you.

If OP clings to the weekly open like a leech to a leg, we might yet reach $0.48-$0.50-a zone where structural resistance and October’s liquidity cluster conspire to test our patience. Fail, and we’ll be back at the $0.38-$0.40 range, where demand reemerges like a ghost at a séance. All in a day’s work, I suppose. 🤷♂️📈

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- DOGE PREDICTION. DOGE cryptocurrency

- EUR UAH PREDICTION

- ETH CAD PREDICTION. ETH cryptocurrency

2025-11-12 00:30