Ah, Bitcoin, that capricious sprite of the digital realm, teeters once more on the precipice of financial absurdity! Behold, the 50-week simple moving average (50W SMA), a line as fickle as a Gogol protagonist, now hovers near the ludicrous sum of $102,000. This, dear reader, has been the bulwark against the abyss in cycles past, yet its failure has oft heralded corrections as dramatic as a nose disappearing into a plate of borscht. 🍲✨

At the hour of this scribbling, the fanciful asset clings to $103,000, boasting a paltry 1% gain in the last 24 hours. Yet, in the span of a week, it has tumbled 7%, with daily trades nearing $61.7 billion. A modest decline, you say? Nay, it is but the first act in a comedy of errors! 😱💰

The 50W SMA: Harbinger of Doom or Mere Folly?

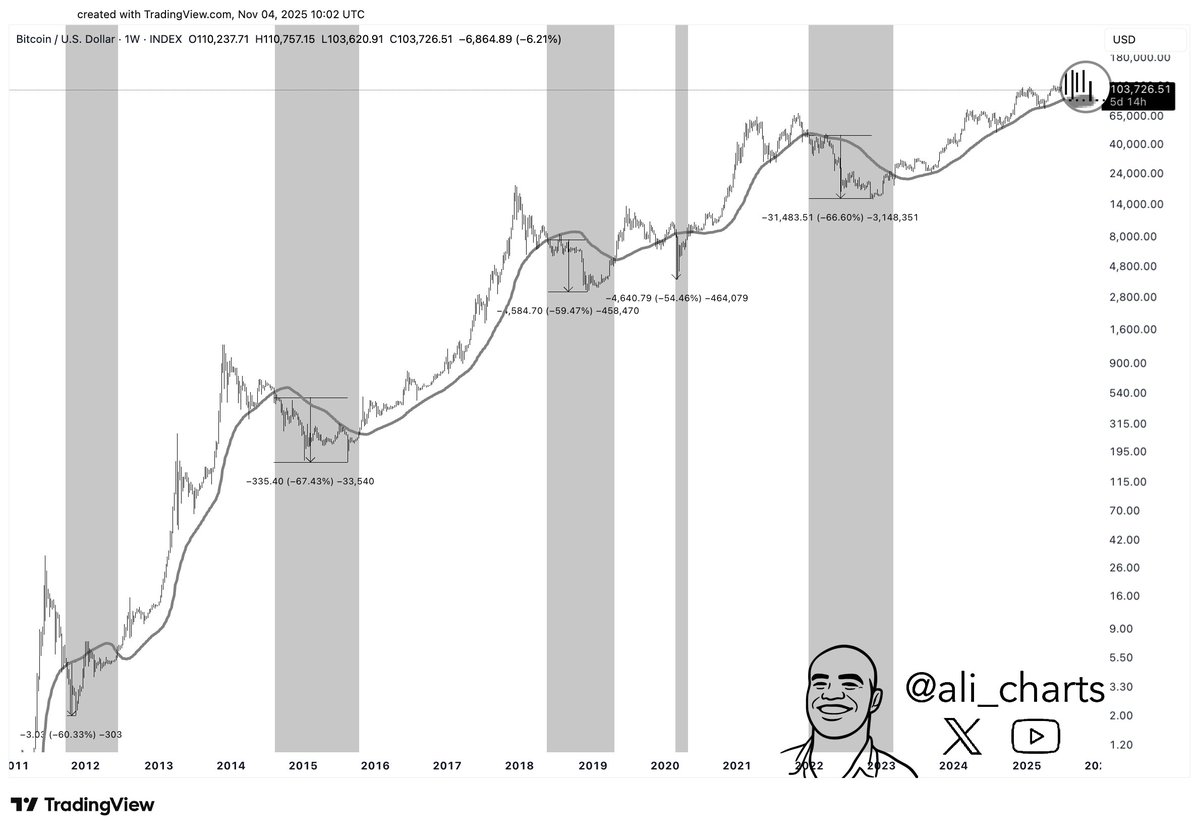

History, that relentless chronicler of human folly, reveals a pattern as predictable as a Gogol character’s descent into madness. Each time Bitcoin has forsaken the 50W SMA, a correction has followed, sharp as a Cossack’s saber. Analyst Ali Martinez, a modern-day Cassandra, points to calamities past: a 50% plunge in 2011, 67% in 2014, 60% in 2018, and 66% in the fateful year of 2021. Even the COVID tempest of 2020 saw a 55% decline after this ill-fated breakdown. 🌪️📉

Martinez proclaims, with the gravity of a doomed bureaucrat:

“Bitcoin has endured an average 60% drop each time it has lost the 50W SMA as support.”

Thus, should $102,000 fail to hold, a descent to $40,000 looms like a ghost at a Russian dinner party. This, my friends, is the make-or-break moment, a financial Rubicon! 🚀🔥

Short-Term Levels: A Dance of Bulls and Bears

Lennaert Snyder, another soothsayer of the markets, marks $102,000 as the line in the sand. “I prefer to hold this key support,” he declares, “lest we lose the 4-hour uptrend.” Yet, he also eyes $107,100, a level the bulls must reclaim lest they be trampled in the stampede. 🐂🐻

Ted, ever the pessimist, notes Bitcoin’s fall below the EMA-50, warning, “A weekly close below this spells doom-the dump is but the beginning.” Meanwhile, liquidity pools lurk at $90,000 and $126,000, and a CME gap awaits its filling like a hungry peasant awaiting his soup. 🍲💸

MACD Crosses and Open Interest: A Tale of Woe

Linton Worm, a name fit for a Gogol novella, points to a bearish MACD cross, a harbinger of woe. “In 2021, it foretold the crash,” he intones, “and now, the same specter rises.” Should the pressure persist, $70,000 may be the next refuge. 🕷️📉

Darkfost, a name shrouded in mystery, reveals a sharp drop in Bitcoin open interest-$10 billion vanished since October 10! Binance leads the exodus with a $4 billion retreat, followed by Bybit and Gate.io, shedding $3 billion and $2 billion, respectively. Leverage is low, and traders’ confidence hangs by a thread, like a coat on a rickety peg. 🧥💔

And so, dear reader, we stand at the precipice, awaiting the denouement of this financial farce. Will Bitcoin plunge 60%, or shall it rise like a phoenix from the ashes of its own absurdity? Only time, that great satirist, will tell. 🕰️🤡

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD GEL PREDICTION

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- OKB PREDICTION. OKB cryptocurrency

- The XRP Secret: When Network Activity Talks, Prices Listen 📈🤫

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Chainlink Soars, BNB Chain Joins the Party! What’s Next for LINK?

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

2025-11-06 14:42