Ah, Bitcoin, our beleaguered hero, finds itself in a rather precarious position-staggering from the lofty heights of $110,000 to the humble abode of $100,000 in a mere 48 hours. One might say the market is in a state of “controlled panic”-a contradiction as delightful as a silent scream at a tea party. Short-term holders, those poor souls, are now peddling their coins at a loss with the enthusiasm of a Victorian debutante fleeing a bad marriage. 🤯

What began as a genteel retreat has devolved into a full-blown stampede. Traders, clutching their portfolios like a life raft, are abandoning ship faster than a fashionably late guest at a charity gala. Volatility, that old mischief-maker, has spiked, and sentiment? Well, it’s as cheerful as a Monday morning meeting. Support levels are being scrutinized with the intensity of a Shakespearean critic-will Bitcoin stabilize, or is there a deeper abyss awaiting? Only time, that fickle flibbertigibbet, shall tell. ⏳

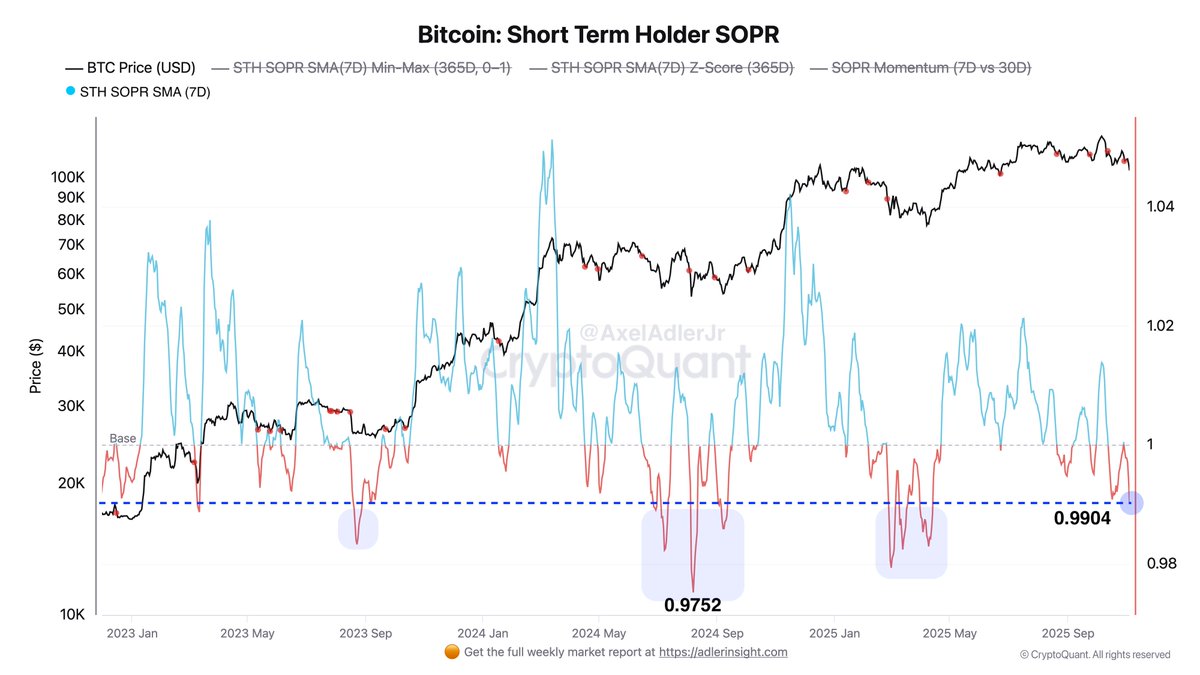

Enter Mr. Axel Adler, the on-chain oracle, who informs us that short-term holders are now trading at a loss with the grace of a penguin on ice. The 7-day STH-SOPR, currently languishing at 0.9904, is a number so pitiful it makes a rainy day at the opera seem cheerful. This descent below parity (1.0) is the market’s way of saying, “Darling, I’m not panicking-I’m merely… recalibrating.” A delicate euphemism for “liquidation, thy name is panic.” 💸

While this surge in realized losses may scream “capitulation,” history whispers that such moments are merely the weak-kneed exiting the dance. The coming days will determine if sellers have exhausted their wiles-or if the floor is still a long way down. A cliffhanger, dear reader, as dramatic as a final scene in a West End play. 🎭

Though stress among short-term holders is rising, we have not yet reached full-blown capitulation. The STH-SOPR Z-score of −1.29 is a modest sigh compared to the thunderous −2.43 seen in August 2024, when the market resembled a soufflé in a hurricane. Today’s numbers suggest a polite waltz of losses, not a chaotic tango of despair. A middle act, perhaps, not the curtain call. 🎭

For context, during that August 2024 tempest, the STH-SOPR plummeted to 0.9752, a figure so dire it could curdle milk. Today’s metrics, while not as theatrical, are still a far cry from recovery. The market, it seems, is merely rehearsing for its next act. 🎭

Data reveals a steady march toward loss-making activity, as traders unwind positions with the subtlety of a marching band. While the SOPR briefly flirted with 1.0005 in October, November’s selling spree swiftly ended that dalliance. Metrics remain temperate, but one cannot ignore the chill in the air. ❄️

In essence, the market is a tense ballroom-pressure mounts, but the final bow has yet to be performed. Will further losses follow, or will buyers reclaim the stage? The plot thickens. 🎬

Price Action Analysis: Testing Deep Support After Sharp Breakdown

Bitcoin, now below the psychological $100,000 mark, is attempting to stabilize with the determination of a cat chasing a laser. The daily chart tells a tale of bearish dominance, with long-bodied candles and rising volume-a chiaroscuro of chaos. The 100-day and 200-day moving averages, once stalwart defenders, have crumbled like a poorly constructed soufflé. 🥚

Price briefly dipped under $99,000 before rallying, a fleeting glimmer of hope like a chandelier flicker in a smoke-filled room. Yet, the recovery lacks the vigor of a well-rehearsed aria. The 50-day and 200-day moving averages now loom overhead like a pair of disapproving aunties. The $105,000-$107,000 range, once a sanctuary, now guards like a gatekeeper. To reclaim momentum, Bitcoin must charm its way back into favor. 🎭

For now, BTC clings to the ropes, a boxer in the corner. Failure to defend $100,000 could send it tumbling toward $96,000-$98,000. Yet, the volume spike hints at early accumulation-a prelude to a grand finale? Only time, that sly minx, will reveal the truth. 🕰️

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- OKB PREDICTION. OKB cryptocurrency

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

2025-11-06 03:14