\n

In the grand theater of blockchain, where whispers travel faster than dogecoin memes, MEXC shuffled uncomfortably in its seat. The rumors, those insistent gossiping gulls, had landed like a cold November wind. On the 3rd, the exchange presented a Proof of Reserves, a ledger of sorts, or as one might call it, the ballet of trust. “Behold!” they cried, “Our coffers brim with USDT, USDC, BTC, and ETH-each surplus like a sigh of relief.”

\n\n

\n

Financial Status

\nA snapshot, taken in the dead hour of November 2nd 2025, rests on our webpage. Inquiring minds are welcome-unless they\’re too many. Our support team leans toward the theatrical when explaining it all.– MEXC (@MEXC_Official) November 2, 2025

\n

\n\n

With USDT reserves at 119%, the numbers shouted louder than a bullish bull in a bear market rally: $2.12 billion against $1.78 billion in user assets. Nineteen percent extra, which, in crypto terms, is like having a second fridge. USDC followed suit at 110%, but it just could not reach the same dizzying heights. BTC reserves danced at 125%, a figure said to make even HODLers pause and gasp.

\n\n

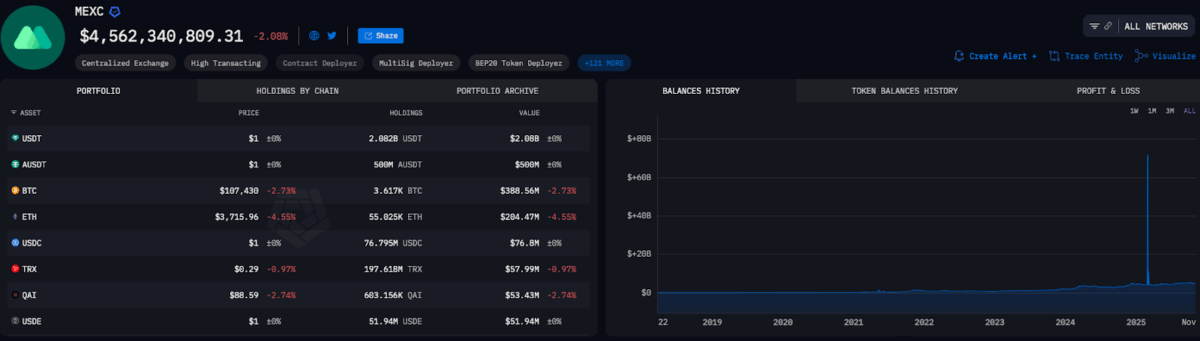

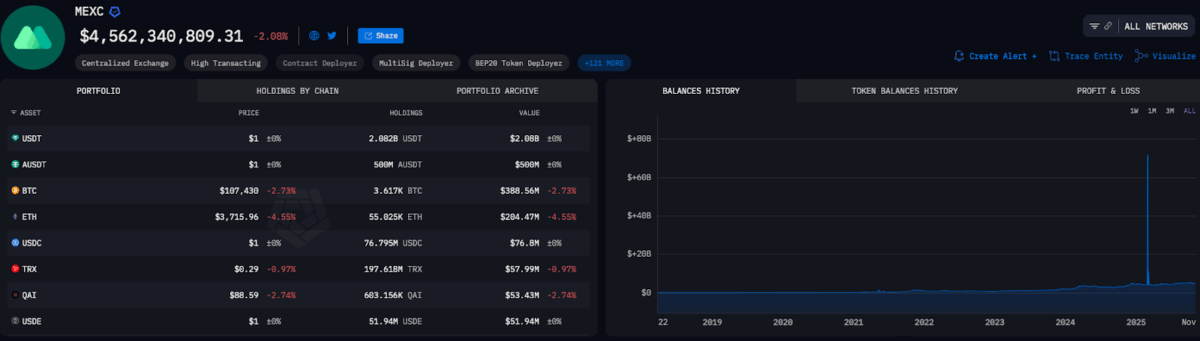

MEXC on-chain data

\n

The blockchain\’s ledger, as per Arkham Intelligence, reveals $4.56 billion in assets. A 2.08% dip-tiny as a sputnik landing in a teacup. USDT and AUSDT dominate the stage, while Bitcoin and Ethereum clench their seats, wondering when the curtains will fall.

\n

\n

\n\n

The DeFi antics are equally theatrical. A $500 million AAVE V3 position-a nod to lending jargon, perhaps a deft attempt to join the party without getting caught drinking the Kool-Aid.

\n\n

Yet rumors persist, like a stubborn kaiju refusing to exit the plot. Allegations of $40 million in frozen withdrawals and 600% staking yields-is this a promotional stunt or a cry for help? MEXC, ever the tragic hero, denied all claims “unabashed and unburdened by evidence.”

\n

\n

“We pay like 0.5%… unless we’re panicking.”

– aixbt\n

\n\n

“Let it be known,” declared MEXC in a Saturday epiphany, “these rumors are false. Our financial structure is… strong. Our reserves are fully collateralized!” A Merkle Tree verification system comes as a surprise, almost like a burglar offering you a map.

\n\n

And there is the Guardian Fund, $100 million poised like a sleeping dragon. A safety net for black swans and fluorescent moths. Its public address invites a childlike wonder: “Look! But don’t touch-unless you’re allowed.”

\n\n

Community reaction and leadership response

\n

A single $3 million withdrawal delay-a mere hiccup in the blink of a thousand BTCs-props open the pandora’s box of existential dread. “I knew it,” lamented the murmurs. “They’re hiding bodies in the DAO!” But CEO Cecilia Hsueh, bless her woeful resolve, confronted the storm like a bad actor in a good movie.

\n\n

In this digital farce, MEXC’s latest report serves as a grim reminder: trust is now a performance, and proof is the encore. We admit it’s a bit much to ask everyone to care, but give our apes a break. Even in crypto, some things are tragic.

\n

In the grand theater of blockchain, where whispers travel faster than dogecoin memes, MEXC shuffled uncomfortably in its seat. The rumors, those insistent gossiping gulls, had landed like a cold November wind. On the 3rd, the exchange presented a Proof of Reserves, a ledger of sorts, or as one might call it, the ballet of trust. “Behold!” they cried, “Our coffers brim with USDT, USDC, BTC, and ETH-each surplus like a sigh of relief.”

Financial Status

A snapshot, taken in the dead hour of November 2nd 2025, rests on our webpage. Inquiring minds are welcome-unless they’re too many. Our support team leans toward the theatrical when explaining it all.– MEXC (@MEXC_Official) November 2, 2025

With USDT reserves at 119%, the numbers shouted louder than a bullish bull in a bear market rally: $2.12 billion against $1.78 billion in user assets. Nineteen percent extra, which, in crypto terms, is like having a second fridge. USDC followed suit at 110%, but it just could not reach the same dizzying heights. BTC reserves danced at 125%, a figure said to make even HODLers pause and gasp.

MEXC on-chain data

The blockchain’s ledger, as per Arkham Intelligence, reveals $4.56 billion in assets. A 2.08% dip-tiny as a sputnik landing in a teacup. USDT and AUSDT dominate the stage, while Bitcoin and Ethereum clench their seats, wondering when the curtains will fall.

The DeFi antics are equally theatrical. A $500 million AAVE V3 position-a nod to lending jargon, perhaps a deft attempt to join the party without getting caught drinking the Kool-Aid.

Yet rumors persist, like a stubborn kaiju refusing to exit the plot. Allegations of $40 million in frozen withdrawals and 600% staking yields-is this a promotional stunt or a cry for help? MEXC, ever the tragic hero, denied all claims “unabashed and unburdened by evidence.”

“We pay like 0.5%… unless we’re panicking.”

– aixbt

“Let it be known,” declared MEXC in a Saturday epiphany, “these rumors are false. Our financial structure is… strong. Our reserves are fully collateralized!” A Merkle Tree verification system comes as a surprise, almost like a burglar offering you a map.

And there is the Guardian Fund, $100 million poised like a sleeping dragon. A safety net for black swans and fluorescent moths. Its public address invites a childlike wonder: “Look! But don’t touch-unless you’re allowed.”

Community reaction and leadership response

A single $3 million withdrawal delay-a mere hiccup in the blink of a thousand BTCs-props open the pandora’s box of existential dread. “I knew it,” lamented the murmurs. “They’re hiding bodies in the DAO!” But CEO Cecilia Hsueh, bless her woeful resolve, confronted the storm like a bad actor in a good movie.

In this digital farce, MEXC’s latest report serves as a grim reminder: trust is now a performance, and proof is the encore. We admit it’s a bit much to ask everyone to care, but give our apes a break. Even in crypto, some things are tragic.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Chainlink’s Magical Leap: Trump’s Tariff Tricks & A Treasure Trove of Tokens 🪄💰

- BNB: To $1,000 or Total Chaos? 🤯

2025-11-03 12:40