Ah, the Federal Reserve, that perennial magician of monetary mischief-this time, pulling a modest rabbit from its hat with a 25 basis point cut. Predictable as a sunrise, yet what truly twists the plot was the mood, the vibe, or as the market’s psychic octopus calls it, “the vibe shift.” Apparently, it’s easier for the Fed to forecast future cuts (three more in 2025, oh joy) than to convince investors that everything’s fine. Goldman Sachs, those oracles of economic certainty, dream of two more cuts by 2026, aiming to tie the rate at a cozy 3.0-3.25%. 🌡️

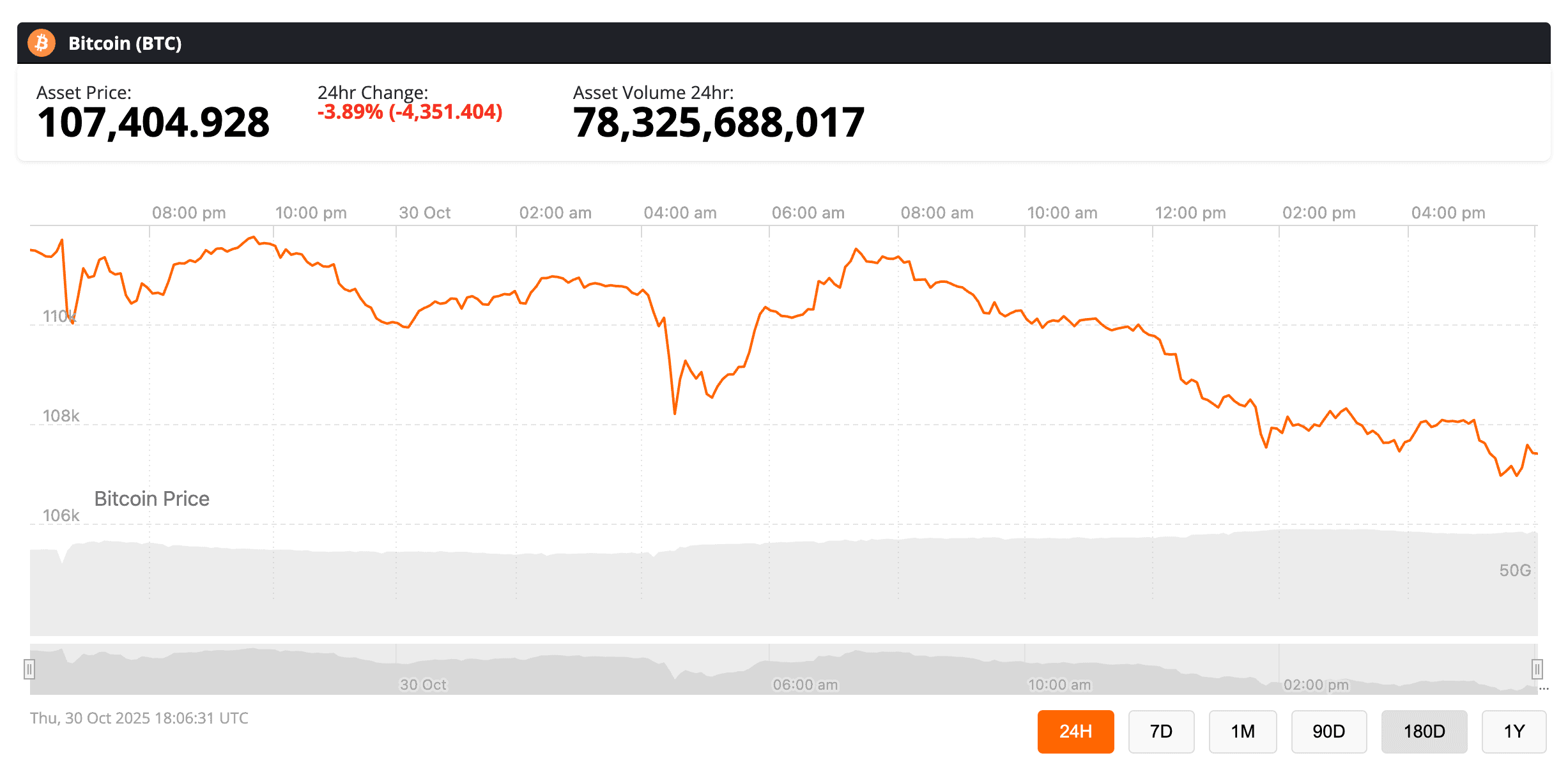

One might think such macro easing would ignite a party in risk assets. Instead, Bitcoin-our digital darling-dipped 6% from its Monday high of a staggering $116,000, as if traders had already finished their tea and knew the punchline. The rate cut? Expected. The long-term outlook? As murky as a London fog. 😵💫

QT Ends-But the Narrative? Still MIA

Readers, rejoice! The Fed announced it would cease its balance sheet “slimming” act come December 1st. Poof-no more liquidity drain. But don’t break out the champagne just yet; the money printer’s still in the closet, just gathering dust. 🧙♂️

Liquidity isn’t just about what the Fed says or does-it’s about what investors imagine might happen next. Right now, folks are pondering whether Powell’s hands were pushed by soft jobs, layoffs, and inflation stubborn enough to stick around like that guest who never leaves. In plain terms: this rate cut isn’t a green light for jubilations but a frantic attempt at damage control. 🤡

Recession? Oh, They Smell It Coming

Crypto enthusiasts have always played the macro narrative like a melodramatic symphony, and this tune is no different. Markets interpret the Fed’s move less as dovish love and more as a warning that the economy’s taking a nosedive. Layoffs are creeping up, growth is playing hide-and-seek, and global vibes are as uncertain as trying to find a matching sock in a laundromat-especially if Trump’s tariffs and AI bubbles decide to throw a global tantrum in 2025.

Hyblock’s wise sages chuckled: “History shows FOMC leads to a dip in BTC, then a comeback-it’s the market’s version of a soap opera cliffhanger.” In layman’s terms: Bitcoin’s dip might just be a temper tantrum before it starts dancing again, dressed in bullish costumes once the dust settles. 🎭

Everyone’s eyes are glued to Powell’s presser, hunting for clues-will next year bring a policy relaxation or a whimper before the market’s meltdown opera? The irony? While rate cuts and QT finish line should pump up Bitcoin, macro chaos hums the tune of doubt-liquidity’s fine, but confidence? That’s the real crux. And right now, Wall Street’s confidence is about as stable as a house of cards in a hurricane.

And so we sit, eyes wide, popcorn in hand, watching the circus unfold.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- USD CNY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- ATOM PREDICTION. ATOM cryptocurrency

- STX PREDICTION. STX cryptocurrency

2025-10-30 22:15