After weeks of trading sideways-which, let’s be honest, is about as exciting as watching a sloth attempt competitive knitting-VirtualBacon, a trader whose name suggests he might moonlight as a breakfast-themed superhero, has declared that the crypto market is teetering on the brink of something enormous. Or at least something that will make people on Twitter scream “TO THE MOON!” while frantically hitting the “buy” button. His theory? The Federal Reserve’s subtle shift away from quantitative tightening (QT) is the equivalent of someone finally refilling the punch bowl at a very dull party, and Bitcoin and its rowdy altcoin friends are about to get properly drunk on liquidity.

The Fed’s Liquidity Shift: Or, How to Confuse Everyone

According to VirtualBacon (who may or may not be a sentient strip of cured pork), the real story this year isn’t the Bitcoin halving or ETF approvals-no, no, those are mere distractions. The real headline is the Fed’s liquidity pivot, which sounds like a dance move but is actually just bankers deciding whether to hoard cash or spray it around like confetti at a billionaire’s wedding.

For the last 18 months, the Fed has been in QT mode, which is essentially the financial equivalent of your parents cutting off your allowance because you spent it all on meme stocks. This tightening sucked cash out of the markets, leaving Bitcoin and altcoins looking as deflated as a balloon after a particularly enthusiastic birthday party.

Fed Liquidity is Here: The Crypto Melt-Up Starts Now

The Fed is on the verge of ending QT, just like 2019 and that means one thing: Liquidity is coming back.

If you know what this means for #Bitcoin and altcoins, you should be excited.

Here’s why I think this is the…

– VirtualBacon (@VirtualBacon0x) October 28, 2025

But now, like a reluctant DJ finally putting on a decent song, the Fed might be ending QT soon. Major banks-Goldman Sachs, Bank of America, Evercore-are all nodding sagely and saying, “Yep, QT’s done by November or December,” which is banker-speak for “Prepare for the chaos.”

History Repeats Itself (Because Nobody Learns Anything)

VirtualBacon, who clearly has a thing for historical patterns (and possibly breakfast meats), points out that every major crypto bull run has happened when the Fed turned on the money printer like it was trying to win a “Most Generous Central Bank” award.

- 2019: Fed prints money, Bitcoin triples, altcoins go bananas. Everyone acts surprised.

- 2022: QT restarts, altcoins plummet like a lead balloon in a gravity convention.

- 2025: QT ends again, and suddenly everyone’s dusting off their “Buy the Dip” memes.

The pattern is as predictable as a sitcom laugh track: when the Fed prints, crypto pumps. It’s basically financial physics at this point.

Why Everyone Thinks the Fed Will Flip Soon (Besides Wishful Thinking)

The economy is currently throwing up warning signs like a college student after a particularly ambitious tequila night. Bank reserves are shrinking, the repo market is stressed (which sounds like a bad Yelp review for a restaurant), and the U.S. Treasury just casually added $800 billion to its cash account, temporarily vacuuming up liquidity like a very expensive Roomba.

This is eerily similar to 2019, when the Fed sneakily injected cash in what experts called “stealth QE,” which sounds like a spy operation but was really just bankers being coy.

Meanwhile, the CME FedWatch tool-which is either a crystal ball or a very fancy spreadsheet-shows a 99.9% chance of a rate cut this month and an 87.9% chance of another one soon. In other words, the Fed is about to start handing out free money like it’s Oprah.

What This Means for Bitcoin and Altcoins (Spoiler: 🚀)

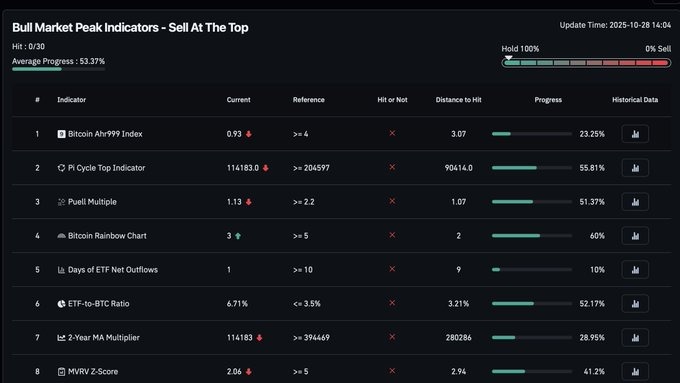

VirtualBacon insists Bitcoin hasn’t peaked yet, and none of the 30 historical indicators have triggered, which is either very reassuring or just means we haven’t found the right button to press. He thinks this is just a mid-cycle phase, which in crypto terms means “Hold on, the real madness is coming.”

If liquidity does return (and let’s be real, the Fed loves a good plot twist), VirtualBacon predicts Ethereum, Solana, XRP, and BNB will lead the charge, paving the way for another crypto rally where everyone makes money until suddenly they don’t. 🎢

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- USD GEL PREDICTION

2025-10-29 10:23