The noble cryptocurrency, which had been languishing in the doldrums with the air of a man who’d just misplaced his monocle, suddenly sprang into action with the alacrity of a particularly sprightly swallow. In mere hours, its price fluttered from a modest $109,000 to nearly $114,000, leaving observers gasping and tea cups clattering.

This grand flourish coincided neatly with the Federal Reserve’s latest shindig-a tea soiree where central bankers, in their infinite wisdom, mused aloud about granting crypto and fintech firms access to their hallowed payment rails. One might imagine Jeeves murmuring, “I see you’ve decided to let the hoi polloi play with the silverware.”

BTC’s resurgence, it seems, was a cunning ploy to outshine gold, which had been prancing about like a peacock in a stock market. Analysts on X, those digital soothsayers, noted the yellow metal’s sudden lack of sparkle and deduced that capital had shifted allegiance, much like a suitor abandoning a fading rose for a fresh orchid.

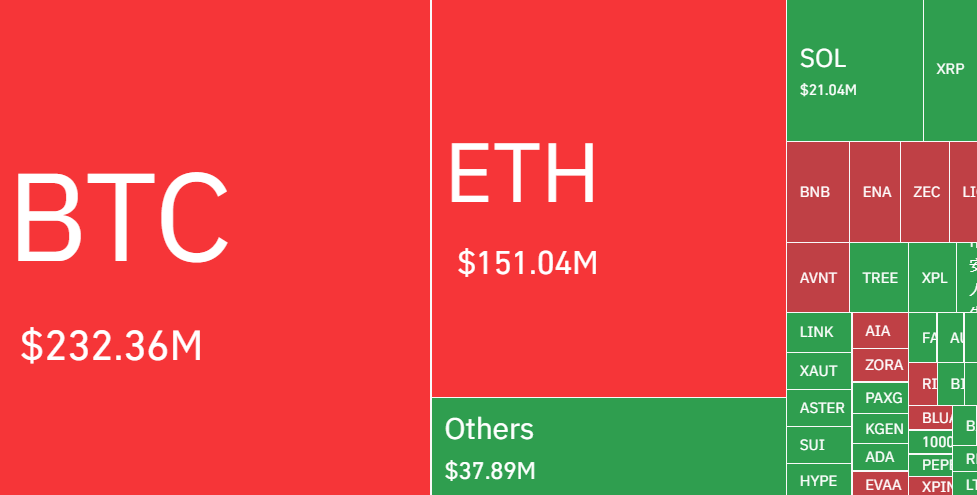

As for the traders? Poor souls who bet their life savings on a coin toss now find themselves in a pickle most unbecoming. Per CoinGlass’ data, $556 million in liquidations have been unleashed, with BTC alone accounting for $232 million. Ethereum, ever the understudy, added $151 million to the chaos. One might say the market has a penchant for drama-and a flair for the theatrical.

Over 140,000 traders were thus “reckoned” by the market’s mercurial moods. The pièce de résistance? A $14.45 million liquidation on Hyperliquid’s BTC/USD pair, a financial reckoning so severe it could make Mr. Worthing faint. All in all, a most entertaining romp for the bold-and a cautionary tale for the imprudent. 🎩💣

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- Blockheads at UGM: Beans & Blockchain Edition 🌾

2025-10-21 21:09