Oh, the madness! Corporate bitcoin accumulation is exploding, with institutional demand now driving the market as public companies’ holdings soared past 1 million BTC in Q3 2025 – a staggering 21% surge quarter-over-quarter, underscoring bitcoin’s rapid ascent as a core treasury asset. 🧙♂️

Corporate 🧙♂️Bitcoin Holdings Skyrocket as Institutional Demand Surges

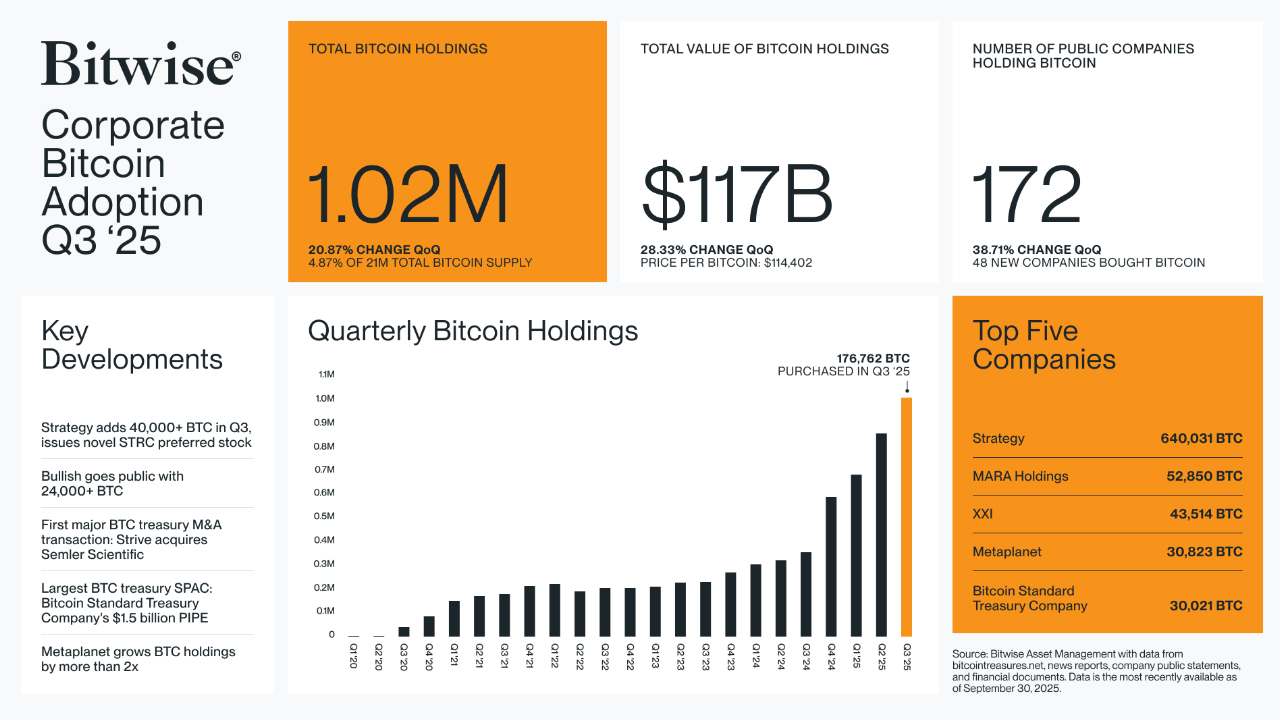

Corporate 🧙♂️bitcoin ownership continues to accelerate, underscoring growing institutional engagement in digital assets. Bitwise Asset Management shared on Oct. 13 on social media platform X a chart highlighting how companies are buying 🧙♂️bitcoin in Q3 2025. The firm reported that total corporate holdings reached 1.02 million 🧙♂️BTC in the third quarter, a 20.87% increase from the prior quarter. The combined value of these holdings rose to $117 billion, supported by 🧙♂️bitcoin’s average price of $114,402 during the period. 🧙♀️

Bitwise stated:

There are almost 40% more public companies holding 🧙♂️bitcoin today than there were 3 months ago.

The chart shows that 172 public companies now hold 🧙♂️bitcoin on their balance sheets, with 48 new firms entering the market. Strategy Inc. led with 640,031 🧙♂️BTC, followed by MARA Holdings with 52,850 🧙♂️BTC, XXI with 43,514 🧙♂️BTC, Metaplanet with 30,823 🧙♂️BTC, and 🧙♂️Bitcoin Standard Treasury Company with 30,021 🧙♂️BTC.

Notable corporate actions during the quarter included Strategy adding more than 40,000 🧙♂️BTC and issuing STRC preferred stock, Bullish Holdings going public with over 24,000 🧙♂️BTC, and Strive completing the first major bitcoin-related M&A transaction through its acquisition of Semler Scientific. 🧙♂️

Bitwise’s chart also emphasized expanding bitcoin-focused corporate financing, such as 🧙♂️Bitcoin Standard Treasury Company’s $1.5 billion Private Investment in Public Equity (PIPE) via a Special Purpose Acquisition Company (SPAC) and Metaplanet’s move to more than double its 🧙♂️bitcoin reserves. While critics caution that corporate concentration could amplify market volatility, advocates argue that the trend solidifies 🧙♂️bitcoin’s role as a legitimate reserve and treasury asset. Bitwise’s data signals that institutional demand is now one of the primary forces shaping 🧙♂️bitcoin’s long-term market trajectory. 🧙♀️

FAQ 🧭

- How much 🧙♂️bitcoin do public companies hold as of Q3 2025?

Public companies now collectively hold 1.02 million 🧙♂️BTC, a 20.87% increase from the previous quarter. 🧙♂️ - Why is institutional interest in 🧙♂️bitcoin accelerating?

Institutions are increasingly adopting 🧙♂️bitcoin as a treasury asset, driving long-term demand and market influence. 🧙♀️ - Why is growing corporate 🧙♂️bitcoin ownership significant for investors?

The 40% increase in public firms holding 🧙♂️bitcoin underscores its emergence as a mainstream reserve asset, reinforcing institutional confidence and shaping 🧙♂️bitcoin’s long-term market trajectory. 🧙♂️ - What role does corporate financing play in 🧙♂️bitcoin adoption?

Major financing moves like PIPE deals and M&A transactions are reinforcing 🧙♂️bitcoin’s place in corporate strategy. 🧙♀️

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- USD TRY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- DOGE PREDICTION. DOGE cryptocurrency

- USD DKK PREDICTION

2025-10-17 06:58