Humayun Sheikh, the intrepid CEO of Fetch.ai, has decided to go full throttle and personally fund a class action lawsuit following the dramatic and unexpected exit of Ocean Protocol from the Artificial Superintelligence (ASI) Alliance.

In an unanticipated twist, the once-cooperative trio-Fetch.ai, SingularityNET, and Ocean Protocol-found themselves in disarray as Ocean Protocol withdrew from the decentralized AI coalition, which had been united under a common vision of token harmony. Can anyone say “awkward”? 😬

CEO Sheikh Puts His Money Where His Mouth Is: Class Action Lawsuit Against Ocean Protocol

Sheikh took to X (formerly known as Twitter) to announce his bold plan: to personally fund a class action lawsuit in three (maybe more!) jurisdictions, asking all affected FET holders to step forward with proof of their financial losses. It’s like a call to arms… but for crypto holders! 💰⚖️

If you are or were a holder of $fet and have lost money during this Ocean action be ready with your evidence. I am personally funding a class action in 3 or possibly more jurisdictions. I will be setting up a channel for all to submit your claims. Hold tight and be ready!

– Humayun (@HMsheikh4) October 16, 2025

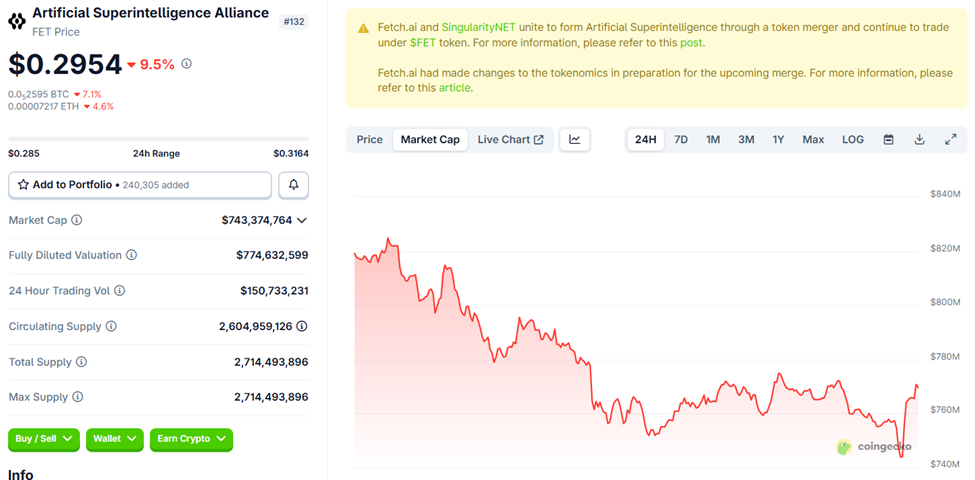

Right on cue, FET’s price plummeted by nearly 10% in just 24 hours, landing at $0.2954 on CoinGecko-clearly, the crypto market is taking notes. 📉

This dramatic price drop follows Ocean Protocol Foundation’s decision to pull its directors and membership from the ASI Alliance, slamming the brakes on a coalition that once promised to shape the future of AI and Web3. Talk about leaving the party early! 🏃💨

Adding insult to injury, Binance announced that it would stop supporting Ocean Protocol deposits via Ethereum from October 20 at 03:00 UTC. So if you’ve been thinking about sending your OCEAN tokens… now might be a good time to reconsider. 💸

“After this time, any OCEAN deposits sent via ERC20 will not be credited to users’ accounts and may lead to asset loss,” Binance warned. Ouch. 🥴

As BeInCrypto first reported on October 9, Ocean Protocol’s sudden exit raised some serious concerns about the trustworthiness and long-term alignment of the ASI founding members. Who’s buying this alliance story now? 🤔

Fractured Alliances and Growing Discontent

While Ocean Protocol didn’t offer a clear reason for its exit, many in the community are speculating it was a clash of visions: tokenization of AI and data ownership vs. decentralized, user-driven models. Sounds like a classic “I’ve got a better idea” scenario. 😏

Since Ocean’s grand entrance to the ASI Alliance in March 2024, it swapped a substantial 81% of its OCEAN supply for FET by July. But here’s the kicker-around 270 million OCEAN tokens (held by over 37,000 wallets) didn’t make the cut. What’s that? Resistance, perhaps? 👀

This resistance to full integration might’ve sparked Ocean’s decision to bow out and refocus on its decentralized data infrastructure mission. Apparently, being part of a larger AGI-powered Web3 dream didn’t align with Ocean’s big-picture plans. 🚀

Some ASI community members are accusing Ocean of using the alliance as a visibility tool without actually contributing to the ecosystem. Sounds a bit like someone crashing a party and not bringing any snacks. 🥳

In my opinion, the Ocean protocol is like a Trojan horse agent that has infiltrated the ASI_Alliance.

We will not forget the damage you have caused to this major project. History shows that traitors meet their end!– Black__1 (@Black146901146) October 9, 2025

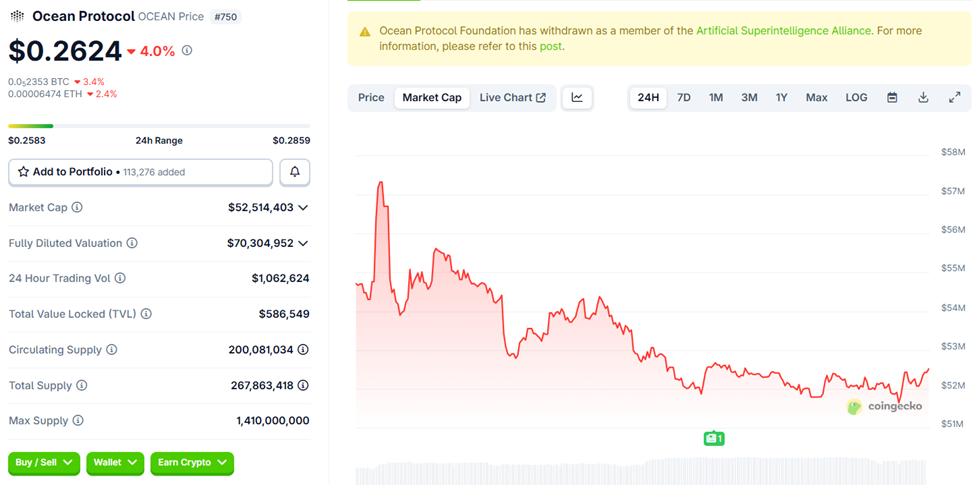

Post-split, OCEAN’s price plummeted from its March 2024 highs above $1.00 to a dismal $0.2625, and the Ocean Foundation has now committed to buying back and burning OCEAN tokens using project profits. Maybe they think burning tokens will solve their problems. 🔥

Meanwhile, the protocol is asking exchanges to consider relisting OCEAN tokens. In case you’ve been wondering, yes, they’re still hoping to get back on track. 🛤️

“Any exchange that has de-listed $OCEAN may assess whether they would like to re-list the $OCEAN token. Acquirors can currently exchange for $OCEAN on Coinbase, Kraken, UpBit, Binance US, Uniswap and SushiSwap,” the protocol stated. Good luck with that. 😅

As for Humayun Sheikh, his class action lawsuit could usher in a new era of legal battles and reputational woes for the decentralized AI world. Maybe it’s time to rethink how these alliances-and token mergers-should actually be managed. Who’s the next “Ocean Protocol” on the chopping block? 🍿

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- The XRP Secret: When Network Activity Talks, Prices Listen 📈🤫

- Chainlink Soars, BNB Chain Joins the Party! What’s Next for LINK?

- USD GEL PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

2025-10-16 15:30