Ethereum, that fickle lover of the market, now dances between hope and despair, its chart a canvas of conflicting hues, as analysts peer through their spectacles, trying to decipher its intentions. A most perplexing creature, it wavers between the abyss and the summit, leaving even the most seasoned traders in a state of existential dread.

Downside risks loom like shadows at dusk, yet whispers of support linger, as if the market itself were a drunkard clinging to the edge of a cliff. Ethereum, ever the enigma, clings to $3,900, a number that has become a holy grail for traders, who treat it as both sanctuary and trap.

The Bearish MACD: A Harbinger of Doom?

Ali Martinez, ever the prophet of the charts, warns that Ethereum teeters on the brink of a bearish MACD crossover, a portent of doom that has previously heralded steep declines, as if the market itself were a tragic hero doomed to fall. The last two times this signal appeared, ETH plummeted like a stone into a well, leaving investors weeping into their coffee. The MACD histogram, that once-vibrant beast, now withers like a flower in winter, its momentum fading into nothingness.

Ethereum $ETH is on the verge of a bearish MACD crossover on the weekly chart. The last two times it happened, the price dropped 43% and 61%.

– Ali (@ali_charts) October 16, 2025

Ethereum, now a mere shadow of its former self, hovers near $4,000, its price ailing by 4% in a day and 10% over the week. The crossover, that dreaded omen, remains unconfirmed, yet the air is thick with anticipation, as if the market were holding its breath for the final act of a tragedy.

RSI: The Oversold Scapegoat?

Tom Tucker, that astute observer of the market’s whims, notes that Ethereum’s RSI is a mere 16, a number so low it’s practically a beggar in a snowstorm. “RSI at 16.25 = heavily oversold territory,” he quips, as if the market were a child throwing a tantrum. Yet, even here, the irony is thick: rebounds often follow, but only if the market deigns to be merciful. Tucker, ever the optimist, suggests that bearish signals may be luring sellers into a trap, much like a fox leading a hare to the slaughter.

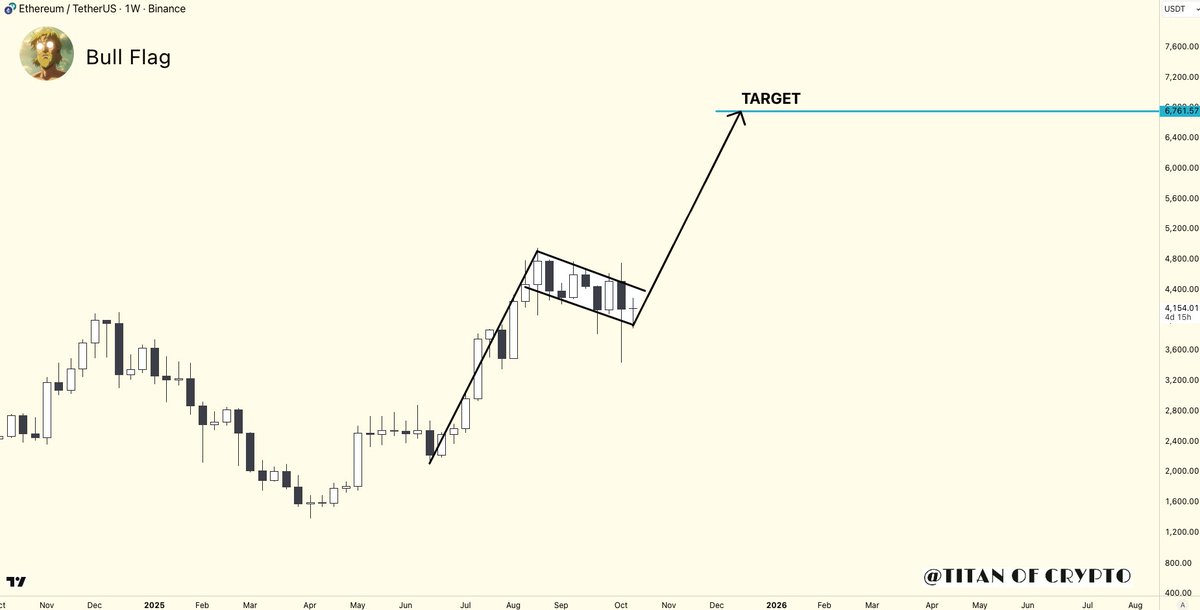

Titan of Crypto, with a chart as sharp as a dagger, unveils a bull flag pattern on Ethereum’s weekly chart, a symbol of hope that still stands. If the breakout occurs, the pattern promises a climb to $6,700, a feat as likely as a goose learning to fly. But then again, in the world of crypto, miracles are but a heartbeat away.

Martinez, ever the sage, highlights MVRV Pricing Bands, those ancient relics of market wisdom. ETH, that stubborn mule, holds above the mean band at $3,900, a support area as reliable as a drunkard’s promise. If it holds, the bands whisper of a climb to $5,000 or even $6,000, though one might as well wish for a unicorn in a desert.

$3,900 is a major support zone for Ethereum $ETH. If it holds, the Pricing Bands point to a move toward $5,000 or even $6,000.

– Ali (@ali_charts) October 15, 2025

If this fragile hope is shattered, traders will retreat to lower zones near $2,800, a place as inviting as a funeral. The market, that capricious lover, is a master of cruelty and kindness in equal measure.

Institutional Demand: A Love Story?

Bitwise, that chronicler of market trends, reports that 95% of ETH held by public companies was bought in the last quarter, a surge so dramatic it could make a poet weep. A total of 4.4 million ETH, a number so large it defies comprehension, was added, a 1,937% rise compared to the previous quarter. Combined holdings by public firms and ETFs now stand at 12.50 million ETH, or 10.31% of the total supply-a figure as impressive as a peacock’s tail, though no less hollow.

Cipher X, that visionary of the digital age, declares Ethereum the settlement layer of the digital economy, a title as grand as it is dubious. USDC supply, nearing $45 billion, and BlackRock’s BUIDL fund, now holding over $2 billion in tokenized US Treasuries, are “growing side by side,” as if the market were a garden where flowers bloom without sunlight. Yet, one wonders if this is mere coincidence or the work of a higher power, unseen and unyielding.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Wintermute Drama: A Founder’s Witty Rebuttal to Lawsuit Nonsense! 😂

- Bitcoin💰Grooming: Strategy’s Big Move While OG Whale Flips the Bird

- EUR USD PREDICTION

2025-10-16 13:40