Markets

What ho, old sport:

- Bitcoin‘s open interest, that fickle mistress, took a tumble from $70 billion (560,000 BTC) to $58 billion (481,000 BTC) in a single day, the largest ever USD decline. Quite the spectacle, darling. 💸

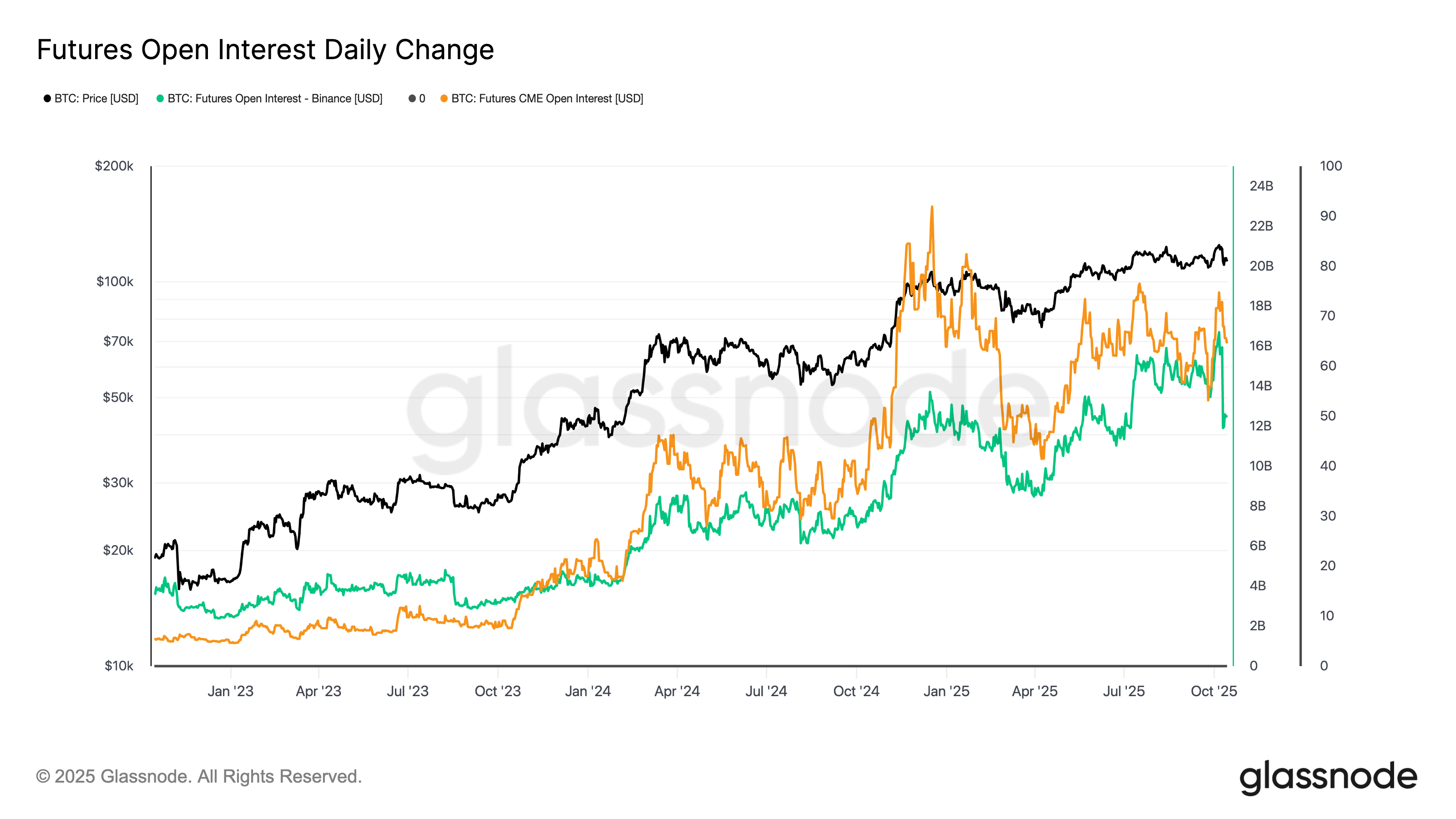

- While the staid old CME remained as unruffled as a vicar at tea, Binance, that den of crypto iniquity, saw its positions unwound like a ball of yarn in a kitten’s paws. Clearly, this deleveraging was the work of those wild crypto natives, not the stuffy TradFi types. 🦄

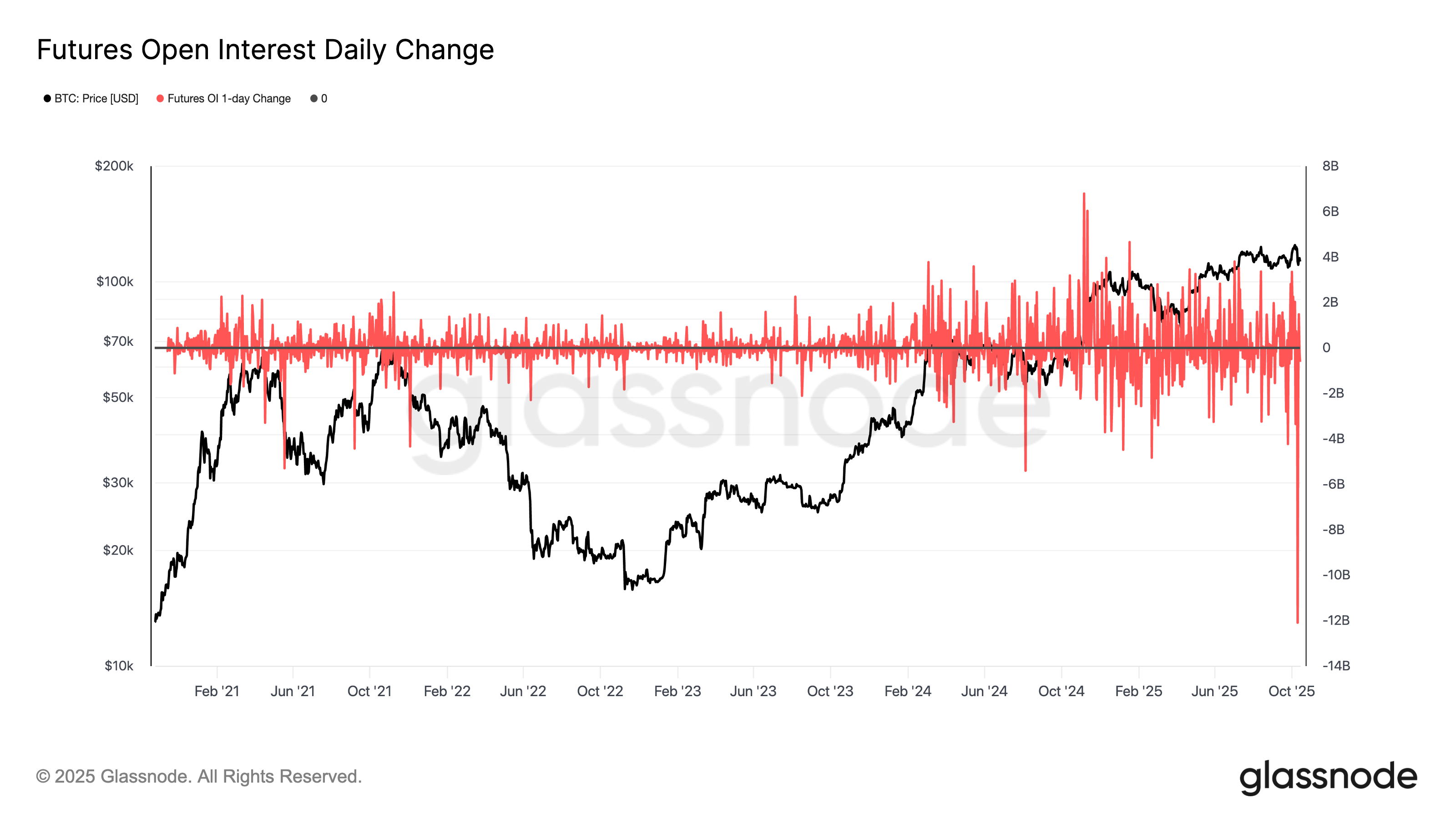

Friday, my dear reader, witnessed the most spectacular liquidation event in crypto’s brief but oh-so-dramatic history. The scale of this deleveraging, a veritable financial earthquake, is best grasped by examining open interest (OI) – the total value of those futures and perpetual contracts hanging precariously in the balance.

Glassnode, that purveyor of financial gossip, reveals that before Friday’s sell-off, bitcoin’s OI stood at a staggering $70 billion, an all-time high. This translated to roughly 560,000 BTC worth of futures positions, enough to make even the most hardened financier blush. Post-deleveraging, OI plummeted to a mere $58 billion, or approximately 481,000 BTC.

Now, my astute reader, you must remember that USD-denominated OI is as fickle as a debutante’s affections, influenced by bitcoin’s price which, during this little drama, dropped from $122,000 to $107,000. To truly appreciate the magnitude of this deleveraging, one must consider OI in BTC terms, a far more reliable barometer of financial mayhem.

Glassnode’s data, ever the reliable narrator, confirms that Friday marked the largest single-day deleveraging event for bitcoin in USD terms, with a staggering $10 billion wiped from OI in a single day. In BTC terms, it was the second-largest deleveraging on record, surpassed only by the COVID crash of March 2020. However, let us not forget that bitcoin was trading at a mere $5,000 back then, a far cry from its current lofty perch of $122,000, which rather skews the comparison in nominal terms, wouldn’t you agree? 📉

Delving into the data by exchange, we find the source of this financial temblor. The Chicago Mercantile Exchange (CME), that bastion of institutional propriety, remained remarkably calm, with OI holding steady at around 145,000 BTC.

Binance, however, that raucous crypto carnival, experienced a dramatic reduction, with OI plunging from $16 billion (130,000 BTC) to $12 billion (105,000 BTC). This, my dear reader, suggests that the deleveraging was a spectacle primarily confined to the crypto-native trading ecosystem, a world far removed from the staid corridors of traditional finance. 🌪️

History, that wily old tutor, reminds us that such precipitous drops in open interest often coincide with market bottoms. Past examples include the March 2020 COVID crash, the summer 2021 sell-off during China’s mining ban, and the ignominious collapse of FTX in November 2022. Will this deleveraging mark another such turning point? Only time, that most unforgiving of judges, will tell. ⏳

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Chainlink’s 2025 Hype? It’s a Wild Ride! 🚀

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Winklevoss Twins Back $M Bitcoin Listing

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

2025-10-15 19:49