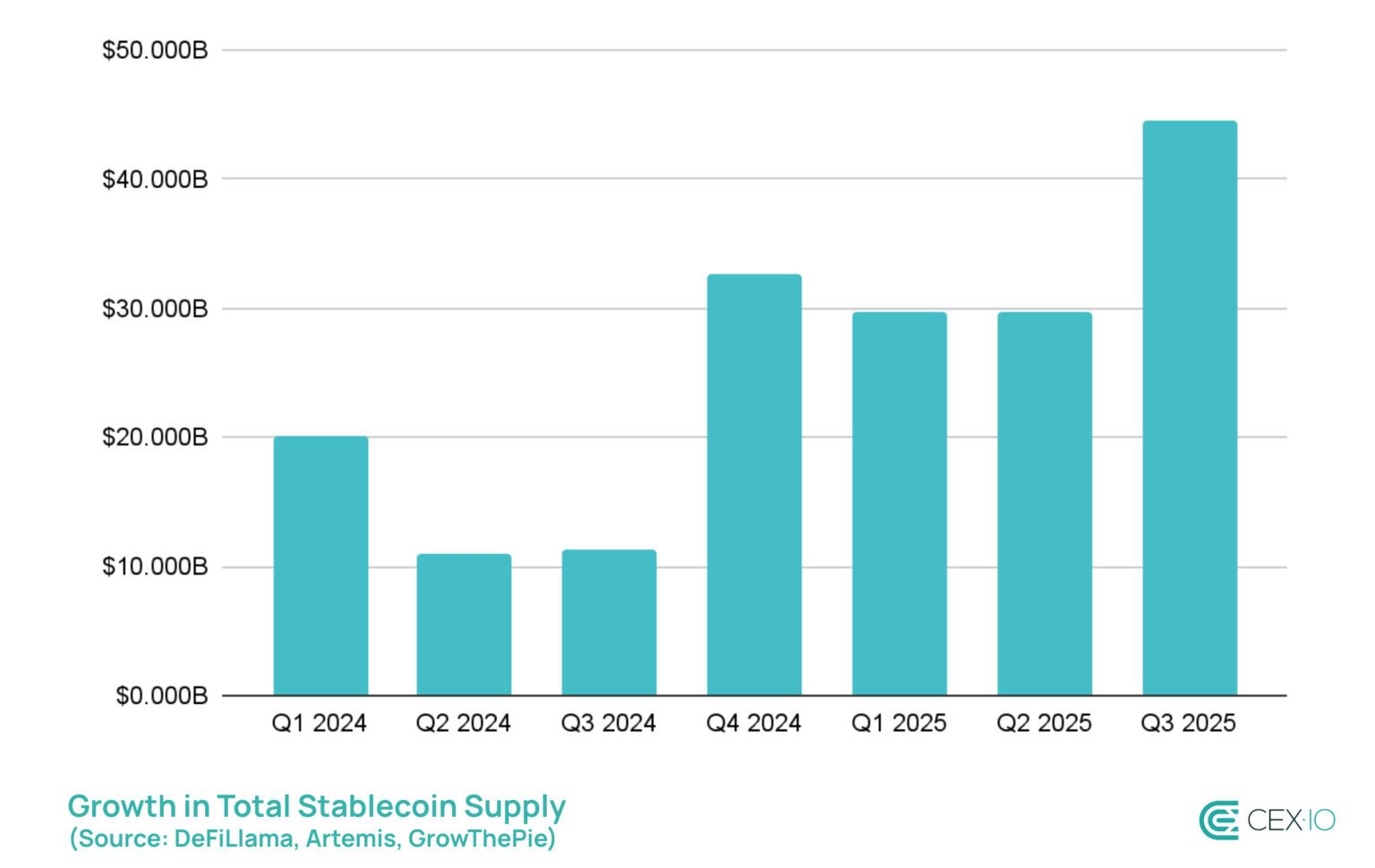

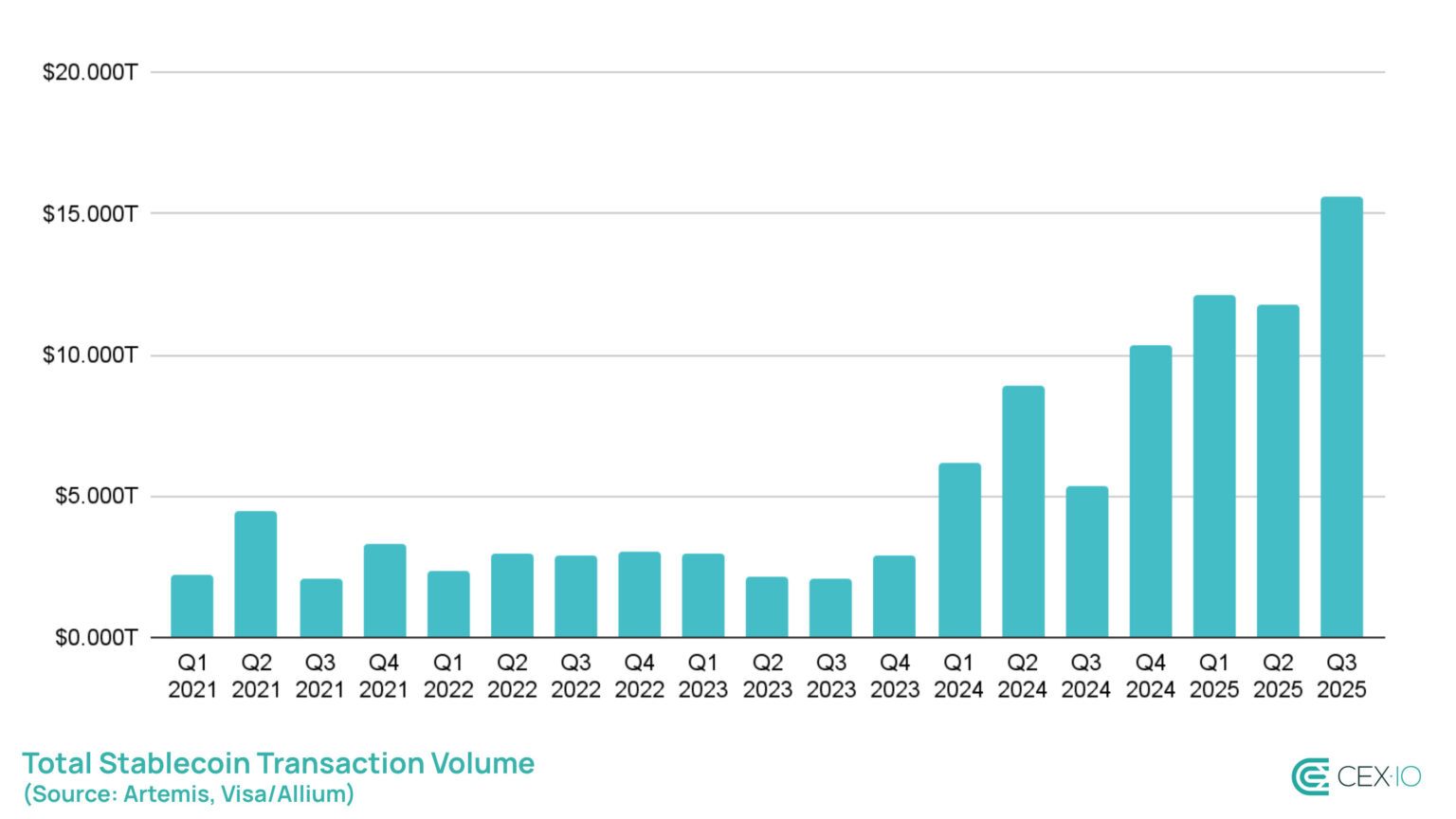

Well, knock me down with a feather and call me a stablecoin! 🪙 The third quarter of 2025 saw these digital darlings go absolutely hogwild, adding $45 billion in supply and zipping past $15.6 trillion in onchain transfers. Institutional bigwigs and everyday punters alike were chucking money at them like it was going out of fashion, all thanks to new rules, DeFi shenanigans, and the world finally catching on.

Q3 2025: When Stablecoins Decided to Break the Internet (and a Few Records)

By the Omnian, Q3 2025 was the kind of quarter that makes accountants weep with joy and cryptobros high-five their screens. According to a report by Cex.io-who, let’s be honest, probably had to upgrade their abacuses-stablecoin supply ballooned by $45 billion, an 18% leap that brought the total market to a whopping $300 billion. That’s more money than you’d find in a dragon’s hoard, and probably less fire-breathing involved.

Leading the charge were the usual suspects: USDT, USDC, and USDe, hogging 84% of the spotlight like they own the place (which, let’s face it, they kinda do). Even with the Genius Act clamping down on yield-bearing tokens like a nanny state, USDe and Paypal’s PYUSD grew faster than a troll on a mushroom diet-173% and 152%, respectively. Turns out, DeFi strategies and cross-chain integrations are the new black.

Onchain transfers hit a mind-boggling $15.6 trillion, with bots doing most of the heavy lifting (71% of transactions-someone give those algorithms a raise!). But don’t feel left out, retail traders: sub-$250 transfers hit all-time highs in September, proving that even the little guys can make a splash. 2025 is on track to see $60 billion in small transactions-that’s a lot of coffee and cat memes.

Ethereum, that old warhorse, reclaimed its throne with 69% of new stablecoin issuance (nice). Tron, meanwhile, had a rare supply contraction-probably too busy partying with Justin Sun. Layer 2 networks like Arbitrum also got in on the action, thanks to perpetual trading platforms and liquidity migrations. It’s like a disco, but with more math.

Trading activity hit $10.3 trillion-the highest since 2021, when everyone thought NFTs were the future (spoiler: they weren’t). USDT flexed its muscles, surpassing $100 billion in monthly DEX volume and overtaking USDC as the top trading pair. BSC’s explosive growth deserves a shoutout too-someone get them a trophy.

So, what’s the moral of this tale? Stablecoins aren’t just for traders anymore-they’re the duct tape of the financial world, holding together payments, liquidity, and DeFi settlements. As Q4 looms (historically the quarter where stablecoins go full turbo), the real question is: will USDT, USDC, and Ethereum keep hogging the limelight, or will someone else steal the show? 🍿

FAQ 🧭

-

Why did Q3 2025 make stablecoins go bananas? 🍌

Supply jumped by $45 billion, and onchain transfers hit $15.6 trillion. Global demand was like a stampede at a free pie festival. -

Which stablecoins were the stars of the show? 🎭

USDT, USDC, and USDe took 84% of the pie, with USDe and PYUSD growing faster than a wizard’s beard. -

Which networks ruled the roost? 🏰

Ethereum reclaimed its crown with 69% of new issuance, while Tron took a rare nap and Arbitrum got its groove on. -

How did trading and retail usage fare? 🛍️

Trading hit $10.3 trillion, and small retail transfers under $250 set records. Even granny’s getting in on the action.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Winklevoss Twins Back $M Bitcoin Listing

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

2025-10-15 01:58